georgemiller

Publish Date: Mon, 29 Sep 2025, 12:02 PM

Key takeaways

- We expect USD inertia in the weeks ahead, barring marked hawkish US data surprises…

- …but Japanese factors may gain more traction in USD-JPY and other JPY crosses.

- Focus will include LDP leadership election and the BoJ’s October decision.

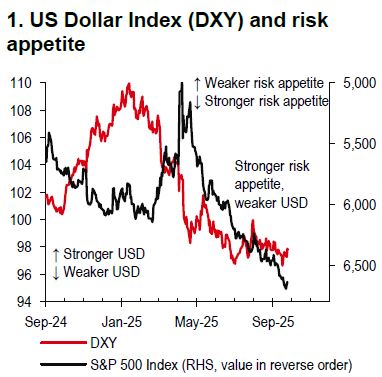

In the coming weeks, the USD looks set to be trapped, in our view. Factors, such as the still buoyant risk appetite (Chart 1) and continued concerns over the Federal Reserve’s (Fed) independence amid the US administration’s legal cases (Reuters, 23 September 2025) point to further USD downside, but this could be offset by cyclical upside risks, given that markets are priced more dovishly than what the recent Fed rhetoric would seem to justify.

It is worth noting that the September “dot plot” shows that the Fed is basically evenly divided between the need for one or two cuts during 4Q25. With a c90% chance of a Fed rate cut at the 28-29 October meeting in the price (Bloomberg, 25 September 2025), it may be hard for US data (like non-farm payroll on 3 October and CPI on 15 October) to out-dove markets and the risks are skewed to a bigger USD bullish reaction if the numbers land hawkishly.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

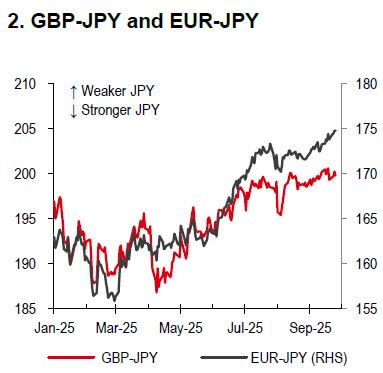

While USD sentiment remains the key driver to USD-JPY, Japanese factors may gain more traction in the coming weeks. Concerns about possible JPY weakness related to Japan’s ruling Liberal Democratic Party (LDP) leadership election (4 October) seem overblown, as the winner will be aware that cost-of-living concerns are what drove their predecessor out. Our economists also expect the Bank of Japan (BoJ) to hike its rates at its 30 October meeting, and markets only see a c55% chance of this happening. As such, a BoJ hike will probably provide further support to the JPY over the near term.

For GBP-JPY (Chart 2), we see the pair going lower in the week ahead, as the GBP is likely to be dragged down by elevated UK fiscal concerns (see FX Viewpoint – GBP: Fiscal risks for details). Other than GBP-JPY, EUR-JPY is also likely to go lower in the weeks ahead, as the EUR may lack catalysts for near-term gains.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/jpy-cross-rates-in-focus/