georgemiller

Publish Date: Tue, 16 Sep 2025, 12:01 PM

Key takeaways

- Weak July and August data have fuelled hopes for policy stimulus; China plans to rebalance and reflate the economy.

- Anti-involution campaign is still in the early stages with detailed sector policies likely to be unveiled soon.

- We expect rate cuts and a resumption of bond purchases; China may intervene more forcefully to stabilise housing.

China data review (August 2025)

- Retail sales slowed to 3.4% y-o-y in August, partly due to a higher base. Distributions for trade-in subsidies resumed in August, but they were not enough to accelerate growth. Moreover, support from subsidies may slow further, given the high base from September last year. A recent campaign to clamp down on excessive spending by government officials on banquets (SCIO, 22 May) also likely weighed on catering sales (which rose 1% y-o-y versus c5% in Q1).

- Fixed Asset Investment fell to -7.1% y-o-y in August, dragged down by a steeper fall in property investment (-19.5%), while manufacturing and infrastructure investment saw their second consecutive month of decline. Trade uncertainty, the outlook for the anti-involution campaign, as well as extreme weather conditions all weighed on investment.

- The property sector continued to drag on growth. Aside from weaker property investment, primary home sales fell 10% y-o-y, while floor space starts were down 18% y-o-y, all steeper falls. The renewed weakness may prompt stronger policy actions, as indicated by Premier Li recently (Gov.cn, 18 August). As prior supply-side efforts appear to have made limited progress, a more promising move would be a direct intervention by the central government.

- CPI contracted by 0.4% y-o-y in August. However, excluding volatile items (food and energy), core CPI continued to improve in y-o-y terms (+0.9%) and stood at its highest level since March 2024. On the producer front, deflationary pressures eased, PPI fell 2.9% (from -3.6% in July), helped by a more favourable base, as well as the ongoing anti-involution campaign.

- Export growth moderated to 4.4% y-o-y in August, largely on the back of a sharper drop in US shipments, despite continued stronger exports to ASEAN (22.5% y-o-y) and the EU (10.4%). Meanwhile, import growth decelerated to 1.3%, as commodity imports (especially crude oil) were weighed down by lower global prices and weakness in the construction sector due to extreme weather.

China Policy Watch – Five FAQs on how to reflate and rebalance

After a resilient H1, China’s growth has slowed in July and August. Some market watchers see this as a turning point that will lead to more assertive easing. We have, indeed, seen an acceleration in policy rollouts recently, and we expect China to dial up its policy support using a combination of cyclical and structural measures. We lay out five key questions around China’s policy expectations and what to watch out for in the remaining months of the year.

Q1: Recent data surprised on the downside: Will policy step up?

Yes, a stronger policy stance is likely to come through but more as a planned move than just reacting to the recent weak data. We expect much of the heavy lifting from fiscal policy, especially from the central government’s budget, while monetary policy will continue to maintain an easing bias. This will not only provide support in the near term but also help the long-term transition, with more structural measures to lift consumption demand and promote technology and innovation. More will be unveiled in the new 15th Five-Year-Plan in October or November.

Q2: Anti-involution: Will the implementation be more than “gradual”?

The anti-involution campaign is a key plank of China’s effort to rebalance its economy, i.e., to stimulate domestic consumption, while reducing excess capacity in the economy. In 2016, it took a month for PPI to turn positive in m-o-m terms (six months in y-o-y terms). This time it may take longer, but it won’t be too gradual: top officials have set the tone in July and government agencies are working out the details. Once sector-specific policies are formed using supervision and enforcement tools, things will speed up – likely in the next month or two.

Q3: Monetary policies: How much policy room does the PBoC have?

We think the People’s Bank of China (PBoC) will cut rates again soon but may be approaching their lower limit, given constraints linked to banks’ net interest margins. Liquidity injections will likely follow, including cuts to the reserve requirement ratio and open market operations. The PBoC may also resume treasury bond purchases from the secondary market soon. “Excess demand” that pushed yields to low levels is no longer a concern, given recent investor rotation into equities, while bond issuance may surge, as the government ramps up fiscal policy support.

Q4: Fiscal space: Is local government debt a binding constraint?

No, for two key reasons. First, the government has already taken significant measures to help alleviate stress in local government debt as seen in the RMB12trn debt swap package announced last year. Second, we are seeing more fiscal reforms to both improve revenue sources for local governments and to have the central government take on a larger role in providing fiscal support. Meanwhile, there is still cRMB3.3trn in new government bonds (general and special bonds) left to be issued for the remainder of 2025. Special bonds will help infrastructure spending and provide funding support for additional consumer subsidies.

Q5: Housing: With the changing rhetoric, will there be an upside surprise?

The housing sector may rise up in terms of policy priorities: in August, Premier Li re-emphasised the urgent need to stabilise the housing market. Bloomberg reported on 14 August 2025 that the government is considering asking distressed asset managers and central state-owned enterprises (SOEs) to acquire housing inventory from troubled developers. Other than purchase relaxations, urbanisation may boost housing demand, as migrant workers gain access to basic public services, including social housing.

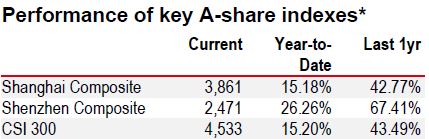

Source: LSEG Eikon

* Past performance is not an indication of future returns

Source: LSEG Eikon. As of 15 September 2025, market close.

https://www.hsbc.com.my/wealth/insights/market-outlook/china-in-focus/five-faqs-on-how-to-reflate-and-rebalance/