georgemiller

Publish Date: Mon, 15 Sep 2025, 08:05 AM

Key takeaways

- With the combination of the Fed’s cutting cycle seen resuming and questions about its independence…

- …the USD is likely to weaken in the months ahead.

- But the ECB’s stance is providing static support to the EUR.

With the magnitude of the USD’s descent since the start of the year, it is not surprising that some may make the case that the worst is behind us. But our baseline scenario still sees the USD weakening in the coming months.

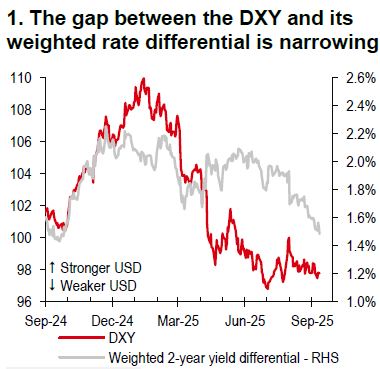

There has been re-convergence in the US Dollar Index (DXY) with its weighted rate differential (Chart 1), after a clear breakdown in these relationships earlier this year when US policy uncertainty was intensifying, especially in the context of tariffs. With this in mind, the pace and size of the Federal Reserve’s (Fed) expected decision to ease will be crucial to the USD. Our analysis suggests that the DXY performance in the six episodes of rate cuts by the Fed over the past 30 years was mixed. Gradual Fed easing can weigh on the USD, but faster easing may not.

While there is a greater focus on the cyclical side of the US, political factors are still relevant, especially when considering market concerns over the Fed’s independence. In our view, the combination of the Fed’s cutting cycle seen resuming and questions about its independence would probably point to two scenarios for the USD to decline.

One opens a faster USD decline if the Fed needs to lower interest rates quickly and US policy uncertainty intensifies in the coming months. The other one is slower moving whereby the USD weakens gradually, but suspicions linger as to what lies next around the corner. We believe the latter is the more likely scenario, but the direction of the USD’s travel has not changed.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

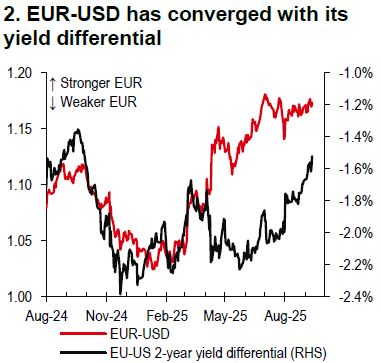

As for the EUR, the latest announcement from the European Central Bank (ECB) came in line with market expectations. On 11 September, the ECB kept its key deposit rate unchanged at 2.00% and said that risks were "more balanced". Our economists’ central case is that the ECB easing cycle is over, but one more insurance cut cannot be ruled out, as the higher US tariffs, a stronger EUR and French political uncertainty all still suggest downside risks to near-term inflation. With EUR-USD converging with its rate differential (Chart 2), the ECB’s stance has been providing static support to the EUR, leaving US factors as the dynamic driver.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/eur-usd-central-banks-diverge/