georgemiller

Publish Date: Fri, 19 Sep 2025, 07:05 AM

Key takeaways

- The FOMC resumed its policy easing, with a widely expected 25bp cut in September.

- The details of the decision were bordered on the hawkish rather than the dovish side of expectations.

- We still see further USD weakness this year.

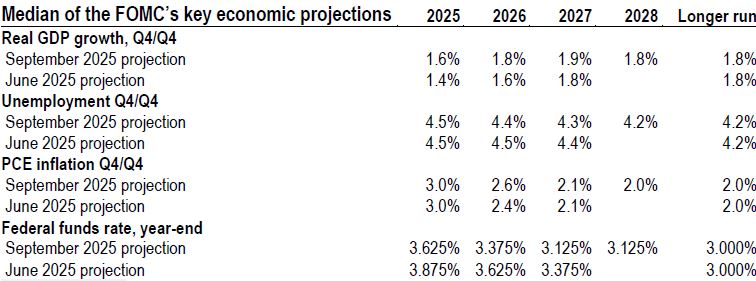

As widely expected, the Federal Reserve (Fed) resumed its policy easing, cutting the federal funds target range by 25bp to 4.00-4.25% at the 16-17 September meeting – the first rate cut this year. The decision was voted 11 to 1, with the lone dissent coming from Fed Governor Stephen Mira in favour of a 50bp reduction. The updated Federal Open Market Committee’s (FOMC) economic projections were small but mostly hawkish, with higher growth and inflation, and lower unemployment (see the table below for details). The median interest rate projections (known as “median dots”) for 2025, 2026, and 2027 are lower than those laid out at the June meeting by 25bp. It suggests two further 25bp cuts in 2025, followed by one additional cut in 2026, more hawkish than market pricing of at least four further 25bp cuts by end-2026 (Bloomberg, 18 September 2025).

Our economists still expect only two more 25bp rate cuts (in December and next March) through end-2026. That being said, there is some risk of a bit more easing than is in our economists’ forecast, given the US labour market developments, particularly if jobless claims data were to trend higher. Indeed, the FOMC judged that “downside risks to employment have risen” in its new policy statement. So, if risks were to materialise, this could come in the form of another 25bp rate cut in October, or more easing at some point in 2026, in our economists’ view.

Source: Federal Reserve

At the press conference, Fed Chair, Jerome Powel, indicated that a 50bp cut was not widely supported, and that the 25bp easing should be viewed as a “risk management cut”. He did not indicate that there had been a big shift in thinking on the FOMC. This perhaps helped remind the FX market that the details of the decision are bordered on the hawkish, rather than the dovish side of expectations. After dropping to a fresh year low, the US Dollar Index (DXY) recovered some initial losses, hovering around 97 (Bloomberg, 18 September 2025).

That being said, we think there is little here to undermine the case for further USD weakness in the months ahead, as the prospective rate cuts from the Fed set it apart from other G10 central banks.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/usd-the-fed-cuts-rates-for-the-first-time-this-year/