georgemiller

Publish Date: Mon, 18 Aug 2025, 12:02 PM

Key takeaways

- China’s H2 economic policy aims to speed up capacity reduction and roll out more demand-boosting policies.

- The new ‘anti-involution’ campaign should help enhance productivity and better balance supply and demand.

- Emphasis on consumption policies to increase goods and services demand could help unlock more growth potential.

China data review (July 2025)

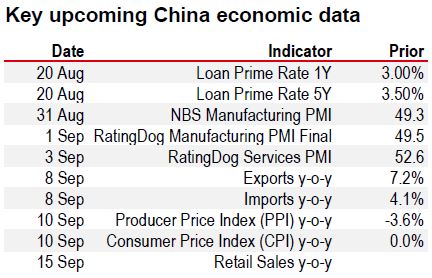

- Retail sales slowed to 3.7% y-o-y in July amidst a notable pullback in auto sales (-1.5% y-o-y). The China Passenger Car Association recently noted that passenger car and EV sales were up in volume terms by 6.3% and 12% y-o-y in July, down from 10.8% and 33.3% in 1H (Yicai, 8 Aug). Also, the third batch of trade-in subsidies was likely deployed only towards late July (Gov.cn, 26 July).

- Industrial production decelerated to 5.7% y-o-y in July likely owing to the antiinvolution campaign. However, sectors benefiting from ongoing policy stimulus, such as equipment upgrading and incentives to promote technology and innovation, still led the overall growth, e.g., high-tech manufacturing up 9.3%.

- Property investment dropped 17% y-o-y in July, the deepest contraction since November 2022. Meanwhile, primary residential home sales also fell 7.1% y-o-y in volume terms. Of note, the latest July Politburo meeting and the Central Urban Work Conference had set the tone that advancing urban renewals and increased urbanisation will be the key focus in the longer term.

- CPI inflation was flat in y-o-y terms in July, largely owing to falling prices of food and energy. However, core CPI continued to improve, rising 0.8% y-o-y, likely helped by the ongoing fiscal push to boost consumption. On the producer side, PPI inflation remained weak in July, dropping 3.6% y-o-y. It will take more time to see impacts from anti-involution campaign.

- Exports sustained the growth momentum, rising 7.2% y-o-y in July, given a low base from last year as well as continued trade restructuring and related frontloading to emerging markets regions. Meanwhile, imports grew 4.1% y-o-y, helped by ongoing strength in processing imports, while ordinary imports also returned to positive growth.

Structural reforms picking up pace

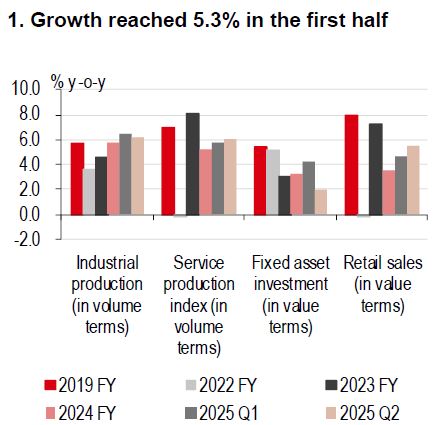

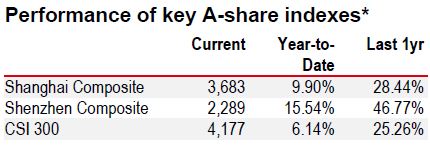

Strong 1H growth (chart 1), reciprocal tariff pauses, technology innovations from DeepSeek to innovative drugs, and recent policy momentum around structural reforms have made markets more optimistic and could lead to more stable H2 growth than originally expected. China is also shifting to high-quality growth, focusing on consumption, urbanisation, technology upgrades, and addressing excess capacity.

Policy support to accelerate

Politburo sets the tone: Policymakers were clear in July’s Politburo meeting (30 July) that supporting growth is still the primary focus. The economic policy in H2 aims to implement structural measures, with capacity reduction set to speed up and large projects and new urbanisation plans to be rolled out in an effort to boost consumption. A larger fiscal push may also include mega infrastructure projects, such as the recent RMB1.2trn Tibet Dam.

“Anti-involution” campaign to accelerate: While the anti-involution push may slow short-term growth due to industry consolidation and layoffs, it should lift productivity and improve the balance between supply and demand in the longer run. Unlike the supply side reforms in 2016, China is aiming for a more market-oriented approach to reduce capacity. A series of laws and regulations, such as the Private Economy Promotion Law, have recently been enacted aiming to level the playing field. If these are properly implemented, they will not only deter and penalise anti-competitive behaviour, but also accelerate national market integration.

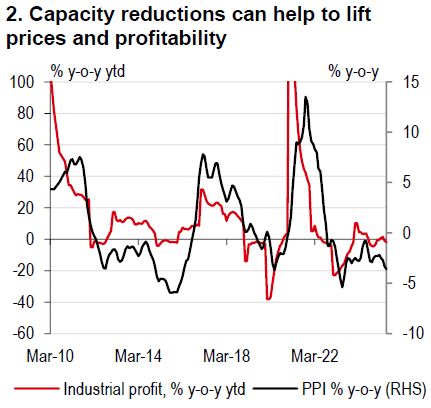

The campaign should also help to lift prices (chart 2). During the prior round of reforms, PPI reverted to positive growth after about three quarters from the launch of the campaign. This time around, the pace may be somewhat slower given the emphasis on the market-based approach.

Boosting domestic demand: Like before, policies aimed at lifting demand will be a key element. The new urbanisation plan will serve as the policy cornerstone, focussing on urban renewal programmes, improved urbanisation rates and the building of city clusters. The plan aims to expand affordable housing too, potentially converting existing stock. These largescale longer-term projects will also receive more focus in the upcoming 15th Five Year Plan.

China is also maintaining its strategy to enhance high-quality consumption growth. While subsidies for consumer durable goods have been in place since last year, a significant development is that the central government is now providing direct support for services consumption, such as child and elderly care. As urbanisation advances, new urban residents may be more willing to increase their spending, especially with equal access to public services.

Source: CEIC, HSBC

Source: CEIC, HSBC

Source: LSEG Eikon

* Past performance is not an indication of future returns

Source: LSEG Eikon. As of 13 August 2025, market close

https://www.hsbc.com.my/wealth/insights/market-outlook/china-in-focus/structural-reforms-picking-up-pace/