georgemiller

Publish Date: Mon, 08 Sep 2025, 07:04 AM

Key takeaways

- Global small-cap stocks have been out of favour in recent years. But in the market rally that began in April, there have been some eye-catching performances in small-cap stock indices.

- Emerging markets are not normally viewed as a defensive play. Yet, that has effectively been the experience in bond markets over last three years.

- It has been a busy year for US utilities, with policy shifts, strong demand growth and infrastructure needs shaping the outlook.

Chart of the week – Vigilantes mounting up?

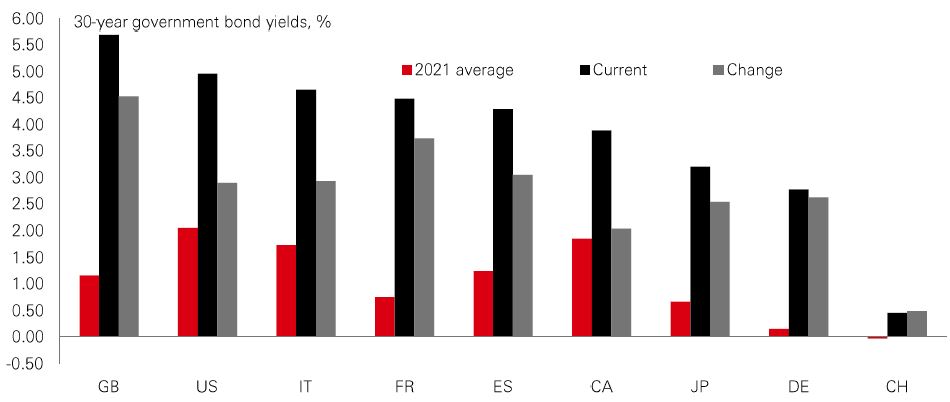

UK 30-year Gilt yields hit a post-1998 high of around 5.70% last week, a 4.5%+ increase from their 2021 average seen ahead of the start of the global tightening cycle. This marks a significant underperformance relative to other developed markets and reflects increasing concerns over the UK’s rising government debt and limited ability to rectify the situation.

Spending cuts are politically difficult while the tax take is already historically high, with further increases potentially undermining competitiveness and weakening already-soft growth. France faces similar problems but has the advantage that its current account is broadly in balance meaning it’s less dependent on international investors to fund the government deficit.

The big question for global markets, however, is whether concerns over fiscal dominance and Fed independence push US long-dated yields significantly higher? At around 5%, they are already at levels that are seen as putting pressure on equities. The US is in a better position than the UK, given the dollar’s status as the world’s reserve currency and the US economy has stronger long-run growth prospects. Its tax take is also low by international standards, offering a route to improving the public finances, albeit a politically unpopular one. But at this stage, worries over fiscal policy and the independence of monetary policy seem likely to persist.

Market Spotlight

Back to school

With summer holidays over, it was “back to school” for markets last week, with three themes and three big questions.

#1, is that despite policy uncertainty, many asset classes are trading at year-highs amid low volatility. Double-digit returns are making 2025 a banner year for investors. Some of the most eye-catching moves have been in Europe, China, and emerging markets – which were all unloved at the start of the year.

#2, is that bond market vigilantes have been spotted, but fixed income returns are steady. The yield curve has ‘bull steepened’ in the US on the prospect of rate cuts and sticky long-term Treasury yields. But it has ‘bear steepened’ in Europe and Japan on fiscal worries. Investors have turned to private and public IG credits as bond substitutes, as well as gold.

#3, the lower US dollar has significantly influenced asset returns in 2025. A weaker dollar can lift emerging market currencies and give EM central bankers space to ease policy. That has been a big reason why EM bonds and stocks are among the best performing assets in 2025.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management, Bloomberg, Macrobond. Data as at 7.30am UK time 05 September 2025.

Lens on…

Big moves in small caps

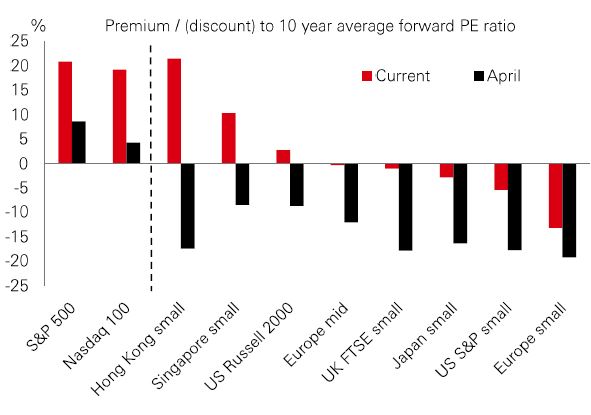

Global small-cap stocks have been out of favour in recent years. But in the market rally that began in April, there have been some eye-catching performances in small-cap stock indices. In August alone, the Russell 2000 index rose 7%, easily outperforming the S&P 500. That was driven by expectations of Fed rate cuts, supportive government policy in the Big Beautiful Bill, and low volatility which helped boost risk-on sentiment.

There have also been some surprisingly strong re-ratings in small-cap valuations outside the US. Moves in Hong Kong and Singapore smaller-caps have been breathtaking (partly due to valuation discounts on offer).

At the other extreme, Europe has been more mixed, with mid-cap gains leaving valuations in line with their 10-year PE averages, but small caps barely budging. That’s despite smaller caps in many cases having a superior profit backdrop to large caps in the current cycle. A recent paper shows that European smaller-cap profits have been relatively resilient during this cycle.

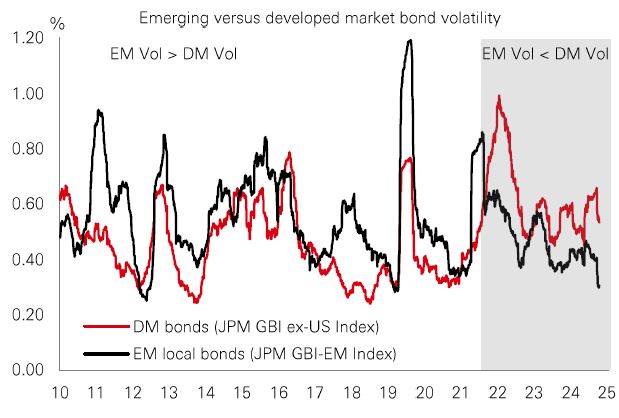

Bond behaviour

Emerging markets are not normally viewed as a defensive play. Yet, that has effectively been the experience in bond markets over last three years. The total return volatility of EM local-currency bonds has been consistently lower than of developed market bonds – and that extends to the volatility of unhedged EM returns in US-dollar terms. This implies that EM-FX volatility has played a part in the performance.

One of the main reasons for the divergence is that the fallout from the post-Covid period of global inflation has been especially significant for DM bond yields, which have repriced higher from historically depressed levels. And while EM bonds were also exposed to the inflation spike, EM volatility not only rose by less but has already normalised to pre-pandemic levels – even as DM yield volatility remains elevated.

The growing maturity of EM bonds as an asset class, where improved market liquidity, depth and local investor participation have been accompanied by structurally better fundamentals, such as higher policy credibility and much healthier fiscal and external balances.

A power play

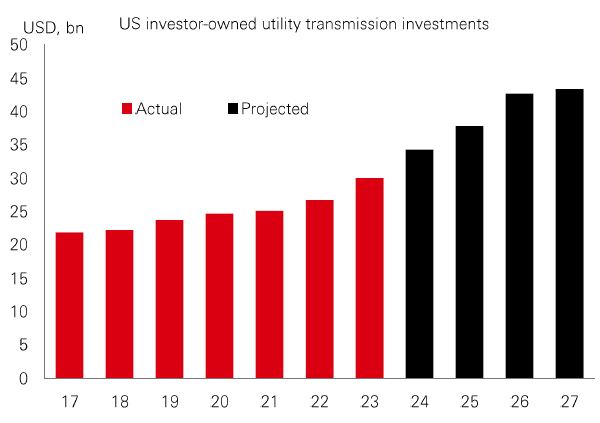

It has been a busy year for US utilities, with policy shifts, strong demand growth and infrastructure needs shaping the outlook. Analysis by some Equity analysts shows that while tariffs have been a focus for markets, companies expect only a modest 2-5% impact on long-term capex plans, helped by diversified supply chains.

Crucially, the One Big Beautiful Bill Act has eased concerns by allowing renewable tax credits beyond the legislated deadline and retains those for nuclear and battery storage. This supports utilities’ near-term investment plans, although the eventual loss of credits will raise costs for new renewables. Alongside this, transmission investment has been a key theme. Reforms and permitting changes should speed up projects that connect supply and demand, boost reliability, and integrate renewables.

Meanwhile, utilities are benefitting from growing load demand from new data centres, electrification and re-shoring. Overall, there could be attractive long-term growth potential in a sector where infrastructure needs, policy support and regulated returns are well aligned.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.. Source: HSBC Asset Management. Macrobond, Bloomberg, BofA Research, Oxford Economics. Data as at 7.30am UK time 05 September 2025.

Key Events and Data Releases

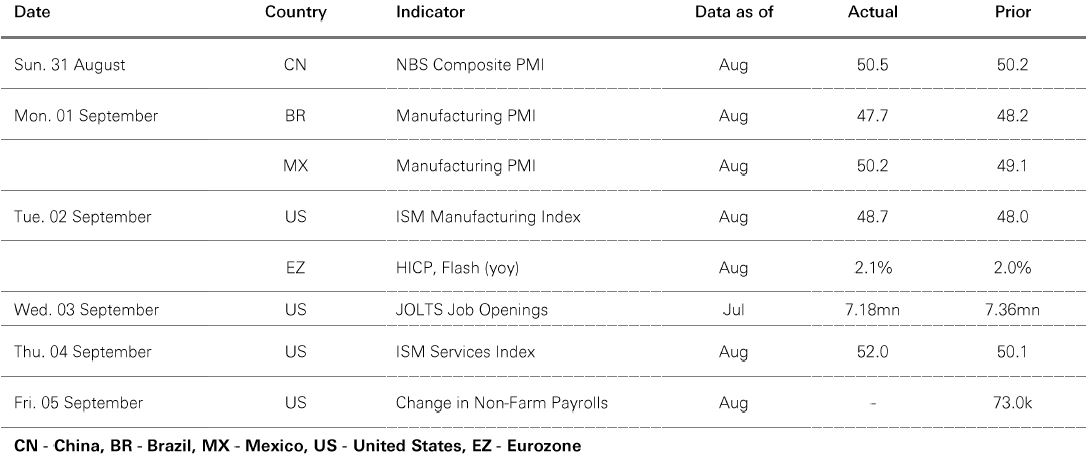

Last week

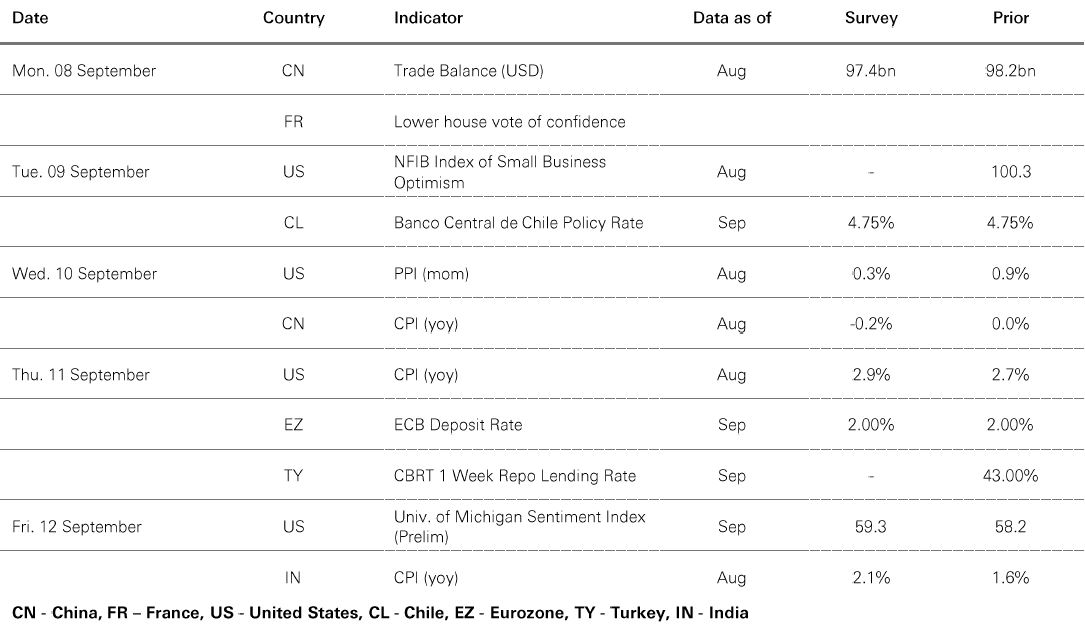

The week ahead

Source: HSBC Asset Management. Data as at 7.30am UK time 05 September 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

Market review

Investors remained cautious amid growing fiscal concerns, driving the US dollar index modestly higher and gold prices to a record high. 30-year German, Japanese, and UK sovereign bond yields reached multi-year highs before stabilising, while French OATs rebounded ahead of a no-confidence vote for PM Bayrou. An initial fall in 10-year US Treasuries reversed ahead of Friday’s key jobs data, with market currently pricing in at least two 0.25% Fed rate cuts by year-end. High-yield credit spreads in the US and eurozone widened. In equity markets, US stocks were on course to finish the week modestly higher, while European stocks dipped slightly. Japan’s Nikkei 225 advanced, alongside broad gains across in Asian markets. India’s Sensex climbed on optimism for GST rate cuts, but China’s Shanghai Composite paused its recent rally amid worries over potential regulatory measures to cool the market.

https://www.hsbc.com.my/wealth/insights/asset-class-views/investment-weekly/vigilantes-mounting-up/