georgemiller

Publish Date: Wed, 06 Aug 2025, 12:01 PM

Key takeaways

- The US has made bilateral deals with a number of countries, resulting in some clarity on trade policies.

- But higher tariffs may result in lower growth and higher US inflation, as indicated in recent surveys and data prints.

- Wobbles have started to show in the US labour market, while other global data is holding up for now.

2025 has been a rollercoaster ride, with US tariffs and geopolitical risks dominating the headlines. The past few weeks have been no different, with numerous trade deals signed between the US and the EU, Japan, Indonesia, Vietnam, Korea, and the Philippines amongst others, whilst negotiations with mainland China continue.

Tariff challenges

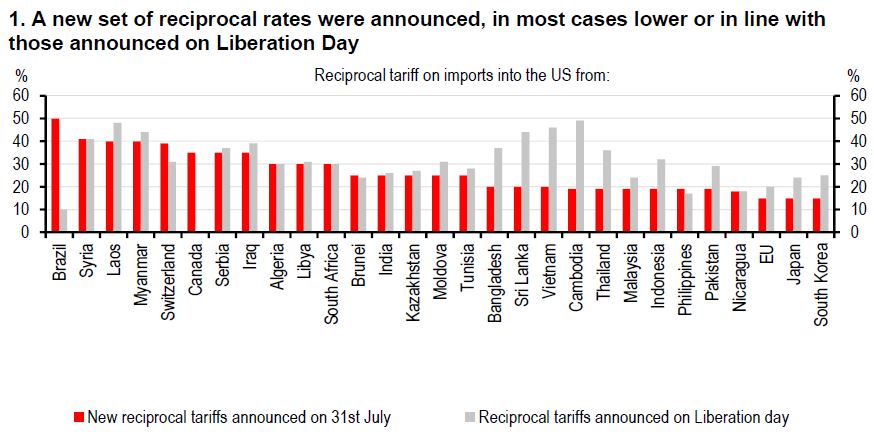

We’ve seen the new, higher, tariff rates – varying between 10%-41% with effect from 7 August – which are set to impact both global trade and the US economy in the coming months. Some of the lower reciprocal rates came on the back of hefty concessions while some smaller nations have seen their rates rise (chart 1). Global trade data remain almost impossible to interpret in real time, with trade flows being distorted to get ahead of tariff increases as US firms try to minimise the import duties.

Source: The White House. Note: Tariff rate for Canada are fentanyl based. USMCA exemptions still apply.

Labour market cracks

We’ve also seen signs of wobbles in the US labour market – with payrolls data seeing sharply negative backward revisions and weak jobs growth over the past few months. There are also growing signs of cost pressures starting to seep into the system – with business surveys and the hard CPI data showing tariff inflation in pockets of the goods sector. But with data releases over the next few months set to stay messy around the 1 August tariff deadline, central bankers in the US and elsewhere are working out how to react.

GDP payback

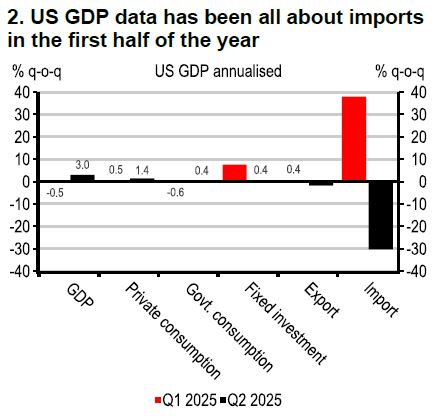

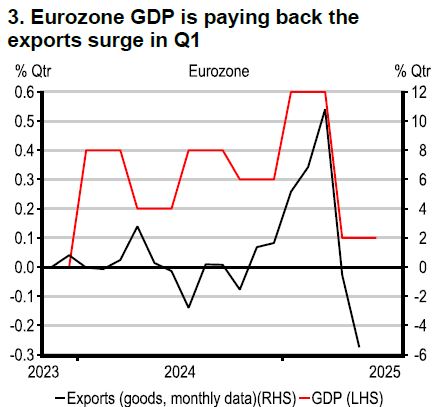

Q2 GDP growth across the world showcased this perfectly, with many economies seeing the payback from Q1 – either from a drop in US goods imports lifting growth in the US (chart 2) or other economies seeing their exports drop back and weigh on their own GDP growth rates (chart 3). With more downside risks to global trade in the coming months, it’s important to look at the underlying consumption and investment data across the world now – and these look broadly healthy outside of the US.

Source: Macrobond

Source: BLS

Inflation easing

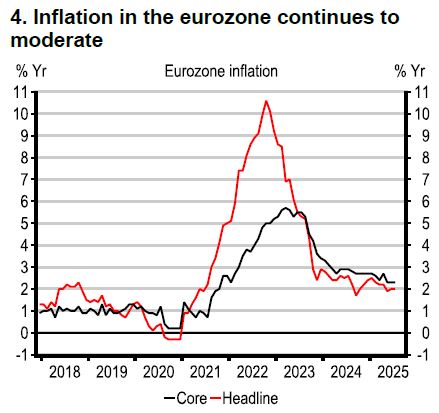

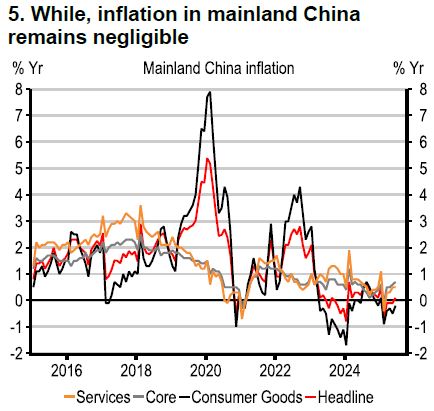

Outside of the US the inflation picture looks much better. Surveys suggest cost pressures are receding, energy prices are down and central banks across Europe, Asia and Latin America have been cutting rates, and many have the scope to continue. The combination of better inflation data and lower interest rates is, so far, seemingly acting as a buffer to the uncertainty created on the tariff front.

Source: Macrobond

Source: Macrobond

Markets holding up

Due to the broadly better growth data, markets continue to take the choppy economic data in their stride, with equity markets reaching new highs. For now, it’s still a case of looking across the data as a whole and appreciating the challenges that each data point poses. And the global economy is, for now, holding up better than might have been expected given the uncertainties out there.

Source: Bloomberg, HSBC

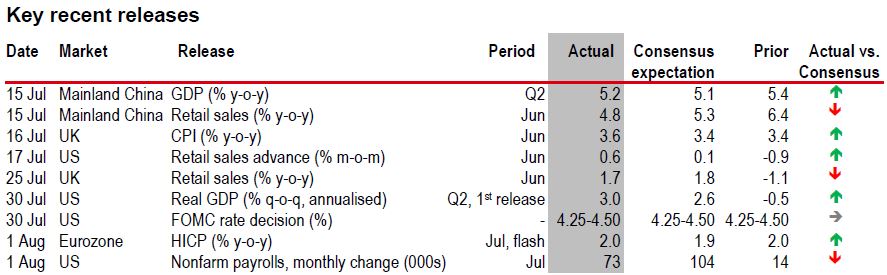

⬆ Positive surprise – actual is higher than consensus, ⬇ Negative surprise – actual is lower than consensus, ➡ Actual is in line with consensus

Source: LSEG Eikon, HSBC

https://www.hsbc.com.my/wealth/insights/market-outlook/macro-monthly/resilient-despite-tariff-challenges/