georgemiller

Publish Date: Wed, 23 Jul 2025, 07:05 AM

Key takeaways

- The USD narrative has been negative so far this year…

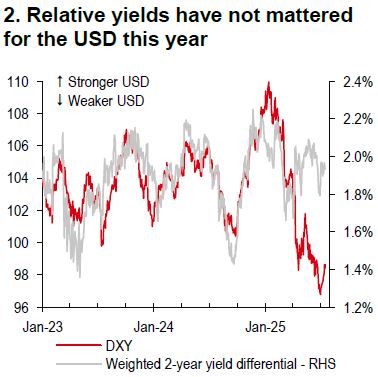

- … and some drivers (like US yields) that should be positive for the currency have not worked.

- Our framework points to a soft USD in the months ahead, but it is worth tracking whether the USD is about to bottom.

The US Dollar Index (DXY) slumped c11% in the first six months of the year, posting its worst 1H performance since 1973. Back then, it lost c15% (Bloomberg, 1 July 2025). While the delay in the US reciprocal tariff deadline to 1 August looked like another de-escalation moment, the announcement of potential tariffs on certain countries, namely Brazil, Canada, the EU and Mexico, and targeted products, such as pharmaceuticals and copper, will keep uncertainty high. That being said, the USD has become the best performing G10 currency so far in July (Bloomberg, 17 July 2025).

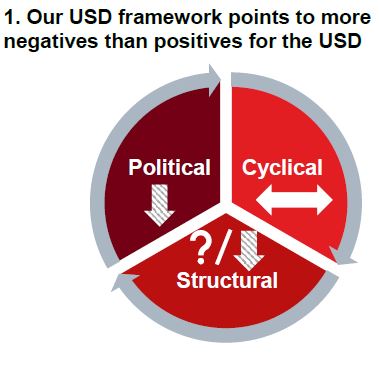

With the second half of the year underway, we continue to rely on our 3-factor framework, benchmarking the USD versus political, structural, and cyclical factors (Chart 1). To summarise, US policy uncertainty persists and is USD negative, albeit not to the same degree as in April. Cyclical pressures on the USD are neutral, given the US economy faces downside risks but the same is true with other currencies. Structural forces have mattered more when considering greater FX hedging of USD assets and conversion by foreigners and corporates, respectively. We have also focused on the deterioration of the US current account and basic balance as reasons behind a softer USD, but such deterioration may not persist once the impact from US tariffs dissipates. The combination of these factors suggests the USD is likely to remain on a softer path in the coming months.

Source: HSBC

Source: Bloomberg, HSBC

But we should be cognisant of what could mark the end of the USD’s decline. An important development would be if the USD began performing in line with what its policy rate implies. If it were to return to a more conventional framework (i.e. both higher US yields and USD, and vice versa, Chart 2), this could also signal a bottoming of the USD is approaching.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/usd-bottoming-out-yet/