georgemiller

Publish Date: Mon, 04 Aug 2025, 07:04 AM

Key takeaways

- The Fed left rates unchanged at its July meeting, but the decision was not unanimous – for the first time in over 30 years, two members dissented, favouring a 0.25% cut.

- Policy uncertainty and fears over the US fiscal trajectory have prompted global investors to diversify away from US dollar-denominated assets this year.

- Japanese assets have been in the crosshairs of both domestic and global risks lately. While trade policy uncertainty has receded following a deal with the US, domestic politics are still a source of volatility for Japanese bonds and the yen.

Chart of the week – Value in Asia Tech

Last week’s deluge of economic data coincided with a peak in Q2 US profits season announcements. The key takeaway is that growth is steady despite uncertainty over policy and tariffs, and that companies are beating relatively low expectations. Another theme dominating attention is the influence of AI on both the market and macro environment.

Some of the S&P 500’s Magnificent Seven technology giants have been among those reporting better-than-expected profits – and the message is that they are doubling down on AI investments. After a wobble earlier this year, renewed AI enthusiasm has helped drive a rally in US tech firms, taking the index back to all-time highs. But there are concerns. One is how quickly they can recoup the billions of dollars of capex spent on chips and data centres, even if there is already evidence of AI accelerating earnings. And from a macro perspective, there’s unease about how AI can boost flagging productivity without hurting labour markets longer-term.

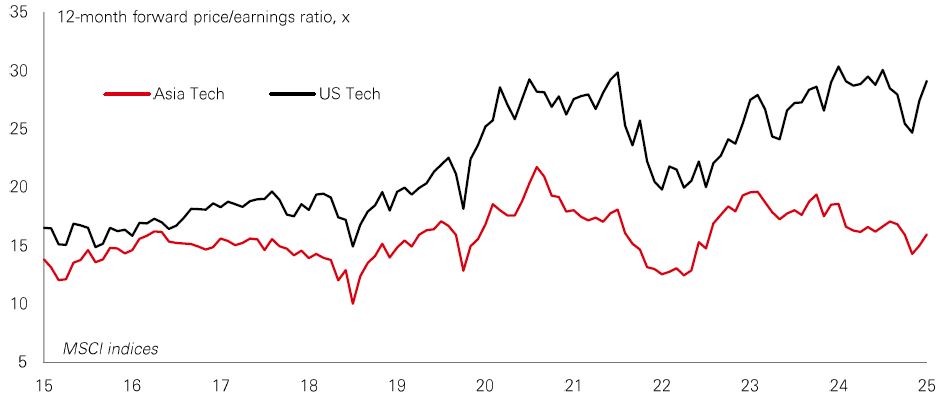

But this isn’t just a US market narrative. In Asia, there are expectations that AI could eventually partly reverse mainland China’s decade-long productivity decline. Mainland China is strong in AI research, and some analysts believe it could go on to lead globally in engineering optimisation, production, and widespread commercialisation. Regionally, Asian export-led economies like Taiwan and South Korea are already pivotal in global semiconductor manufacturing, and the AI boom could be a further catalyst. Like the US, AI-driven demand is contributing to strong performance in Asian markets this year, with the MSCI Asia Tech index up over 15% year-to-date. But even after this rally, the index trades on a 12m forward PE ratio of 16x, versus 29x for US Tech. As the AI theme develops, global investors should consider the potential for AI profits to broaden out to Asia, unlocking tech valuations in markets across the region.

Market Spotlight

Power play

Recently, mainland China started work on what will eventually be the world’s largest hydropower dam in Tibet. Once complete, the RMB1.2trillion (USD170bn) project could generate up to 300 million megawatt hours of electricity every year.

Given recent “anti-involution” policy signals (which aim to cap areas of industrial overcapacity) and the project’s scale, there was a pick-up in equity sectors likely to benefit from both, including energy (+6%, MSCI China, USD), industrials (+5%) and materials (+7%) – with the market up 3% overall. But longer-term, this project – which was first proposed in 2020 in China’s 14th five-year plan – is evidence of the government’s commitment to carbon neutrality.

According to the International Energy Agency, China is by far the world’s largest energy investor, and accounts for nearly a third of global clean energy spending. Over time, power security – following significant expansion in power supply capacity and green energy transition – could become a competitive advantage in technological development and high-end manufacturing, where China is already focusing policy support. For instance, the growing adoption of digitalisation and AI technologies will continue to drive increased electricity demand for data storage, computing, and transmission. In the power stakes, China looks well-positioned to surge.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target. Source: HSBC Asset Management, Bloomberg. Data as at 7.30am UK time 01 August 2025.

Lens on…

Fed holds firm

The Fed left rates unchanged at its July meeting, but the decision was not unanimous – for the first time in over 30 years, two members dissented, favouring a 0.25% cut. Despite this, Chair Powell did not give any strong signals regarding a rate cut at the September meeting. The market interpreted this as mildly hawkish, reducing the probability of a September cut to less than 50%, although it still expects 3-4 rate cuts over the next 12 months.

Ultimately, the Fed is going to be guided by the data and will need to exercise a lot of judgment. Inflation is set to pick up over the summer as the tariff impact feeds through, but growth and the labour market are likely to cool. History shows that periods of slower growth can quickly morph into a sharper downturn. This risk is likely to lead the Fed to cut a couple of times this year, despite rising inflation.

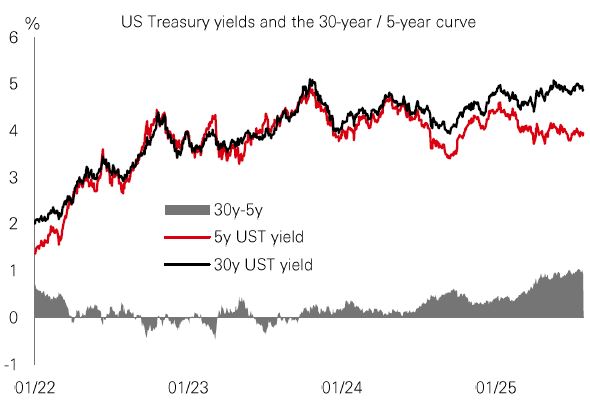

Bonds beyond the US

Policy uncertainty and fears over the US fiscal trajectory have prompted global investors to diversify away from US dollar-denominated assets this year.

Renewed confidence is driving a rebound in eurozone sovereign debt inflows, with EUR120bn entering Italian bonds alone this year. Domestic and foreign investors are responding to falling policy rates, credit spread dynamics, and the ECB’s tools to manage market volatility.

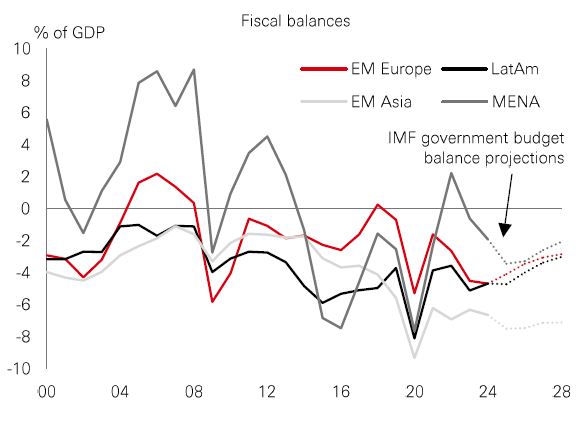

Meanwhile, in emerging markets, debt fundamentals have improved significantly over the past 20 years, supported by improving fiscal discipline, lower public debt ratios, and strong demographic trends. This year’s weakness in the US dollar has also been a tailwind. However, the picture across EMs is nuanced. While EM Asia, particularly China, faces widening deficits, Latin America, EM Europe, and MENA show signs of gradual fiscal improvement post-Covid.

Japan’s policy tightrope

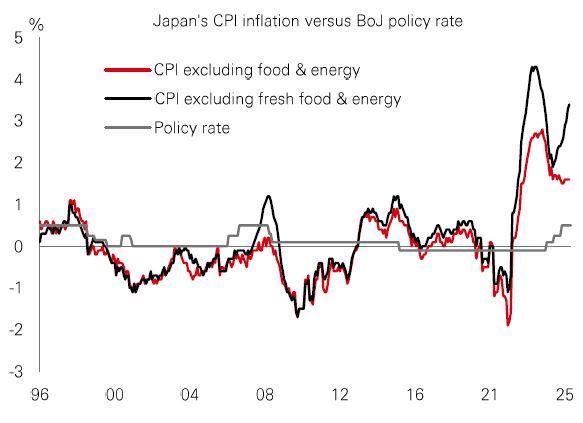

Japanese assets have been in the crosshairs of both domestic and global risks lately. While trade policy uncertainty has receded following a deal with the US, domestic politics are still a source of volatility for Japanese bonds and the yen. PM Ishiba has been under pressure to resign after the defeat of his LDP party in recent Upper House elections. But there are concerns that political turmoil could result in new leadership that takes a more dovish fiscal stance, fanning worries about debt sustainability.

Core inflation is running above 3% compared to a policy rate of 0.5%, implying a deeply negative real policy rate. But the path to normalisation is likely to be gradual. While the BoJ raised its inflation forecast at last week’s meeting, getting to inflation that is sustainably averaging the 2% target is fraught with challenges. And debt sustainability may factor into BoJ decision-making even if Japan’s public debt is largely domestically owned and its fiscal balance is not as wide as in global peers. Overall, policy uncertainty could perpetuate volatility in domestic assets, while a constrained BoJ means those betting on a stronger yen could be surprised.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 01 August 2025.

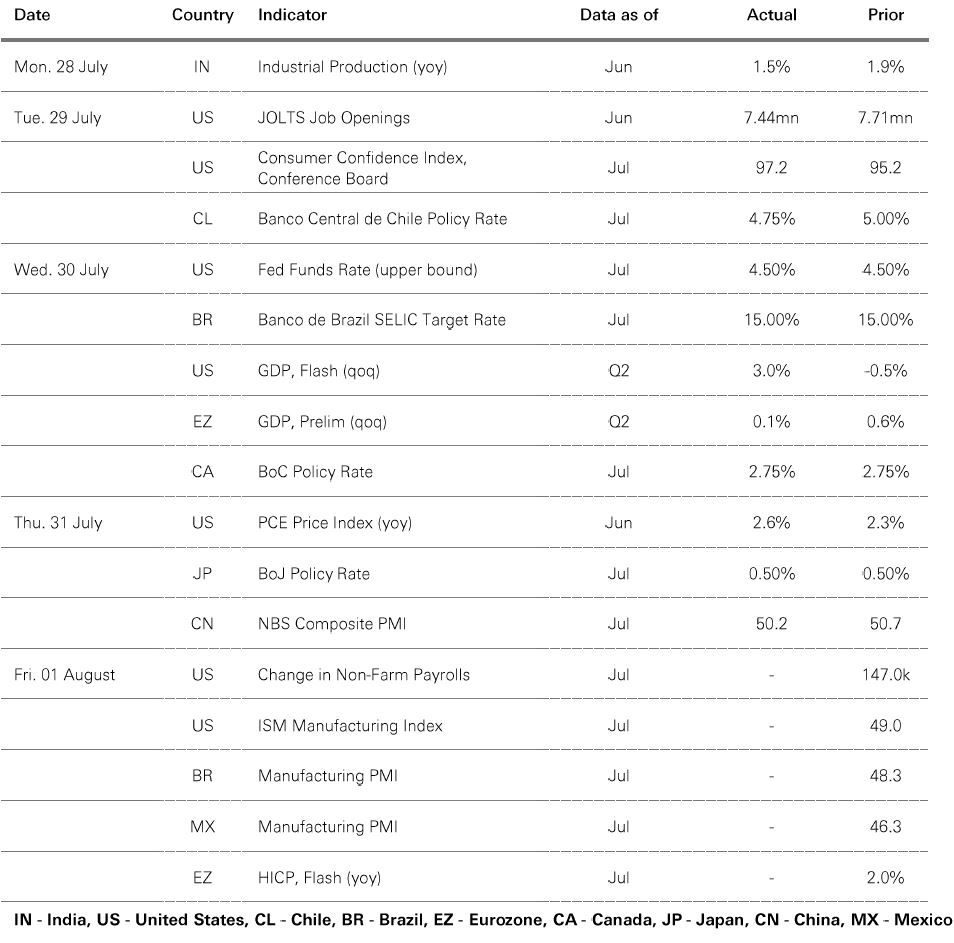

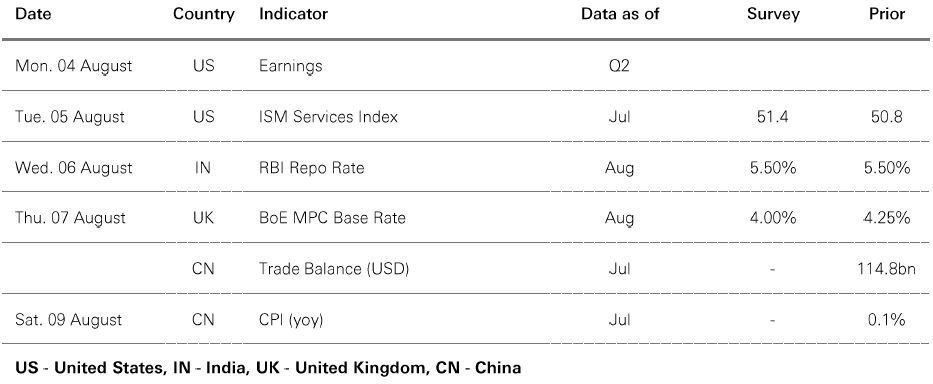

Key Events and Data Releases

Last week

The week ahead

Source: HSBC Asset Management. Data as at 7.30am UK time 01 August 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Market review

Risk sentiment was little changed last week as investors absorbed news on US trade deals ahead of the 1st August deadline, and assessed the global monetary outlook following key central banks’ policy meetings. The US dollar strengthened, while US Treasury yields remained range-bound, and European yields slightly declined. Euro credit spreads tightened, whereas US high-yield spreads widened modestly. In equity markets, US stocks mostly declined: the S&P 500 traded lower, with the small-cap Russell 2000 experiencing sharper losses, but Nasdaq edged up, supported by some tech firms’ positive Q2 results. European stock markets were mixed, with German DAX and French CAC lagging. Japan's Nikkei 225 and other Asian equities broadly fell amid weaker regional currencies. In commodities, oil gained ground amid ongoing geopolitical concerns, while gold and copper prices were lower.

https://www.hsbc.com.my/wealth/insights/asset-class-views/investment-weekly/value-in-asia-tech/