georgemiller

Publish Date: Mon, 15 Sep 2025, 07:05 AM

Key takeaways

- Mainland Chinese stocks have performed well this year – with the offshore market in Hong Kong rising by more than 30%. But during Q3, some of the biggest moves in mainland China have been in the onshore A-share market – with firms in the growth-oriented ChiNext index doing especially well.

- A genuine conundrum in investment markets today is that despite still elevated levels of policy uncertainty, equity market volatility – as measured by the VIX index – has been remarkably low over the summer months.

- Fixed income seems to be in flux, with the usual order of risk premia almost inverted. Fiscal risk premia for government bonds, especially in the US, are rising as government debt burdens balloon. But risk premia in credit markets are shrinking, with high-grade issuers deleveraging, lengthening debt maturities, and building cash buffers.

Chart of the week – Stagflation-lite US

The US Federal Reserve looks set to cut the funds rate at its 17 September meeting. The main question appears to be whether it will surprise the market with a 0.5% move. This marks a significant shift in expectations relative to those that prevailed immediately after Chair Powell’s July press conference, when the market was pricing only around a 40% chance of a 0.25% rate cut in September.

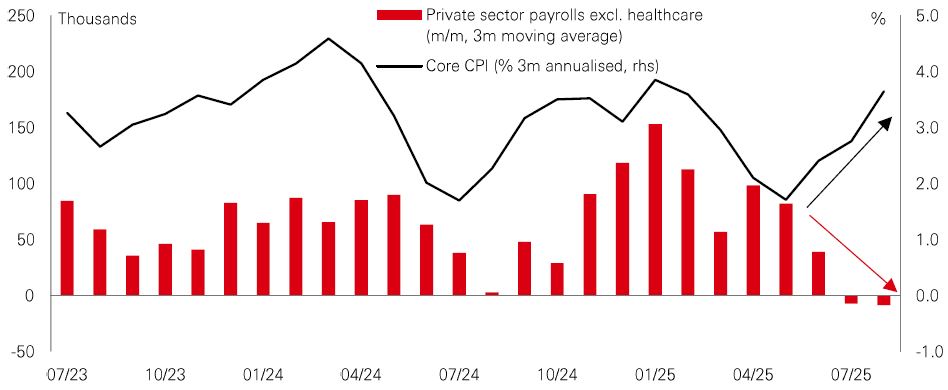

Deteriorating labour data have been key. The July payrolls release was weaker than expected and included substantial downward revisions to May and June. This was followed by another soft reading for August and further large downward revisions for the twelve months to March 2025. The upshot is that total non-farm payrolls fell in June and have risen by an average of only around 30k from June to August. Moreover, once healthcare jobs are excluded, private sector payrolls have edged down since April, indicating a significant cooling. On the inflation front, the latest two core CPI prints have been broadly as expected, showing a gradual pick-up in goods price inflation, driven partly by tariffs, and stickiness in some service sector prices.

The worse-than-expected labour data have pulled rates lower across the curve, despite inflation creeping up. The 1.5% of Fed cuts now priced in by end-2026, the decline in 10-year Treasury yields and the steepness of the 2s-10s yield curve suggest the rates market is increasingly concerned about the state of the economy. Fed cuts plus an AI surge are boosting stocks.

Market Spotlight

Resurgent India

Global trade uncertainty and a cyclical economic slowdown crimped the profit growth outlook for Indian firms this year, leaving the country’s stock market a relative underperformer versus global peers. It marks a significant shift in mood after a surging two-year rally that took Indian stock valuations to long-term highs late last year.

From here, expectations of a cyclical recovery driven by supportive monetary and fiscal policies are good news for the profits outlook. In terms of policy support, we think the goods & services tax (GST) overhaul and cuts, personal income tax relief, front-loaded rate cuts, and regulatory moves to improve credit availability, should help revive urban consumption. Softer inflation is also helping consumer real purchasing power. It’s worth remembering too, that India’s strong structural tailwinds, including significant infrastructure spending and the “demographic dividend” from its rapidly growing working age population, are also longer-term drivers.

While stock valuations remain a little high versus EM peers, the combination of growth in both corporate profits and GDP provide a degree of justification.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management, Bloomberg, Macrobond. Data as at 7.30am UK time 12 September 2025.

Lens on…

China’s bull run

Mainland Chinese stocks have performed well this year – with the offshore market in Hong Kong rising by more than 30%. But during Q3, some of the biggest moves in mainland China have been in the onshore A-share market – with firms in the growth-oriented ChiNext index doing especially well.

Several factors have been driving this performance. One is the continuing readiness of policymakers to offer targeted support to the economy and markets. Efforts to tackle over-production and excessive discounting in some sectors is one example. The extension of the US-China tariff truce has also helped build confidence. And mainland China’s fast-growing technology sectors have also been a re-rating catalyst.

Where now? The impressive onshore market rally has been driven by higher liquidity and multiple expansion, with Q2 reporting season seeing fairly modest year-on-year profits growth. Given its lower valuations and exposure to high-tech sectors, the mainland Chinese market has the potential to benefit from rising global fund inflows.

Desensitised markets

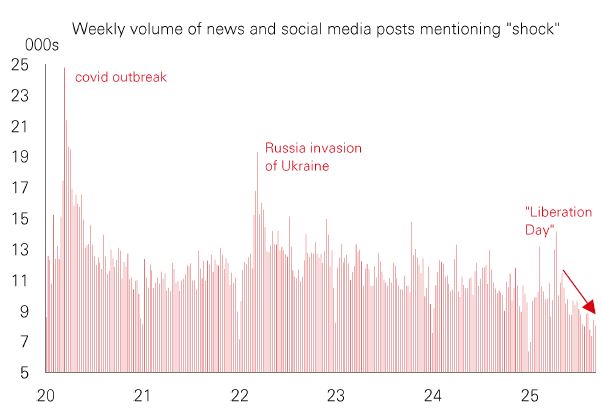

A genuine conundrum in investment markets today is that despite still elevated levels of policy uncertainty, equity market volatility – as measured by the VIX index – has been remarkably low over the summer months. What gives? One possible reason is that investors may have been reassured by evidence that disruptive US policy actions are constrained by market sell-offs, especially in the bond market. We saw a taste of that in the aftermath of the early-April Liberation Day announcements.

But with uncertainty now a feature, rather than a bug, of the global landscape, could investors – and the media – have lost some sensitivity to developments that once would have triggered major headlines and market ructions? It’s interesting to see that news stories and social media posts mentioning the word “shock” have collapsed in recent months. This could mean the bar for global developments to trigger market volatility is now higher. But the risk now is that sanguine markets encourage extreme policy moves by the US administration. And with significant economic headwinds stemming from a soft labour market and sticky inflation, another burst in volatility this year cannot be ruled out.

Credit – a haven for portfolios?

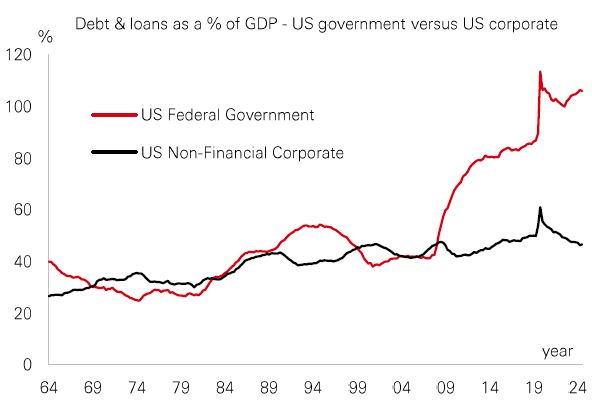

Fixed income seems to be in flux, with the usual order of risk premia almost inverted. Fiscal risk premia for government bonds, especially in the US, are rising as government debt burdens balloon. But risk premia in credit markets are shrinking, with high-grade issuers deleveraging, lengthening debt maturities, and building cash buffers. The 2010s saw a protracted period of divergence between US sovereign and US corporate indebtedness. US federal debt-to-GDP is now at all-time highs and rising but corporate debt-to-GDP is below historical highs and falling.

This divergence is an important long-term anchor for credit spreads. Equilibrium spreads could remain at current low levels despite higher government bond yields because fundamentals justify a bigger increase in sovereign risk premia than credit risk premia. Over time, investors may well seek safety in the fortress balances sheets of the high-grade corporate sector.

Overall, while spreads may appear low, these structural changes imply that current spreads may not necessarily be too tight.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 12 September 2025.

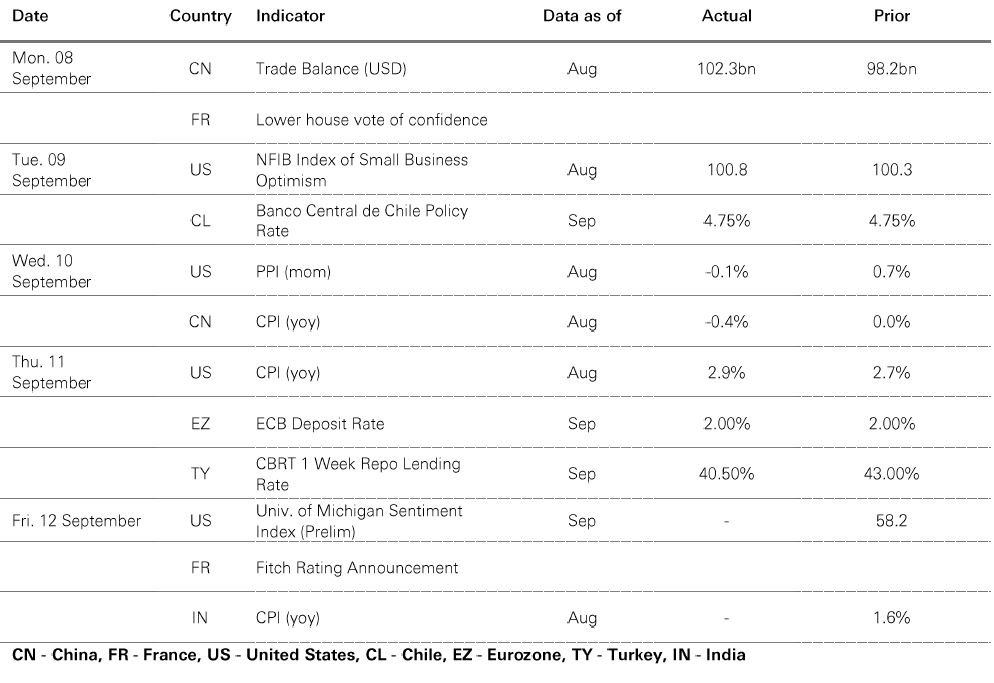

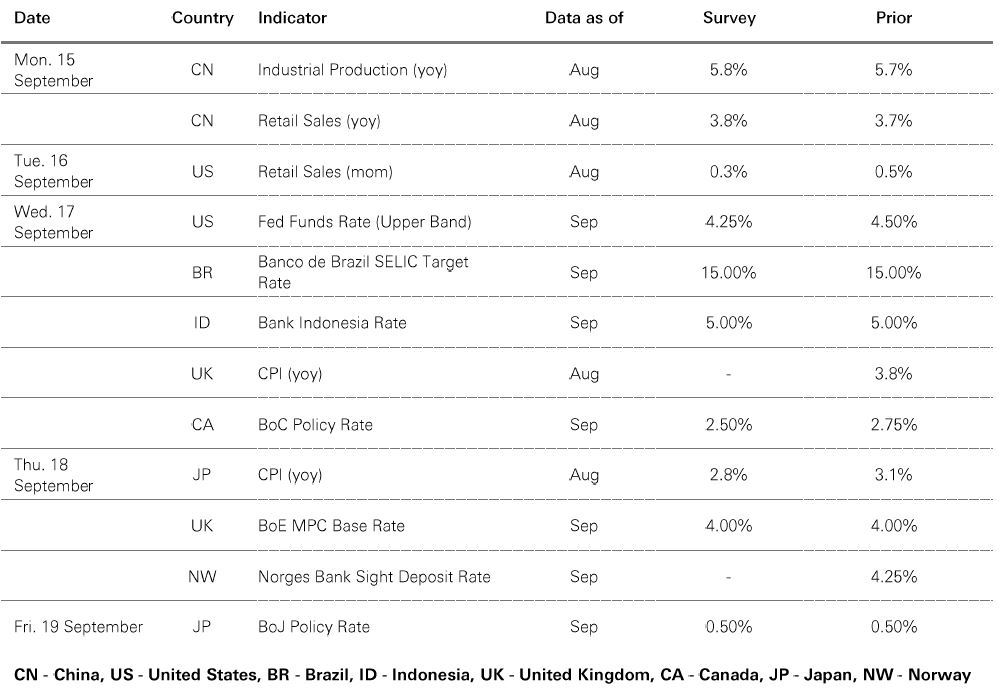

Key Events and Data Releases

Last week

The week ahead

Source: HSBC Asset Management. Data as at 7.30am UK time 12 September 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

Market review

Positive risk market sentiment persisted last week, despite rising geopolitical tensions. The US dollar index was range-bound, while gold prices touched a record high. 10-year Treasury yields fell on further signs of labour market softening ahead of this week’s FOMC meeting. Investors are pricing in five to six 0.25% rate cuts over the next 12 months as the latest CPI data largely met consensus. In Europe, the ECB left policy on hold, with growth risks now viewed as “more balanced”. US and eurozone IG and HY credit spreads narrowed. In DM equities, the S&P 500 and Japan’s Nikkei 225 reached all-time highs. The Euro Stoxx 50 advanced, alongside gains in most Asian markets. South Korea’s Kospi and the Hang Seng index saw notable increases, and the Shanghai Composite also rose. Political uncertainties weighed on Indonesian stocks. In commodities, oil prices trimmed earlier gains.

https://www.hsbc.com.my/wealth/insights/asset-class-views/investment-weekly/stagflation-lite-us/