georgemiller

Publish Date: Fri, 01 Aug 2025, 12:02 PM

Key takeaways

- As widely expected, the Fed left policy rates steady, though with two dissenting votes for an immediate cut.

- The overall guidance from the Fed suggests a patient policy, sending the DXY higher…

- … but the USD still faces downside from political and structural drivers, and the return of cyclical headwinds.

The Federal Open Market Committee (FOMC) kept the federal funds target range steady at 4.25-4.50% for a fifth consecutive meeting in July. This came in line with market expectations. The accompanying statement had one dovish change, with the new observation that “economic activity moderated in the first half of the year”. In addition, there were two dissenting votes from the Federal Reserve (Fed) Governor Christopher Waller and Michelle Bowman who called for an immediate 25bp cut. The market impact of this dissent was modest, however, as the views are still evidently dovish outliers on the FOMC.

Fed Chair Powell’s overall comments show that most of the policymakers still support a wait-and-see approach to any future rate cuts. Crucially, Chair Powell talked of the “coming months” when describing the timeframe over which the data would be analysed to decide on next steps. While this does not rule out a cut at the next meeting on 16-17 September, it did not indicate that policymakers were any closer to delivering an easing than they were at the June meeting. Our economists still expect 75bp of cumulative Fed rate cuts through this year and next, delivered in three 25bp steps: September, December, and next March.

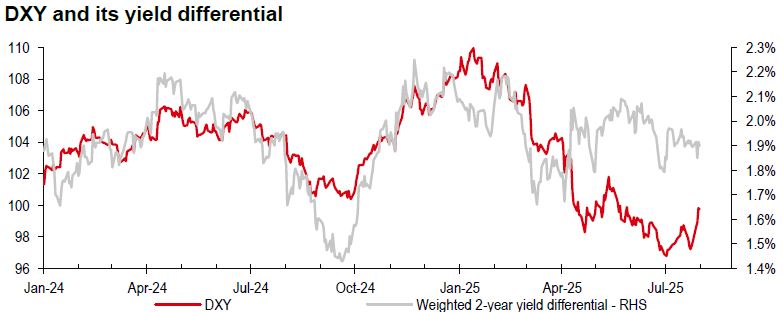

Following Chair Powell’s press conference, the US Dollar Index (DXY) surged to as high as 99.98 (Bloomberg, 31 July 2025), as markets have pared expectations for a September rate cut. Rates market now views a September cut as a 50:50 call, down from a c66% likelihood attached to this outcome ahead of the July meeting.

Source: Bloomberg, HSBC

Cyclical headwinds (via narrowing yield differentials) for the USD are easing for now but may return when the Fed resumes its rate-cutting cycle. Questions still remain over US trade policy, the path for the US budget deficit, and the political pressure on the Fed. The USD still faces headwinds from political and, to a lesser extent, structural drivers. All this points to a soft USD in the months ahead. Still, recent USD price action is a challenge to those who argue for persistent currency weakness that would extend into 2026 – a narrative we do not agree.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/usd-the-fed-remains-patient-on-rate-cuts/