georgemiller

Publish Date: Mon, 18 Aug 2025, 12:01 PM

Key takeaways

- USD weakness has paused lately, but could resume…

- …depending on the direction of Fed policy and the coming arrival of its new chair.

- If markets show concerns over Fed independence, the USD could face headwinds.

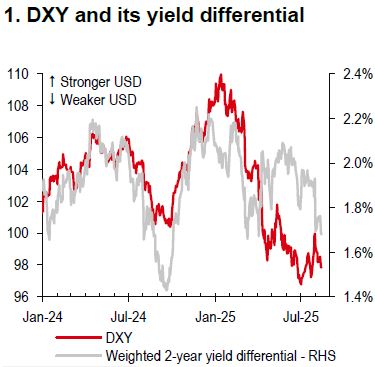

Throughout most of this year, the relationship of the USD with interest rate differentials has been poor, as US policy uncertainty and structural forces are overshadowing such cyclical drivers of the USD. However, there have been nascent signs of the USD’s cyclical drivers taking on greater importance, with the gap between the US Dollar Index (DXY) and its weighted rate differential narrowing (Chart 1).

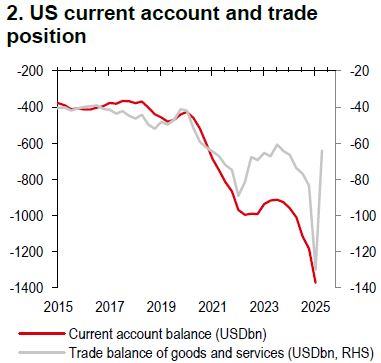

The fact that heightened US trade policy uncertainty no longer coincides with a lower USD gives room for other factors, such as US yields, to increasingly matter. The USD’s weakness has paused lately, in part due to the likelihood of an improvement in the US current account position amid a narrowing trade deficit (Chart 2).

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

We can back out why USD weakness has paused, but there are other considerations that could soon start testing the currency again. This largely comes down to the Federal Reserve’s (Fed) stance on monetary policy and who could be the next Chair. As the resumption of the Fed’s easing cycle is coming, the cyclical influence for the USD is likely to become more dominant, and gradual Fed easing would still see the USD as a higher yielding currency.

There is frequent dialogue about Fed Chair Jerome Powell’s likely departure in May 2026 and who could take over (Reuters, 6 July 2025). Market interpretation of political bias for the Fed can carry different outcomes for the USD. If this is relatively benign in the end and the Fed can cut rates gradually, this supports our central case for the USD to weaken gradually versus many currencies. If, however, markets become concerned about political interference for the Fed, then the USD could behave differently, depending on how cross-asset volatility shifts and long-term US bond yields move. In a problematic situation, the USD would initially weaken versus core currencies like the EUR, JPY, and CHF, but it could be trickier for other currencies that are sensitive to heightened risk aversion, such as the AUD, the NZD, and many other emerging market currencies.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/usd-focus-on-the-fed/