georgemiller

Publish Date: Mon, 28 Jul 2025, 08:06 AM

Key takeaways

- The ECB was on hold in July, as widely expected.

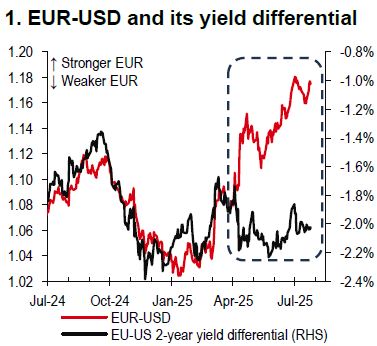

- The EUR is still much stronger than what its yield differential implies, which assumes a ‘good case’ outcome on tariffs.

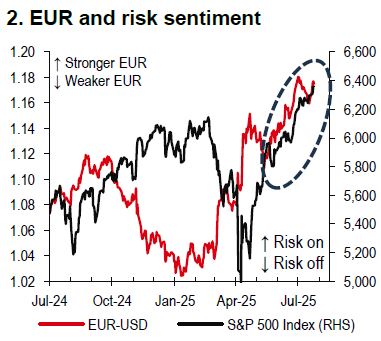

- Risks for the EUR are skewed to the downside if trade tensions intensify and/or evidence of economic weakness emerge.

On 24 July, the European Central Bank (ECB) kept its deposit rate steady at 2% for the first time in more than a year, after slashing rates by 2% in total since the beginning of the easing cycle in June 2024.

The statement stresses that the environment remains exceptionally uncertain, especially because of trade disputes, with risks to growth remaining tilted to the downside. Having said that, ECB President Lagarde seemed to focus on the positive impact of a possible trade deal lifting uncertainty and also reaffirmed that the central bank is in a very good place to hold and watch how the risks will evolve over the next few months.

While plenty of uncertainty remains, our economists think that the ECB is done cutting rates if the EUR stays around the current level. But if EUR-USD were to head towards the 1.25-1.30 range, this could mean a bigger inflation undershooting, pushing the ECB to reconsider cutting rates in December or early next year. Markets have also pared back expectations of further ECB easing, currently pricing in a c20% chance of a rate cut in September (Bloomberg, 24 July 2025).

It is worth noting that the EUR still enjoys an unusually large premium relative to the interest rate differential (Chart 1), which assumes a ‘good case’ outcome on tariffs. Media reports suggest that the US and the EU are closing in on a trade deal which would place 15% tariffs on the EU (FT, Bloomberg, 23 July) − higher than the 10% ‘baseline’, but certainly not as impactful as a 30% rate.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

Meanwhile, the EUR is returning to its ‘risk on’ persona (Chart 2). Any material escalation in tariffs could see risk aversion, probably weighing on the EUR. Conversely, trade deals with lower tariff levels could support risk appetite, which is likely to be EUR-positive. As such, we look for the EUR to move mostly sideways in the weeks ahead; but risks are skewed to the downside, especially if trade tensions intensify or evidence of Eurozone economic weakness emerges.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/eur-return-to-risk-on-persona/