georgemiller

Publish Date: Mon, 22 Sep 2025, 12:02 PM

Key takeaways

- As widely expected, the BoE kept rates on hold and slowed QT in September…

- …and the Fed’s 25bp cut came in line with market expectations, albeit with marginally hawkish details.

- We expect GBP-USD to go higher in the months ahead, while fiscal risks could weigh on the GBP against the EUR.

On 18 September, the Bank of England’s (BoE) Monetary Policy Committee (MPC) voted by 7-2 to keep its key policy rate on hold at 4.0%. The decision came in line with market expectations. On quantitative tightening (QT), the BoE announced that the stock of the UK government bonds (known as “gilts”) held in the Asset Purchase Facility (APF) will be reduced by GBP70bn over the next 12 months, compared to the previous GBP100bn-a-year reduction pace. The central bank will also aim to sell fewer long maturity gilts than gilts at other maturities.

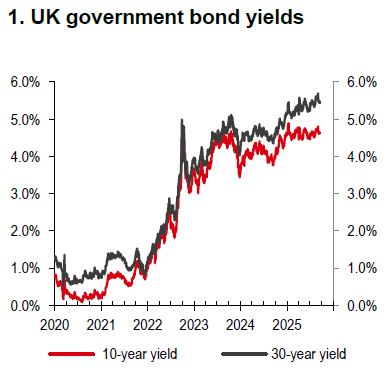

Slowing QT and reducing the proportion of long maturity gilt sales should generally help stabilise financial market conditions and the GBP, but the impact may prove marginal. We think that the Autumn Budget (26 November) is likely to remain the key driver for the GBP in 4Q25, with the fragility of the UK government finances being a key risk for the GBP. Higher long-term gilt yields (Chart 1) would likely weigh on the GBP if it comes to growing market concern on the UK government’s capacity to meet its fiscal target. Higher taxes or lower government spending may also add to GBP woes for an already stalled economy. But the GBP weakness is likely to reflect against the EUR.

Source: Bloomberg, HSBC

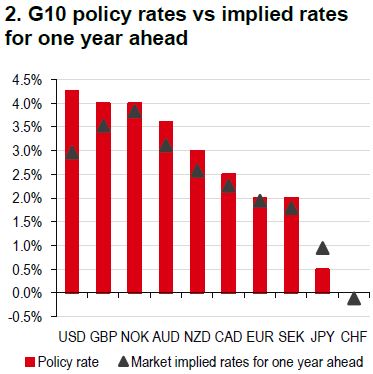

Source: Bloomberg, HSBC

As for GBP-USD, US factors would probably have a more dominant impact. The Federal Reserve (Fed) resumed its policy easing, with a widely expected 25bp cut in September; however, the details of the decision were bordered on the hawkish side of expectations (for more details, please refer to USD: The Fed cuts rates for the first time this year). While these factors supported the USD, the outlook remains weak, as the Fed’s easing path is likely to be in contrast to much of other G10 central banks (Chart 2). We still expect the USD to weaken gradually in the months ahead, and that also means GBP-USD could go higher.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/gbp-usd-central-bank-decisions-in-focus/