georgemiller

Publish Date: Mon, 25 Aug 2025, 12:02 PM

Key takeaways

- There is limited scope for the quarter-to-date underperformance of the JPY and the NZD to extend…

- …which the JPY would be supported by converging USJapan rates, amongst other domestic developments…

- …while positive factors for the NZD may be delayed.

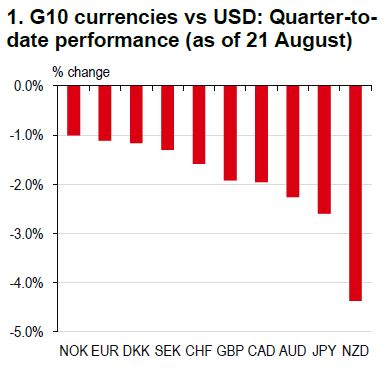

So far this quarter, the NZD is the worst-performing G10 currency, with the JPY coming in second to last (Chart 1). The question arises as to whether or not this trend will continue.

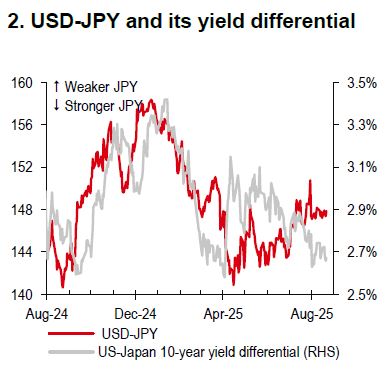

In our view, there is scope for the JPY to strengthen against the USD in the months ahead. Cyclical drivers, in particular yield differentials, have started to become more dominant in the FX market. Coming on the heels of a likely resumption of the Federal Reserve (Fed) easing at its 16-17 September meeting, yield differentials between the US and Japan would probably narrow, which points to USD-JPY downside (Chart 2), especially if the Bank of Japan (BoJ) turns more hawkish. Our economists expect the BoJ to deliver its rate hike at its 29-30 October, while markets only priced in c50% for this to happen (Bloomberg, 21 August 2025). In addition, less Japanese political uncertainty and less angst about the future fiscal path should help the JPY.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

As for the NZD, we turn cautious over the near term. The Reserve Bank of New Zealand (RBNZ) cut its policy rate by 25bp to 3.00% at its 20 August meeting, with a 50bp cut discussed. The RBNZ's policy rate projection was also revised lower to trough at 2.55% in 1Q26 (previously 2.85%), weighing on the NZD. External factors, like lacklustre emerging Asian currency performance, have also turned less favourable, pausing the rise in NZD-USD.

However, our cautious near-term stance on NZD-USD does not change our optimistic medium-term stance, where we think monetary and fiscal easing globally should provide a cushion for downside growth risks. The NZD is likely to be supported by a stronger terms of trade outlook, more direct exposure to potential fiscal measures from China, and more consistent bond inflows – these considerations are sitting in the back seat at the moment.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/jpy-and-nzd-underperformance-to-continue/