georgemiller

Publish Date: Mon, 11 Aug 2025, 12:01 PM

Key takeaways

- As expected, the BoE delivered a 25bp cut in August…

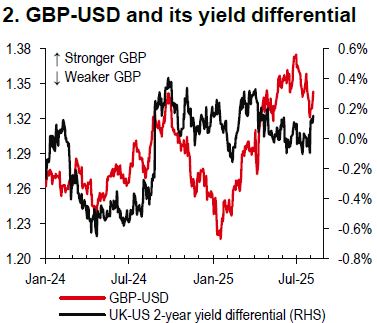

- …but dissents and an upward inflation forecast revision made it feel like a hawkish cut, sending the GBP higher.

- The Autumn Budget is likely to stand as a major risk for the GBP via fiscal, monetary and political channels.

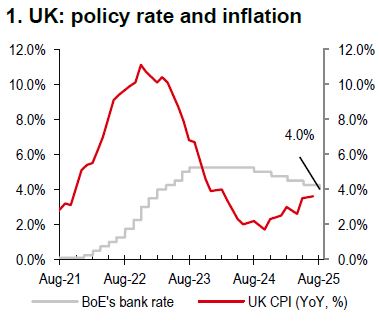

On 7 August, the Bank of England (BoE) cut its policy rate by 25bp to 4.0%, which was the fifth cut in the current easing cycle, as widely expected. The overall tone of the BoE meeting was rather hawkish, given the dissents within the Monetary Policy Committee (MPC) and an upward inflation forecast revision.

The rate cut decision was made after a second vote, as the first round was a 4-4-1 deadlock, with four members (Catherine Mann and Huw Pill, as in May, plus Megan Greene and Clare Lombardelli) preferring a hold and one member (Alan Taylor) voting for a 50bp reduction. This showed what a tight call the decision proved to be, and there is a risk of a slowdown in the pace of easing from here.

Beyond the bullish knee-jerk reaction to the vote split, the GBP should also look towards the medium-term forecast for inflation. The BoE raised its near-term inflation forecast to 4.0% in September (from 3.7% previously) and its two- and three-year ahead inflation forecasts to 2.0% (from 1.9% previously). This may once again indicate that the BoE will not be in a rush to ease policy again soon.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

The GBP spiked higher against both the USD and the EUR, as markets have pared expectations for a November rate cut. The rates market now sees only c35% for this to happen, down from a c80% likelihood ahead of the meeting (Bloomberg, 8 August 2025). Nevertheless, our economists’ base case is that more evidence of disinflation against the backdrop of a weakening labour market will come through, allowing the BoE to reduce its policy rate at a continued 25bp-per-quarter pace, until it gets to 3.0% in Q3 2026.

Meanwhile, the UK’s public finance situation has deteriorated since March. As the Autumn Budget (around late October or early November) approaches, the GBP is likely to face downside risks. The possibility of tax hikes could alter the outlook for inflation and unemployment and, thereby, the BoE’s easing path. It could also stir up political uncertainty if the Chancellor’s tax and spending decisions deepen divisions within the Labour party. As such, the GBP is likely to weaken against the EUR, but not by much against the USD, which is still weighed down by US policy uncertainty.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/gbp-the-boes-hawkish-cut/