georgemiller

Publish Date: Mon, 28 Jul 2025, 07:04 AM

Key takeaways

- Japan’s ruling coalition lost its majority in the Upper House election, with market focus moving to US tariffs.

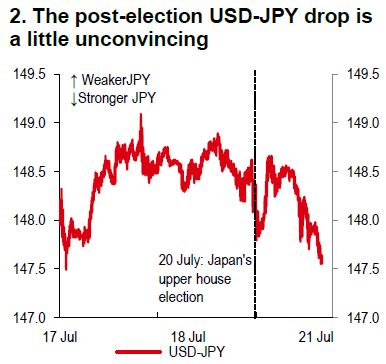

- The post-election drop in USD-JPY appears to be a little unconvincing.

- Unless there is a breakthrough in trade talks, the JPY is likely to underperform the USD over the near term.

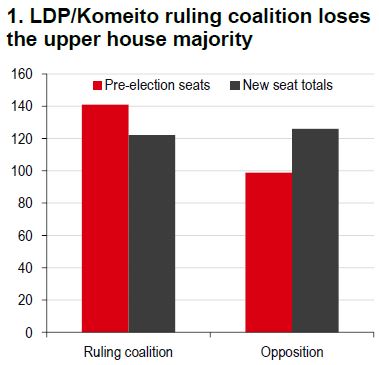

In Japan’s upper house election on 20 July, the Liberal Democratic Party (LDP) and its junior coalition partner, Komeito, failed to secure enough seats (at least 50 out of the 124 seats up for re-election) to hold on to their majority (Chart 1). This marks the second consecutive defeat for the LDP under Prime Minister Shigeru Ishiba’s leadership following last October’s lower house election. Despite the electoral setback which deprived the LDP of a majority in both legislative houses for the first time since 1955, Prime Minister (PM) Ishiba has publicly vowed to stay on as Japan’s leader.

Source: Media reports, HSBC

Source: Bloomberg, HSBC

We are not convinced that the post-election dip in USD-JPY will be sustained (Chart 2). Perhaps, there is some relief in the FX market that things did not come out even worse for the ruling coalition, with the announcement by PM Ishiba removing some political uncertainty. However, without a majority in either parliamentary house, the ruling coalition will likely have to compromise with opposition parties to pass legislation. This could see looser fiscal policy and complicate the Bank of Japan's (BoJ) path to monetary policy normalisation, while our economists still expect a BoJ hike in 4Q25.

The immediate focus may now move to whether a US-Japan trade deal can be struck before 1 August. Markets may still see challenges for Japan to get a favourable trade deal. Any failure to secure a deal could see the JPY weaken, more so if other nations are successful in their negotiations. That being said, the likely extent of any USD-JPY bounce could be curtailed by the possibility of FX intervention by Japan’s Ministry of Finance (MoF), with rhetoric already more evident ahead of key levels around 150 and 152. There were already some verbal comments from Finance Minister, Katsunobu Kato, and Deputy Chief Cabinet Secretary, Kazuhiko Aoki (Bloomberg, 17 July 2025).

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/jpy-ruling-coalition-loses-upper-house-majority/