georgemiller

Publish Date: Fri, 05 Sep 2025, 07:04 AM

Key takeaways

- The GST rate cuts and rationalisation across a host of goods and services has been approved by the GST Council and will be effective from 22 September.

- Key to funding the tax cuts without a large fiscal implication is the folding of the compensation cess into the GST.

- Growth could be higher and inflation lower, improving India’s macro mix.

The Goods and Services Tax(GST) overhaul announced by Prime Minister Modi on 15 August was approved by the GST Council on 3 September. The following are worth noting:

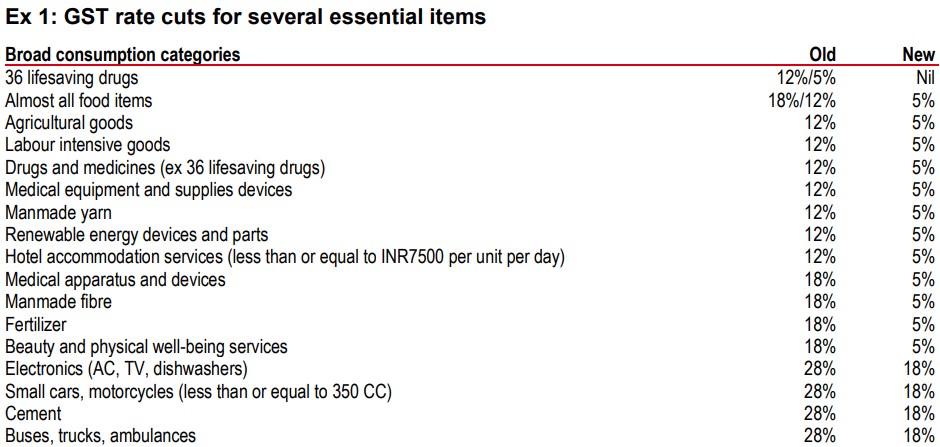

Fewer and lower rates. The new rate structure will comprise two key rates – 5% (merit rate) and 18% (standard rate) – alongside a 40% ‘de-merit’ rate. This was arrived at by slashing tax rates from 12% to 5% and from 28% to 18% for the majority of items (though rates were raised for a few items like coal). The new rates will apply from 22 September (except for tobacco products, which will be moved from the compensation cess rate to the 40% GST rate later in the year).

Products impacted. On the consumption side, several essential items saw a rate cut (e.g.,toothpaste, shampoo, small cars, air conditioners, and medicines, see Exhibit 1). On the production side, inputs in several sectors will face a lower tax burden (e.g. tractors in the agriculture sector, leather and marbles in labour-intensive goods, cement in construction sector, RE devices in the power sector, medical devices in the healthcare sectors). Some exemptions were added –individual life and health insurance policies will be exempt from the GST.

Structural improvements. The rationalisation was not limited to lower and fewer tax rates. Some of the inverted duty problems were corrected for the textiles and fertiliser sectors. Plans were laid out for easier GST registration, pre-filled returns, and quicker refunds. If these improvements are indeed made, it will improve the ease-of-doing-business environment.

From compensation cess to a 40% bracket. The compensation cess fund, which served several purposes since the inception of the GST regime, will be closed around September (or when the GST bonds are fully repaid). The items in the compensation cess bucket will be moved to the 40% GST bracket, making it regular GST revenue to be shared by the centre and state governments. This has been a key step for ensuring that the fiscal cost of tax cuts is not too high.

Fiscal implication. Details showed that the gross revenue loss from the tax cuts is about INR930bn (USD10.8bn) in a consumption base of FY24. Revenues folded from the compensation cess to the 40% tax bracket can fund INR450bn (USD5.2bn) of the loss, leaving a net loss of INR480bn (USD5.6bn), which is 0.16% of GDP.

Scaling this to the FY26 base implies a net revenue loss of INR570bn (0.16% of GDP) over a year. Since only halfofthe fiscal year is left, the implication for FY26 would be around 0.1% of GDP.

Growth boost. Crudely put, the government’s loss is the consumer’s gain. Over a year, led by stronger consumption, GDP growth can increaseby 0.2ppt. (However, for this to transpire, the government should not run a tighter fiscal policy to offset the consumption boost.)

It is also important to put the GST cuts in a broader context. If we add on the benefits from the income tax cut earlier this year (0.3% of GDP), and a lower debt servicing burden due to repo rate cuts (0.17% of GDP), the overall boost to consumption can be 0.6% of GDP. Of course, a part of this could be saved instead of spent, lowering the net boost.

Inflation impact. We estimate that the tax rate cuts can lower headline CPI inflation by c1ppt if producers pass on all benefits to consumers. If the pass-through is only partial, the inflation fall could be closer to 0.5ppt. We expect the RBI to cut rates once again by 25bp in 4Q25, taking the repo rate to 5.25%.

https://www.hsbc.com.my/wealth/insights/market-outlook/india-economics/gst-rationalisation-goes-live/