georgemiller

Publish Date: Mon, 06 Oct 2025, 07:04 AM

Key takeaways

- With the US domestic and geopolitical environment seeing an eventful start to 2026, focus on the macro backdrop has taken a back seat, despite an avalanche of data as statistical agencies return from the shutdown. But arguably, when policy uncertainty picks up, fundamentals provide a much-needed anchor.

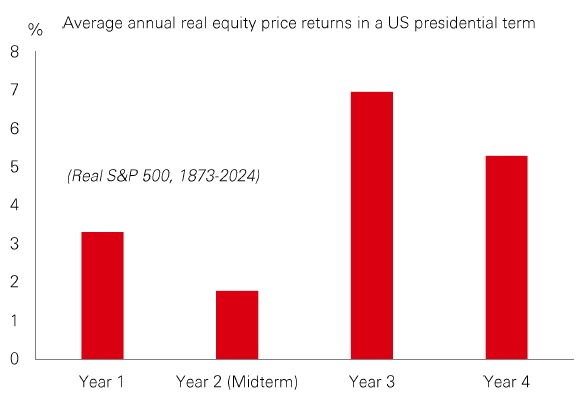

- Historically, the second year of a US presidential term tends to be a tricky one for markets. It’s often the weakest year for real stock returns in the S&P 500, thanks to the uncertainty that midterm elections bring.

- After a strong 2025 for many Asian stock markets, momentum has continued into the new year. In South Korea, for instance, the MSCI index is up by 10% in USD terms in 2026 – after nearly doubling in 2025. Other Asian indices – notably in China and Japan – have also built on last year’s good performance.

Chart of the week – Fiscal dominance and the Fed

They used to say: “Don’t fight the Fed.” But have the rules quietly changed? Last week, attention turned to another big macro theme: fiscal dominance. In plain terms, fiscal dominance is when high government debt and persistent deficits start to constrain – or influence – central bank behaviour. In economic models, it’s associated with higher and more volatile inflation, and boom-bust cycles. But the good news is that we’re probably not fully there yet.

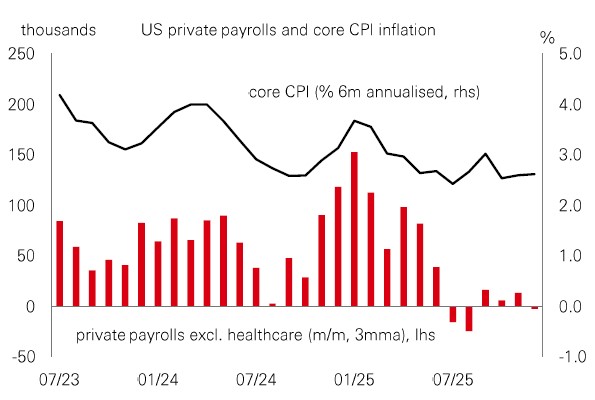

At least that’s the conclusion from the new research by former Fed Chair Janet Yellen. She documents multiple ways the Fed continues to assert its independence – ongoing CPI disinflation, and the unusual “low-hire, low-fire” labour market stasis (see page 2). Markets, however, are telling a more ambiguous story:

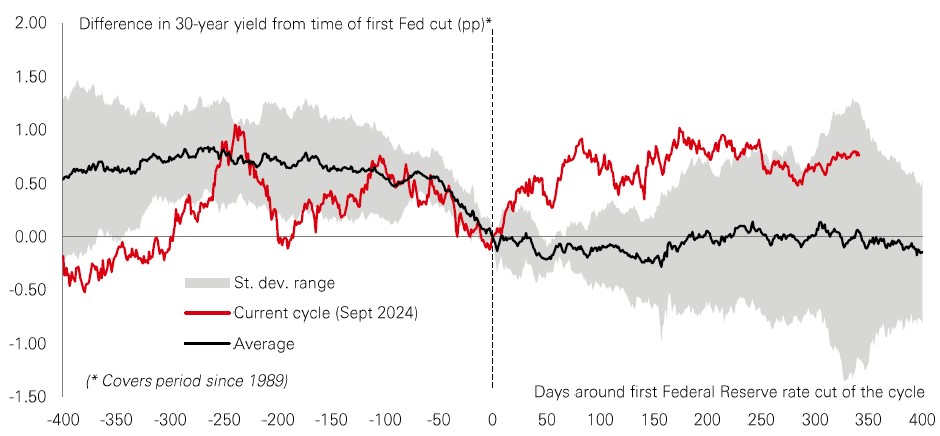

1. Long-term bond yields are unusually sticky, even as the Fed cuts rates. This is the mirror image of the 2000s-2010s playbook, and one that we call the “reverse conundrum” (see chart).

2️. Term premia are rising, and the correlation between stocks and bonds is no longer reliably negative. These are classic signals that investors perceive a more volatile inflation regime.

3️. The debasement trade keeps working. Short USD, long gold and commodities remains a powerful trend – an inflation-sentiment signal, even as standard measures (like 5y/5y breakevens) look benign.

So, it’s clear that something has changed. Now, when the Fed cuts rates, do bond yields go down… or up? The new pattern points to a bumpier, more volatile market regime in 2026 – and strengthens the case for diversifying the diversifiers in portfolios.

Market Spotlight

Volatility dampener

Investor demand for private credit was strong last year, with a robust annual performance in the high single figures and rapid market growth. In direct lending (the largest private credit sub-category), competition for funding buyouts and corporate deals caused spreads to tighten, but the asset class remains appealing for its relative stability, its yield premium over public markets, and the regular income generated from underlying interest payments.

Private credit has grown from being fairly niche at the time of the global financial crisis in 2008 to a market of more than USD 3 trillion today. While further rate cuts this year could potentially crimp performance, policy easing could also relieve pressure on borrowers and boost dealmaking activity – which, in turn, should keep returns attractive.

In addition, the asset class boasts solid form as a volatility dampener. Direct lending not only experienced smaller drawdowns during both the global financial crisis and the 2020 Covid pandemic sell-offs, but also delivered a positive return during the 2022 inflation shock, when most risk assets sold off. Some alternatives specialists point to it being a potential portfolio diversifier in an environment where episodic volatility is expected.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management, Bloomberg, Macrobond. Data as at 7.30am UK time 16 January 2026.

Lens on…

Looking through the noise

With the US domestic and geopolitical environment seeing an eventful start to 2026, focus on the macro backdrop has taken a back seat, despite an avalanche of data as statistical agencies return from the shutdown. But arguably, when policy uncertainty picks up, fundamentals provide a much-needed anchor.

On that score, headline US data have not thrown up any nasty surprises, although some of the details require careful monitoring. Q3 GDP surpassed expectations, although growth was unbalanced – robust consumer spending relied on a falling savings rate, while, outside of AI-related capex, investment was soft. The labour market remains a conundrum – firms are stuck in a “low hire, low fire” equilibrium and consumers are pessimistic about job prospects. Inflation in the high twos is not where the Fed wants it to be, but moderating wage growth and a soft housing market point to gradually easing price pressures this year.

Sophomore slump

Historically, the second year of a US presidential term tends to be a tricky one for markets. It’s often the weakest year for real stock returns in the S&P 500, thanks to the uncertainty that midterm elections bring. Investors don’t like surprises; unexpected policy shifts and questions about the economic outlook often weigh on risk appetite during this period.

We also know that almost every midterm election has resulted in the incumbent president's party losing seats in the House of Representatives. If Republicans lose their slim House majority this year, it could result in a Republican president and a Democrat-controlled House: a political gridlock scenario. The good news is that markets often welcome this. A divided government means a lower chance of large policy changes, which tends to calm volatility and boost stocks post-election.

Nonetheless, in an environment where AI enthusiasm persists but risks of episodic volatility remain -- caused by high policy and economic uncertainty, elevated tech sector valuations, and heightened geopolitical concerns -- the impact of the US midterms on market sentiment is also worth monitoring.

Marginal gains

After a strong 2025 for many Asian stock markets, momentum has continued into the new year. In South Korea, for instance, the MSCI index is up by 10% in USD terms in 2026 – after nearly doubling in 2025. Technology stocks are driving the gains, with export-heavy industries like autos, shipbuilding, and defence, up too. Other Asian indices – notably in China and Japan – have also built on last year’s good performance.

However, after 2025’s rerating in Asia, attention is now turning to profits momentum. Here, there are positive signs, with cyclical and structural factors, including policy efforts across the region, supporting the outlook.

But there is some cause for caution. Macro and policy uncertainty, as well as geopolitical tensions could spur volatility. And in South Korea, a rapid rise in the amount of margin debt in use in the market – at a record level of over KRW 28bn (~USD 19bn) – could also spark volatility if sentiment cools (although current levels are modest relative to Korea’s market cap). A diversified approach in Asia, with selectivity across countries and sectors, can help capture the growth upside while cushioning against downside risks.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Costs may vary with fluctuations in the exchange rate. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 16 January 2026.

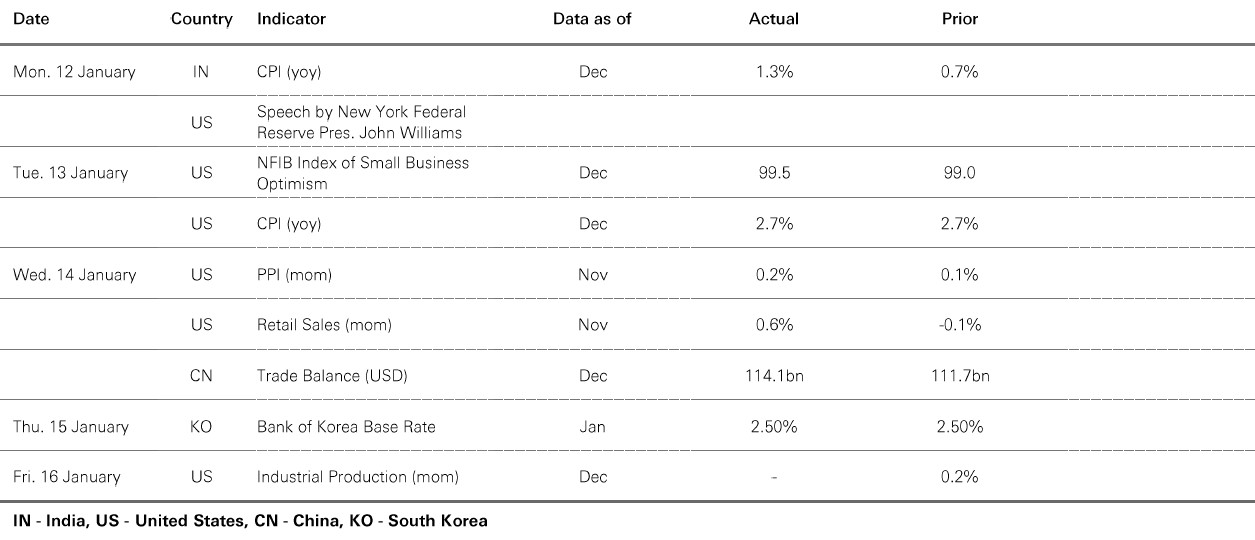

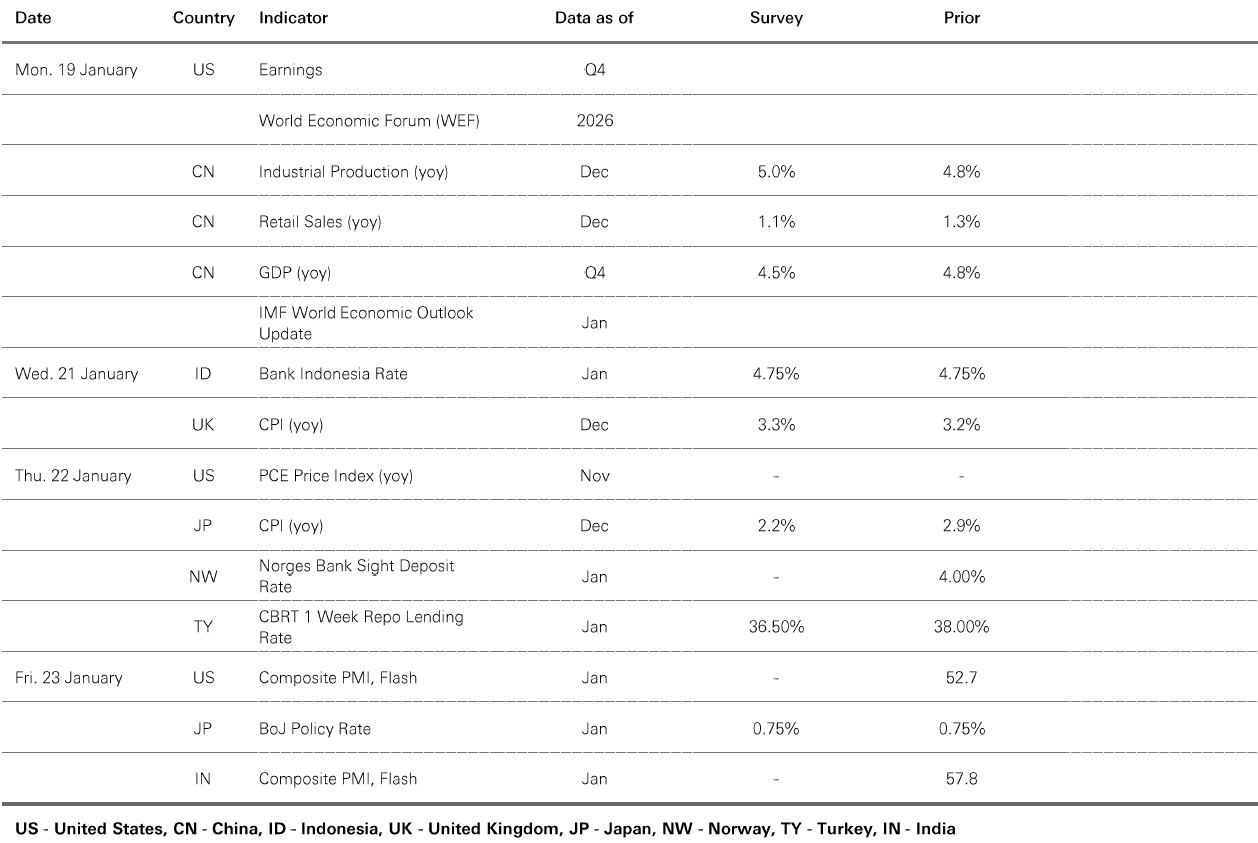

Key Events and Data Releases

Last week

The week ahead

Source: HSBC Asset Management. Data as at 7.30am UK time 16 January 2026. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

Market review

Market sentiment stayed largely positive amid the kick-off of the Q4 2025 US earnings season. The US dollar index rose modestly, while lingering geopolitical risks drove gold prices higher, and oil prices remained volatile. 10-year US Treasury yields were range-bound, whereas rising fiscal worries weighed on JGBs amid mounting expectations of an early election in Japan. The trend of “broadening out” continues in global stock markets: US equities traded mixed, with the small-cap Russell 2000 outperforming the S&P 500 and the tech-dominated Nasdaq. The Euro Stoxx 50 index reached a fresh high, while a weaker yen boosted Japan’s Nikkei 225. Elsewhere in Asian markets, the tech-driven Korean Kospi remained a star performer. Hang Seng also advanced, alongside mild gains in India’s Sensex, whereas Shanghai Composite pulled back from recent rallies.

https://www.hsbc.com.my/wealth/insights/asset-class-views/investment-weekly/article/