georgemiller

Publish Date: Mon, 28 Jul 2025, 07:04 AM

Key takeaways

- The US dollar index (DXY) has fallen 10% in 2025, taking it to a three-year low and its worst start to a year since 1973. In part that’s because global investors have cooled on US assets amid policy uncertainty, fiscal worries, and a weaker growth outlook.

- When rates rose sharply in 2022-2023, flows into money markets soared. But with central banks now cutting rates, the case for switching to fixed income assets is strengthening.

- Indonesia continues to be a star performer in emerging market local-currency bonds, with IndoGBs generating a total return of more than 5% over the past three months alone.

Chart of the week – Is the US economy approaching stall speed?

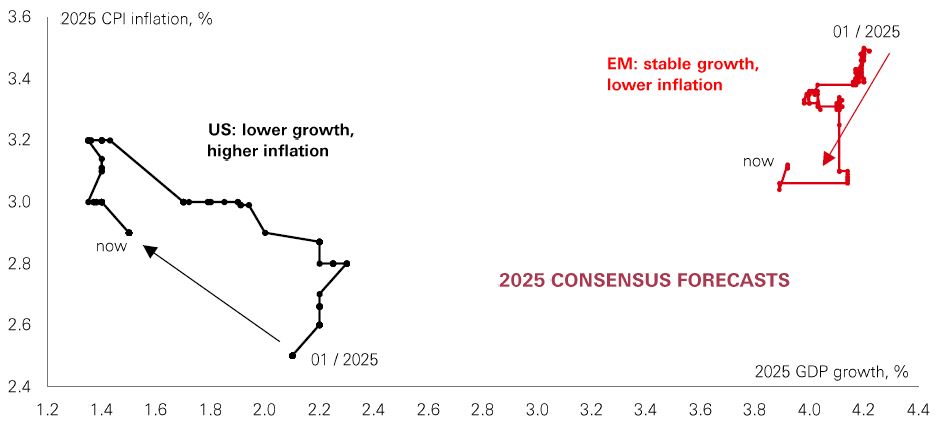

Markets currently see very little chance of a rate cut at this week’s US Fed meeting, with a move not fully-priced until late October. But the discussions between Fed members may be far more interesting, and at least one dissenting vote in favour of a rate cut – Governor Waller – seems likely. While Governor Waller’s recent call for a July rate cut has been viewed as political by some commentators, his arguments should not be dismissed. Essentially, Waller believes tariffs will not produce persistent inflation, because inflation expectations are well-anchored. But he is concerned that the economy is slowing below trend and payrolls growth is near stall speed.

While the US’s recent history of above-target inflation means the wider Fed is understandably cautious about cutting rates, Waller has a point regarding the stall speed of the economy. Typically, once growth drops around one percentage point below trend, it goes on to experience a sharper downturn. The current Bloomberg consensus forecast is for growth to drop 1.3 percentage points below the Congressional Budget Office's trend estimate by Q425.

Waller’s concerns about downside risks put him at odds not only with most Fed members but also with equity investors, given that the S&P 500 hit another all-time high last week. Investors appear more focussed on positive news on tariffs, such as the US-Japan trade deal, and progress with the US-EU talks.

Market Spotlight

A new globalisation

The 1990s and 2000s period of “hyper-globalisation” was characterised by a major increase in international trade and capital flows. However, global trade growth has stagnated since the financial crisis, hastened by the shock of Covid and rising US protectionism. Investor attention remains centered on the global economic challenges posed by US tariff increases. But less noticed has been how economic interdependency within emerging markets is rapidly growing.

China’s flagship Belt and Road initiative (BRI) is a key part of this story. According to a recent study by Australia’s Griffith University and the Green Finance & Development Center in Beijing, China’s investments in BRI members have surged this year, totalling USD124bn in H1, already surpassing last year’s USD122bn total. And unlike the early stages of the BRI, which was primarily state-led, private companies are now taking the lead as they look to seize opportunities in faster growing economies of the Global South.

This “new globalisation” could contribute to many emerging and frontier markets experiencing superior rates of economic growth in the coming years. And for investors, this should help unlock valuation opportunities in these regions.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management, Bloomberg. Data as at 7.30am UK time 25 July 2025.

Lens on…

Greenback blues

The US dollar index (DXY) has fallen 10% in 2025, taking it to a three-year low and its worst start to a year since 1973. In part that’s because global investors have cooled on US assets amid policy uncertainty, fiscal worries, and a weaker growth outlook. In contrast, the euro (+13%) and the British pound (+8%) have strengthened sharply against the dollar this year. That’s been helped by a pick-up in sentiment towards Europe, where major fiscal expansion in Germany boosts the growth outlook.

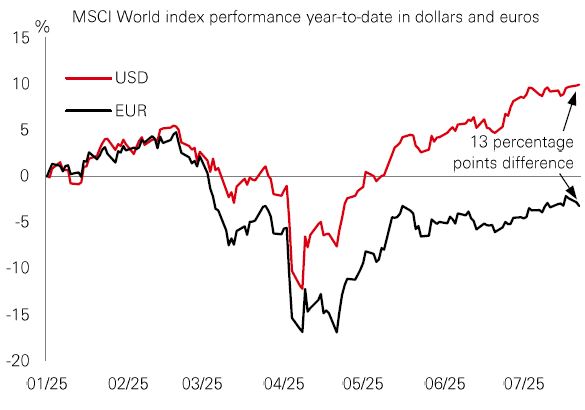

An eye-catching consequence of the greenback weakness is that FX volatility is having a strong influence on stock market index returns. In dollar terms, for instance, the developed market MSCI World index is up by 11% this year. But in euro terms it’s down by 2%. Stock market volatility tends to trump FX volatility, which is a key reason why global investors have historically tended to leave their US exposure unhedged and benefit from the once-dependably strong dollar sweetening their returns. That’s not working this year, and hedging US equity exposure now looks like a potentially preferable option for global investors.

Short duration bonds

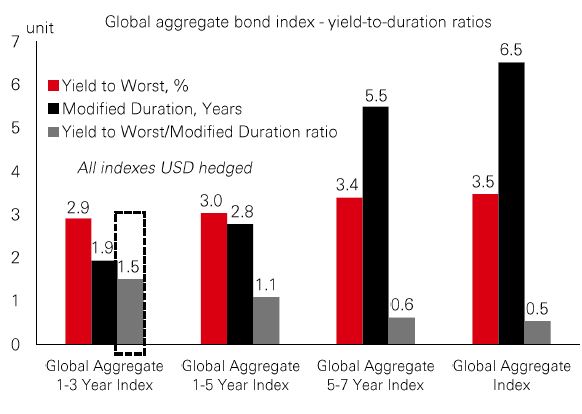

When rates rose sharply in 2022-2023, flows into money markets soared. But with central banks now cutting rates, the case for switching to fixed income assets is strengthening. But with the rate cut path uncertain, and the yield curve still flatter than normal, the return on duration-based investments faces challenges.

Indeed, analysis by some Global Fixed Income teams show that, for now, the extra yield on longer-dated bonds may not justify the duration risk (the potential for rates to change over time). In the Global Aggregate bond index, the 1-3 year index currently has a higher yield-to-duration ratio – a key measure of the compensation for taking duration risk – than longer-duration indices.

With still-elevated starting yields and potential for capital appreciation as the curve steepens, short duration appears well-positioned.

Indonesia in demand

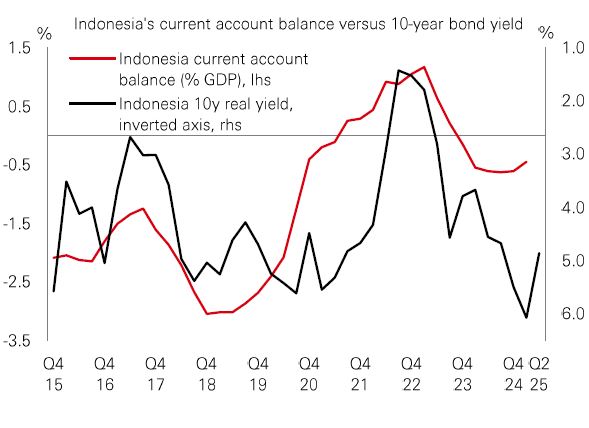

Indonesia continues to be a star performer in emerging market local-currency bonds, with IndoGBs generating a total return of more than 5% over the past three months alone.

The fundamental story for the country’s bonds remains encouraging. Bank Indonesia is on an easing cycle and cut rates again recently, by more than expected. Core inflation has been ticking lower towards 2%, and GDP growth – stable at around 5% – should be cushioned from external uncertainties as policy eases. Growth should also be buoyed by Indonesia’s recently-agreed US trade deal, which sees exports to the US attract an average tariff of 19%, down from the previously-threatened 32%. It marks a stark shift for a country once badged one of the ‘fragile five’ EMs deemed over-reliant on foreign investment to fund growth.

Indeed, Indonesia can afford a growth focus given its low inflation and lack of macro imbalances. Its current account has been roughly in balance since the pandemic and its budget deficit has been well within the statutory 3% limit. Some analysts think it gives real yields space to fall in the coming months, offering further support to bond returns.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 25 July 2025.

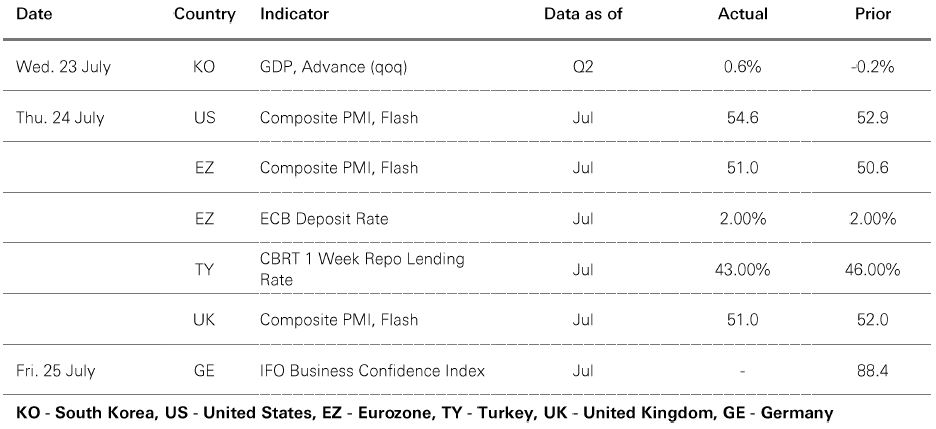

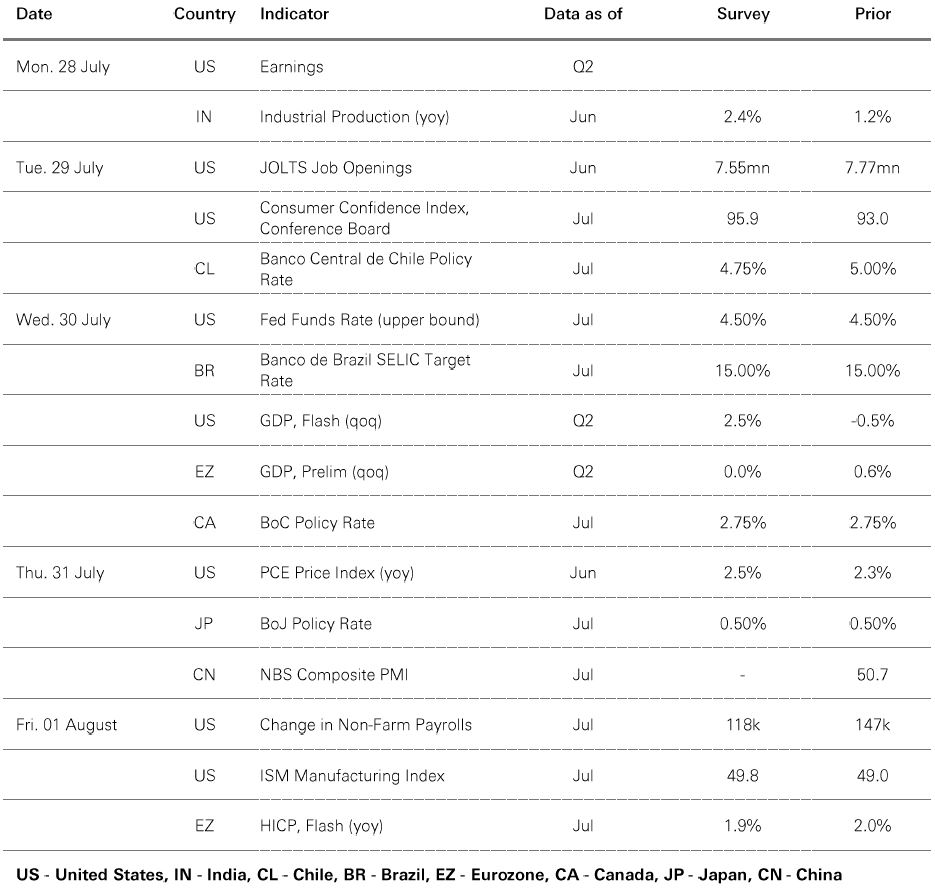

Key Events and Data Releases

Last week

The week ahead

Source: HSBC Asset Management. Data as at 7.30am UK time 25 July 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

Market review

Risk sentiment increased last week amid overall beats in US Q2 earnings and a trade deal announced between US and Japan, and reported progress on a deal between the US and the EU. The US dollar and US Treasury yields fell on the week. European yield moves were mixed and muted overall. US equities saw broad-based gains, with high-beta sectors like technology outperforming. European stock markets saw limited moves, barring the UK which saw solid momentum in the FTSE 100. Japan's Nikkei rose sharply in response to the US trade deal news, with the yen falling. While the Shanghai composite and Hang Seng rose in EM Asia equities, South Korea's Kospi and India's Sensex both lost ground. In commodities, oil was lower and gold rose.

https://www.hsbc.com.my/wealth/insights/asset-class-views/investment-weekly/is-the-us-economy-approaching-stall-speed/