georgemiller

Publish Date: Wed, 16 Jul 2025, 08:05 AM

Key takeaways

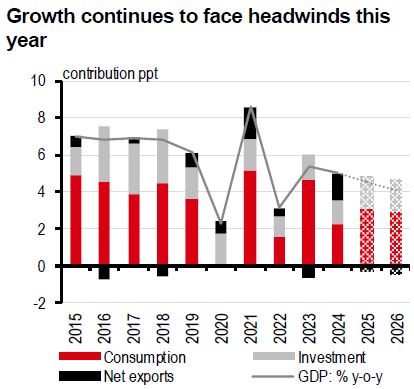

- Growth has been off to a decent start this year, but external and domestic headwinds still present challenges.

- Policy easing may focus on consumption and jobs, while the property market has yet to fully stabilise.

- The emphasis of China’s next five-year plan, due in Q4, will likely be on transitioning towards higher-quality growth.

China data review (June & Q2 2025)

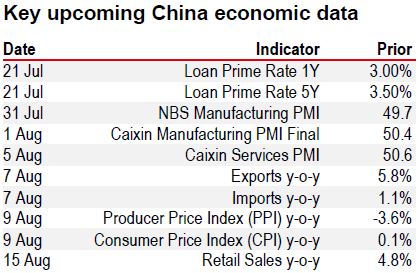

- GDP growth picked up to 5.2% y-o-y in Q2 and rounded out H1 at 5.3%. While this puts the economy in a better position to reach the “around 5%” growth target this year, the June print showed that some headwinds still persist.

- Fixed asset investment saw its first y-o-y contraction since November 2021, slowing to -0.1% in June. The property sector slowdown continued to weigh on growth, with property investment falling 12.9% y-o-y, while infrastructure and manufacturing investment both decelerated despite the ongoing rollout of fiscal support as seen in high levels of government bond issuance.

- Industrial Production rose 6.8% y-o-y in June, receiving a boost from both a temporary external calm due to the reciprocal tariff pause between China and the US and ongoing domestic policy support to cultivate new growth drivers and promote consumer trade-ins and equipment renewals. Relatedly, high-tech manufacturing still led the growth as it rose 9.7% y-o-y in the month.

- Retail sales were up 4.8% y-o-y in June, down from 6.4% in May, as some subsidies for trade-in programs dried up, weighing on purchases of household appliances and consumer electronics. However, even as some local governments reported the expiration of some funds, almost half of the trade-in subsidy funds are still due to be distributed in the rest of the year.

- CPI inflation rose 0.1% y-o-y in June, as a steady pickup in core CPI (+0.7% y-o-y) provided a welcome boost, driven by ongoing consumption policy stimulus which continued to support prices of durable goods. But PPI fell further, -3.6% y-o-y, with drags from relatively weak oil prices, excess capacity and insufficient end-demand across some sectors, including along the housing supply chain.

- Exports grew 5.8% y-o-y in June, boosted by the recent reciprocal tariff pause between the US and China. Shipments to the US saw some recovery as the decline narrowed to -16.1%, up from a low of -34.5% in May. Imports rose 1.1% y-o-y, the first rise since February, as demand was lifted by more fiscal support, bolstering infrastructure-related construction and equipment upgrading.

China stimulus: Not in a rush

Tariff turbulence with the US has dominated the headlines. While we see two sided-risks on US-China trade from ongoing negotiations, China’s trade-weighted tariff on exports to the US remains at around 50%, including the c20% in place before Trump 2.0. But despite the steep tariff hike, recent trade data has been holding up, as front-loading and trade restructuring have helped to offset the impact. Domestic economic data has also been relatively firm.

Pro-growth policies

While some downside risks have moderated, we still see pressures on growth. Externally, it’s uncertain whether the US and China can strike a deal before 14 August, the end of the 90-day tariff pause agreed during the Geneva talks. Domestically, over 12 million university graduates this year will add pressure to the labour market, while certain industries are consolidating. Consumption continues to recover, but ongoing property sector weakness lingers.

We expect China to roll out pro-growth measures already in the pipeline, though a ‘bazooka’ stimulus seems unlikely. With policymakers favouring structural solutions for structural issues, support is likely to be directed at stimulating consumption and stabilising the job market. Consumption policies are focussing on near-term measures, such as subsidies for durables, and long-term stimulus, such as through expansion of social safety nets and pension reforms.

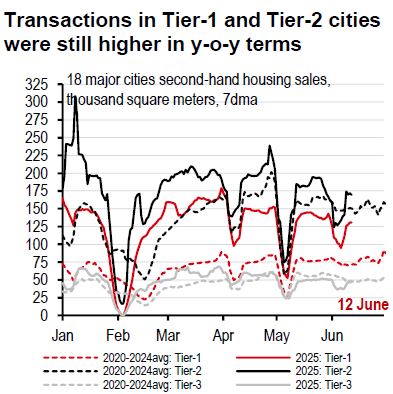

Property holding up

Though still a concern, the housing market no longer appears to be the government’s primary policy focus. So long as the situation remains manageable, we don’t expect ‘bazooka’-style measures to be introduced. Most recently, the Central Urban Work Conference was held from 14-15 July, and emphasized a new urbanisation model, which could involve more urban village renovations as well as development of city clusters. Meanwhile, implementation of announced measures continues, for example, with Zhejiang province recently saying that it would use special local government bonds to purchase commodity housing. However, the subdued national trend may have masked a significant dichotomy in the recovery – large cities with population inflows are exhibiting faster rebounds.

Higher-quality growth

The Outline of the 15th Five-Year Plan will likely to be released in Q4 2025. The emphasis will be on facilitating China’s long-term transition towards higher-quality growth, likely echoing the areas we already see policy pivoting towards in recent years, including frontier technology fields, new forms of consumption, and green development.

Source: Wind, HSBC

Source: Wind, HSBC

Source: LSEG Eikon

* Past performance is not an indication of future returns

Source: LSEG Eikon. As of 14 July 2025 market close

https://www.hsbc.com.my/wealth/insights/market-outlook/china-in-focus/china-stimulus-not-in-a-rush/