georgemiller

Publish Date: Mon, 15 Sep 2025, 08:06 AM

Key takeaways

- Downside risks to the GBP look set to build…

- … with growing market concern on the UK government’s capacity to meet its fiscal target, on top of stagflationary signs.

- That said, US factors will eventually dominate GBP-USD.

The UK Treasury announced that the Autumn Budget will be held on 26 November. There is growing market concern on the UK government’s capacity to meet its fiscal target. In March, the government had to make budgetary adjustments to restore GBP9.9bn of fiscal headroom. But a failure to push through spending cuts has resulted in additional fiscal slippage which the government now faces a much larger fiscal gap to fill in November, with estimates (excluding any headroom) ranging from GBP20bn to 40bn (Bloomberg, 3 September 2025).

The Bank of England’s (BoE) Decision Maker Panel survey showed further stagflationary evidence. One-year ahead inflation expectations rose to 3.44% (from 3.18% previously), while three-year ahead expectations rose to 2.99% (from 2.80%). Employment expectations fell, illustrating the conflicting signals emerging from the economy. In his testimony to the Treasury select committee on 3 -September, BoE Governor, Andrew Bailey, reiterated his inflation concerns (Bloomberg, 4 September 2025). With the Autumn Budget creating added near-term uncertainty, the BoE is in no rush to cut rates. The market expects the BoE to keep rates steady at its 19 September meeting, and only see a c20% chance of rate cut in November (Bloomberg, 4 September 2025).

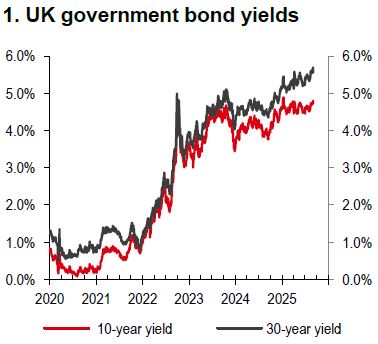

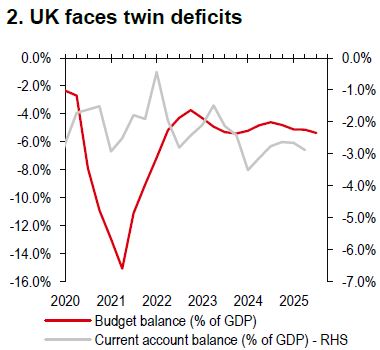

The combination of sluggish productivity growth, fiscal pressures and bond yields reaching new highs (Chart 1) is providing a challenging cyclical backdrop for the GBP. In addition, the structural challenges of the UK’s twin fiscal and current account deficits (Chart 2) could also weigh on the GBP, in our view.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

However, the UK is not alone in facing challenges. There are growing market concerns about the Federal Reserve’s (Fed) independence, while political risks are rising in France. In our view, the GBP is likely to be sensitive to UK budget news over the near term, probably facing downside risks, but US factors (in particular, discussions around the Fed) will eventually dominate GBP-USD.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/gbp-fiscal-risks/