georgemiller

Publish Date: Mon, 01 Sep 2025, 12:02 PM

Key takeaways

- Most EM currencies have lost upward momentum lately, as markets are looking for clues on the Fed’s rate path…

- …but the Fed has finally signalled an exit to its rate hold.

- EM currencies are likely to appreciate in this upcoming Fed’s rate cutting cycle, in our view.

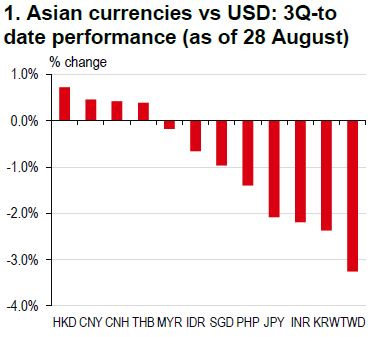

Many emerging market (EM) currencies have lost appreciation momentum so far in the third quarter, with most Asian currencies surrendering some earlier gains (Chart 1). This is partly because the US Dollar Index (DXY) has stabilised, rather than falling further, as markets look for clues on the Federal Reserve’s (Fed) policy path.

Going forward, the Fed’s policy is likely to be a key driver for the FX market. At the Fed’s annual economic symposium in Jackson Hole in August, Chair Jerome Powell signalled a rate cut soon. Fed funds futures are now pricing in rate cuts of c55bp by the end of the year, with a c88% chance of a 25bp cut at its 16-17 September meeting (Bloomberg, 28 August 2025).

Relatedly, the potential for a more dovish tilt in the composition of the Federal Open Market Committee (FOMC) is also catching market attention. Stephen Miran (who authored the ‘Mar-a-Lago Accord’ which laid out a framework to weaken the USD) has been nominated to temporarily fill in for Adriana Kugler (who stepped down from her position as a governor on 8 August but whose term was due to end in January 2026) and he may be confirmed by the Senate just in time to vote at the FOMC’s September meeting. Meanwhile, US President Trump announced on 25 August (US time) that he is removing Fed Governor Lisa Cook. Cook challenged this order in court and in the meantime, the Fed has deferred a decision on her status (Bloomberg, 28 August 2025). If there are growing market concerns about the Fed’s independence, the USD could take a hit. Our base case is for the USD to weaken modestly over the coming months.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

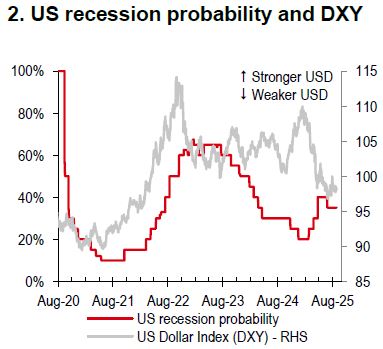

In our view, EM currencies could be stable or even outperform in the upcoming Fed’s rate-cutting cycle. First, the US economy is slowing but not in a recession, with Bloomberg’s US recession probability forecast currently standing at c35% (Chart 2), and so there will probably be limited negative spillover impact to EM growth, with rather contained “safe haven” demand for the USD. Second, many EM central banks have been cutting rates and some EM governments have been rolling out more supportive fiscal measures and embarking on market reforms in response to the US’s imposition of tariffs. These measures could support EM growth and currencies.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/em-currencies-when-the-fed-resumes-cutting-rates/