georgemiller

Publish Date: Wed, 10 Sep 2025, 08:05 AM

Key takeaways

- As reciprocal tariffs took effect in August, global data should remain volatile in the coming months.

- US labour market data have clearly weakened – how will consumers and the Federal Reserve react?

- Inflationary pressure is building in the US, but less so elsewhere due to lower energy prices.

2025 has been a year of very messy global data. Global trade readings have been distorted by tariffs and frontloading, as have inflation prints in the US. Big moves in the oil price have caused falls in inflation outside the US and we’ve had growth data hold up much better than many had expected. But after all the policy noise, what happens now?

Tariff payback

The final third of the year is likely to be characterised by how much payback there is now that US tariffs are set at their August rates, the impact on the US economy, and how the Federal Reserve (Fed) reacts given that data. A September rate cut looks locked in, but after that, the trade-off between activity and inflation data will be key.

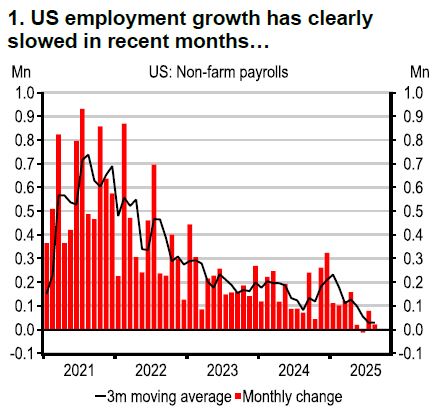

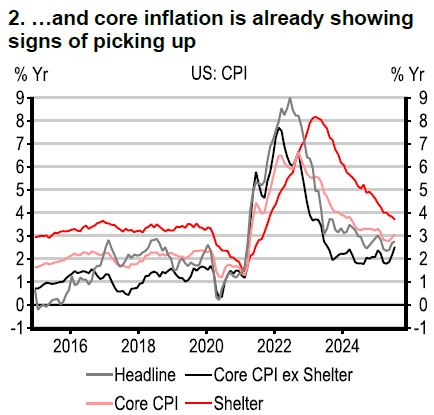

Meanwhile, the US labour market is clearly wobbling after the weak prints (and backward revisions) in July and August (chart 1). On the other side of the equation, the US inflation data continue to show growing evidence of the tariff impact (chart 2) – the detail here will be key in the coming months to see where these effects are being seen.

Source: Macrobond

Source: BLS

Consumer strength

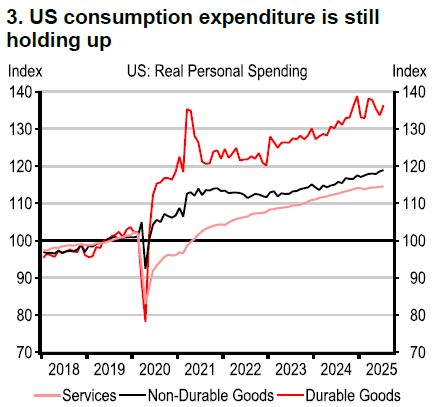

Despite all of the uncertainty around tariff and fiscal policy, the US consumer is, for now, still spending (chart 3). Whether that resilience continues despite more worries about job security will play a big role in the global outlook in the coming months.

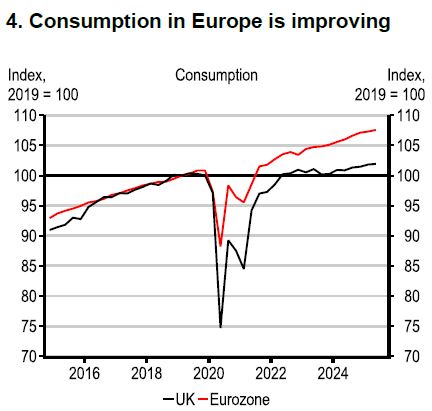

Because of the combination of better exports so far this year and lower inflation (helped by lower oil prices), we’re seeing a better-than-expected set of growth data across much of the rest of the world. Consumers in Europe, Asia and Latin America are seeing a better real wage picture, and while spending has held up (chart 4), caution is clearly limiting how much of that increased income is spent.

Source: Macrobond

Source: Macrobond

The trade picture will also become even more clouded in the next few months. July’s data saw another wave of US imports picking up, and while this should drop back in August after the new tariffs, the path after that is less certain given impending sector tariffs. We still expect a pay back in terms of exports to the US for many economies.

Fiscal challenges

For policymakers, it’s not an easy mix to digest. We continue to expect the Fed to cut in September, December and March, and while the European Central Bank is most likely finished with its easing cycle, elsewhere central banks are still broadly cutting rates. However, despite lower policy rates, government bond yields remain high, and in some cases are rising – highlighting the scale of the fiscal challenge many governments are facing in these uncertain times.

Source: Bloomberg, HSBC

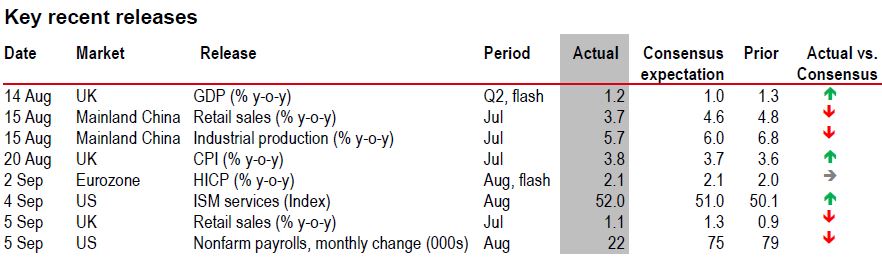

⬆ Positive surprise – actual is higher than consensus, ⬇ Negative surprise – actual is lower than consensus, ➡ Actual is in line with consensus

Source: LSEG Eikon, HSBC

https://www.hsbc.com.my/wealth/insights/market-outlook/macro-monthly/assessing-the-tariff-fallout/