georgemiller

Publish Date: Mon, 11 Aug 2025, 12:01 PM

Key takeaways

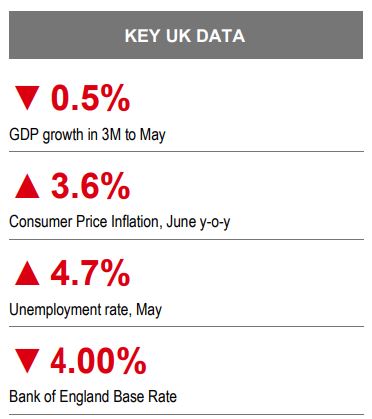

- The Bank of England cuts Bank Rate by 0.25ppts in August.

- GDP growth lacks direction amid ‘temporary’ pressures…

- …while inflation is expected to stay above 3.5% throughout the rest of 2025.

Source: HSBC

The ‘stag’ is weak and lacks direction…

UK GDP growth fell for a second consecutive month in May, albeit grew 0.5% on a three-month-on-three-month basis, driven by all three broad sectors. However, the degree of uncertainty in the data is elevated and likely distorted by a range of temporary factors including the front-loading ahead of tariff and stamp duty changes, and retail seasonality adjustments. Nonetheless, underlying economic growth is weak and lacks direction. The PMIs point to little momentum in activity amid continued pressures, notably from higher labour costs that are translating into soft employment demand; the unemployment rate rose to 4.7% in the three-months to May. Meanwhile, GfK consumer confidence in July was lower than a year ago.

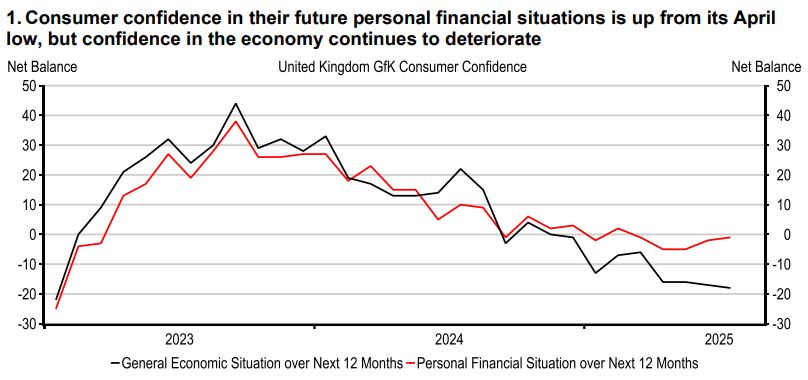

But all is not lost, many of the factors currently weighing on sentiment are one-off ‘shocks’ the effects of which should subside. Indeed, many indicators are off their March/April lows and forward-looking indicators from both consumers and businesses are more positive. Consumers, while pessimistic about the economic outlook (chart 1), are relatively more certain of their own personal financial situations going forward. Perhaps in part a reflection of wage growth and falling interest rates helping to offset the impact of higher prices. A clear risk lies in the upcoming Autumn Budget, not only in terms of possible policies announced, but also the uncertainty in the lead-up to it.

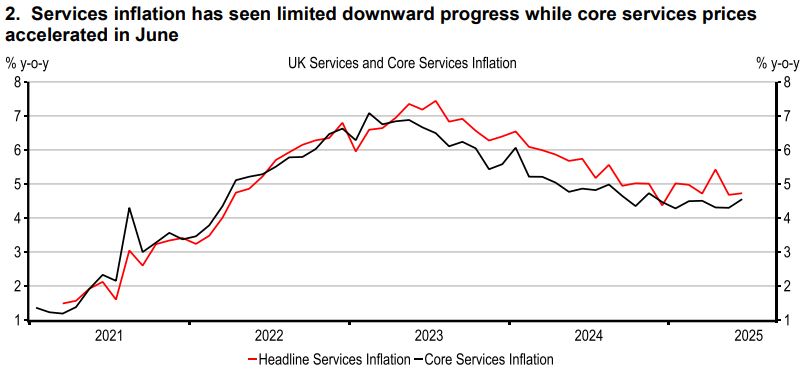

…while the ‘flation’ is strong and sticky

The headline rate of CPI inflation rose to 3.6% y-o-y in June from 3.4% in May. Some of that acceleration is of little concern; however, there were signs of price stickiness. Although services inflation was unchanged at 4.7%, core services (chart 2) rose 0.3ppts by our estimates. At its August policy decision, the BoE raised their near-term inflation profile – expected to stay above 3.5% through the remainder of 2025 – and pointed to increased risks of second-round effects via inflation expectations, which remain elevated, and the potential translation into wage growth.

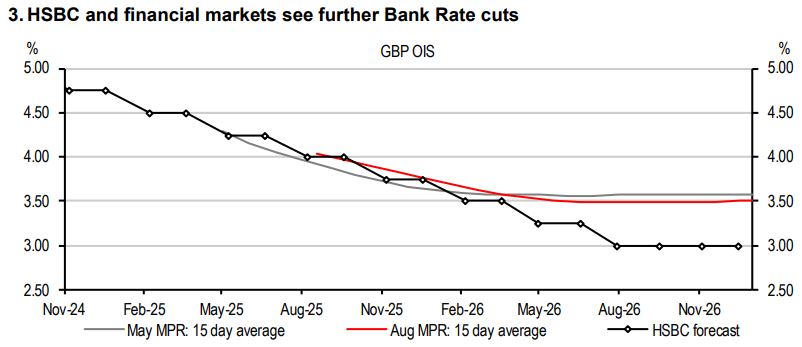

Nonetheless, wage growth has moderated, and the BoE cut Bank Rate by 0.25ppts to 4.00% in August. But rates setters are divided, and although that is not new, it points to a lack of improvement in clarity over the outlook for the UK economy. The BoE will need to continue to tread a fine line between managing medium-term price stability and unnecessarily damaging growth. We maintain our view that further moderations in wage growth will help to alleviate inflationary concerns and enable Bank Rate to fall further but the risk is on the side of a slower pace of rate cuts.

Source: Macrobond, GfK, HSBC

Source: Macrobond, HSBC calculations

Source: Bloomberg, HSBC forecasts

https://www.hsbc.com.my/wealth/insights/market-outlook/uk-in-focus/stagflation-risks/