georgemiller

Publish Date: Mon, 04 Aug 2025, 08:05 AM

Key takeaways

- The BoJ kept rates steady in July, as expected.

- BoJ Governor provided no hints over the timing of a future rate hike, emphasising the need to examine more future data.

- The JPY weakened past 150 per USD; further weakness seems likely over the near term.

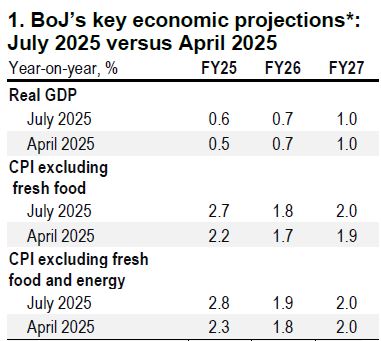

On 31 July, the Bank of Japan (BoJ) kept its policy rate unchanged at 0.5%, in line with market expectations. In the latest quarterly outlook report, the BoJ slightly nudged up its GDP growth forecast for FY2025 and substantially raised its FY2025 inflation forecasts (Table 1).

However, BoJ Governor Kazuo Ueda during his press conference gave no indications that the BoJ is ready to hike rates soon, despite the recent reduction of tariff uncertainty. In particular, he downplayed the FY2025 inflation forecast upgrade and said that it was due to food and supply-side factors, which monetary policy should not respond to, while the underlying inflation trend is still below 2%. He also stressed the need to examine more future data on tariff impact, wage growth, and cost pass-through. He even made a passing remark on the JPY, to say that it is not deviating much from the BoJ’s view.

In our economists’ view, the BoJ’s upward revisions to inflation and growth should support the case for a 25bp rate hike in October, but the BoJ may wait for the US Federal Reserve (Fed) to move first before embarking on the next step of policy normalisation.

*Figures represent the medians of the BoJ’s board members' forecasts for the fiscal years 2025, 2026 and 2027.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

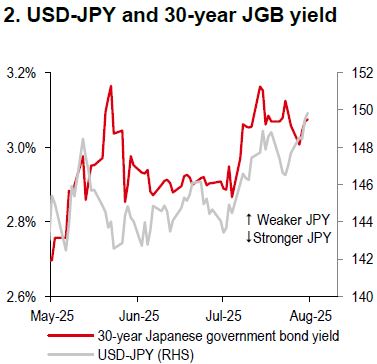

USD-JPY rose steadily higher, following the BoJ meeting. The JPY was the worstperforming G10 currency in July, losing c4.5 % against the USD (Bloomberg, 31 July 2025). We expect the JPY to weaken further in the near term for two key reasons:

- USD-JPY is sensitive to the risks of a hawkish Fed (please read “USD: The Fed remains patient on rate cuts”), strong US data and a dovish BoJ (as discussed above) – all of which materialised to some degree in recent days.

- USD-JPY is following long-term Japanese government bond (JGB) yield lately (Chart 2). This means Japan’s ruling Liberal Democratic Party (LDP) leadership uncertainty and fiscal risks would be negative for the JPY. If Japanese leaders were to be more pro-easing (both fiscal and monetary), the JPY may come under pressure.

The risks of FX intervention loom larger above 152 on USD-JPY.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/jpy-a-still-dovish-boj/