georgemiller

Publish Date: Wed, 08 Oct 2025, 12:02 PM

Key takeaways

- Front-loading and the AI hardware boom have boosted export volumes so far this year…

- …but US tariffs are set to take their toll, weighing on trade and investment across ASEAN.

- Still, this year and beyond, monetary and fiscal easing should help the region digest the impact.

Indonesia is on a steady course, for now, with fiscal easing at the margin, as well as substantial rate cuts, expected to support growth at its current pace. Thailand, by contrast, is facing greater challenges, not least because fewer tourists are venturing into the kingdom than in the past. In the Philippines, less affected by US tariffs than many others, growth should tick up in 2026, though in Malaysia, still gaining market share in key sectors, exports will inevitably be affected by slowing trade globally. Singapore, too, remains exposed to the global turmoil, though it has the deep fiscal pockets to smooth over those bumps. Vietnam is taking it all in its stride, even if growth may ease.

Economy profiles

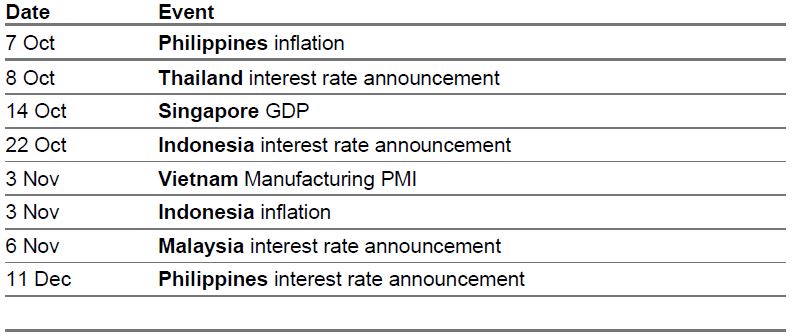

Key upcoming events

Source: LSEG Eikon, HSBC

Indonesia

Growth urgency

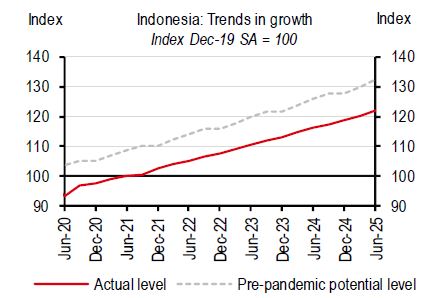

Indonesia’s post-pandemic GDP growth has been weak. Despite higher-than-expected 2Q25 GDP growth of 5.1%, we estimate that GDP is still c7.5% below its pre-pandemic trend. The highfrequency indicators like manufacturing PMI, credit, and consumer sentiment also point to softness.

That being said, we think that a strong 2Q GDP print reflects a pick-up in informal sector consumption. This growth is benefitting from (1) falling inflation, which is also pushing up real wage growth; (2) the two sets of fiscal stimulus via social welfare schemes; and (3) a recent rise in agricultural production. We believe this can put a floor under growth in an otherwise unstable year but may not be sufficient to push up growth meaningfully, since formal sector consumption, the other half of the consumption pie, is not doing as well. What lies beneath the weak growth momentum is sluggish investment, which over time could hurt the capacity of the economy to create jobs.

Against this macro backdrop, street protests in Indonesia intensified towards the end of August, which, we believe, resulted in a slew of policy changes. There was a cabinet reshuffle, including the appointment of a new finance minister. The government planned to transfer part of its cash balances held with Bank Indonesia (BI) to state lenders to boost lending. It revised up its 2026 fiscal deficit target, announced new social welfare schemes for 4Q25, and reintroduced its burden sharing programme for a specific government project. Some other developments we will be watching over the next few weeks include discussions around any changes in the budget deficit cap, and the BI’s mandate.

Eventually, we believe reforms will be needed to stoke investment, jobs, and growth. Here, an opportunity to grow manufacturing and raise exports at a time when supply chains are being remapped may well be knocking at the door. With producers looking to remap and diversify manufacturing bases after the new round of US tariff increases, Indonesia may gain in a way it was not able to in the first Trump presidency. Encouragingly, it already produces the goods advanced economies tend to buy from Asia. Indonesia’s exports to the US look a lot like Vietnam’s export mix, comprising a lot more apparel, footwear, electrical machinery and furniture, and very different from the commodity-intensive exports to China. However, these are still rather small and need to be scaled up.

Is that doable? It will not be easy, but it is not impossible either. Indonesia will have to work hard on several fronts – enhancing infrastructure development, expanding trade agreements, developing a skilled workforce, and streamlining regulatory and business practices.

Indonesia runs a negative output gap

Source: CEIC, HSBC

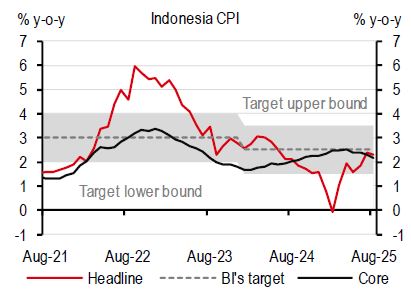

Inflation is well below BI’s 2.5% target

Source: CEIC, HSBC

Malaysia

Eyes on semiconductors

Since the introduction of “reciprocal tariffs” by the US on 2 April, foreign delegations have rushed to Washington, D.C., to strike trade deals. Malaysia is no exception, particularly as it, along with many ASEAN peers, sought to avoid being the “victim” of their own success. After 1 August, the dust seems to have settled, more or less.

From 7 August, Malaysia joined ASEAN emerging markets peers in the “19-20% tariff club” of exports to the US. At first glance, the 19% tariff rate is not ideal, but likely manageable. After all, Malaysia ran a trade surplus with the US of USD25bn in 2024, much smaller than Vietnam and Thailand. Its trade is also more diversified with only a 13% export exposure ratio to the US.

Now that everyone in ASEAN-5 faces similar tariff rates, it’s likely that the trade and FDI dynamics will return to the starting point, meaning that Malaysia’s competitiveness remains. Recall that Malaysia was one of the main beneficiaries of earlier US-China trade tensions alongside Vietnam. Its FDI inflows have been consistently topping the region since late 2021, now standing at 4% of GDP in 1Q25 on a 4-quarter-moving average basis. The tariff rate is not the only factor, though undeniably important, in determining the attractiveness of an investment destination. Rather, FDI reflects investors’ long-term confidence in an economy, which involves a confluence of factors.

However, major tariff issues remain unresolved. The lingering issue is the fate of potential semiconductor tariffs, which President Trump threatened to be 100% at first and which was later raised to 300%. For Malaysia, the stakes are high as it is deeply embedded in tech supply chains. Its chip exports to the US alone account for 6% of its GDP. However, if Apple’s exemption offers some guidance, many tech giants, who have a long presence in Malaysia, are also likely to follow suit if they make new investment commitments in the US. In fact, many of them have already done so.

While the market’s attention is naturally on tariff risks, it is important to look at domestic resilience. Fortunately, Malaysia’s decent private consumption and double-digit investment growth can partially offset some external risks, at least over the near-term. We forecast 2025 growth forecast at 4.2%, and recently upgraded our 2026 forecast to 4.0% (from 3.9%) on better clarity on tariffs.

In addition, inflation remains well behaved, as headline CPI decelerated to 1.4% y-o-y y-t-d as of July. Given subdued inflation momentum, we recently lowered our headline inflation forecast to 1.5% (from 1.9%) for 2025 but kept our 2026 forecast at 1.7%.

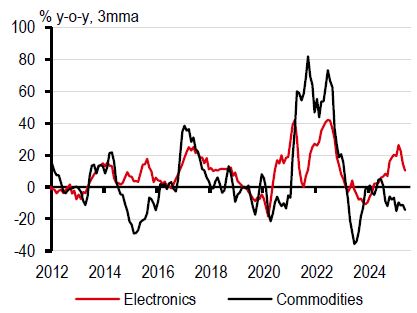

Malaysia is seeing strong, albeit moderating, electronics exports

Source: CEIC, HSBC

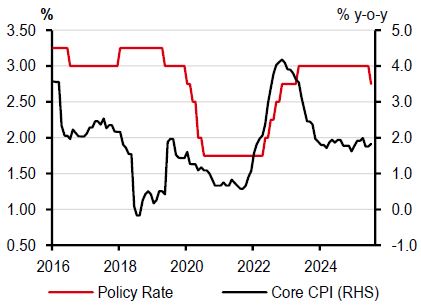

BNM delivered a 25bp rate cut in July, but it was only a one-off pre-emptive one

Source: CEIC, HSBC

Philippines

A good place

Liberation Day wasn’t a good day for the archipelago. Having the most amicable ties with the US in Southeast Asia, many had expected the Philippines to garner a better reciprocal tariff rate than its competitors. Liberation Day came and, as it turned out, the Philippines was one of only two countries in Asia that saw their reciprocal tariff rate increase from the rate that was first announced back on 2 April. From 17% on 2 April, the Philippines now faces a slightly higher reciprocal tariff rate of 19%, a rate that is in line with the tariffs imposed on other ASEAN economies. FDI commitments in the Philippines, therefore, dropped and the peso weakened against the USD to as much as 58.3 when the final reciprocal tariff rate was announced.

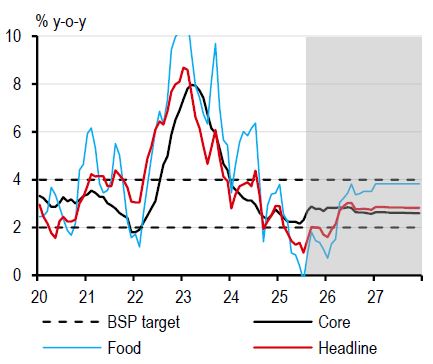

A favourable tariff differential would have been a significant opportunity for the Philippines to attract FDI and boost its manufacturing sector. But not all is lost; the Philippines still finds itself in a good place. It all starts with low inflation and how this has kept the country’s domestic engines humming. Thanks to lower rice prices, inflation has been hovering below the Bangko Sentral ng Pilipinas’ (BSP) 2-4% target band for six consecutive months and is likely to remain soft for rest of the year.

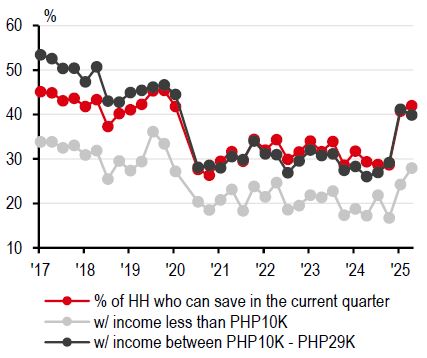

With inflation finally under control, the purchasing power of households has remained intact. As a result, private consumption, the economy’s main engine, has accelerated for two consecutive quarters already. And, despite consuming more, households, especially low and middle-income ones, were finally able to save. In fact, BSP data shows that the share of households with income of less than USD500 a month that were able to put aside money for savings was almost back to prepandemic levels in 2Q25. This has pushed the national saving rate high enough to close the economy’s saving-investment gap during the quarter, making the economy less reliant on foreign capital to finance its current account deficit.

All this has given the BSP confidence to quicken and, perhaps, deepen its easing cycle, paving the way for domestic investment to rise in the quarters ahead.

The Philippines may have lost an opportunity, but its macroeconomic fundamentals and domestic engines are likely to ensure that growth remains intact. We expect the Philippines to be the second fastest growing economy in ASEAN at 5.5% in 2025.

The share of households that can save has jumped back to pre-pandemic levels

Source: BSP, HSBC

Subject to stable rice prices, we expect inflation to average below 3% in 2026

Note: Shaded area represents HSBC forecasts.

Source: CEIC, HSBC

Singapore

Time to pause

It is interesting to see how quickly things change. Around “liberation day” in April, there was a debate if Singapore would enter a technical recession in 2Q25. However, 2Q growth delivered a significant upside surprise, growing 1.4% q-o-q or 4.4% y-o-y, even beating some emerging market peers.

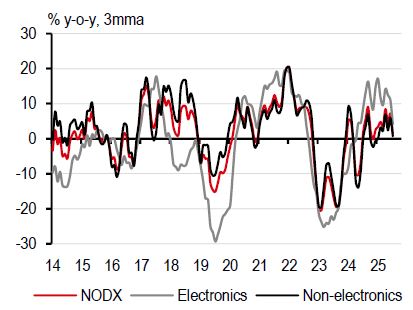

As a trade-dependent economy, Singapore has benefitted well from trade frontloading. On a y-o-y basis, manufacturing has outshone other sectors, growing 5.4% y-o-y. This is particularly evident in two of Singapore’s growth pillars: electronics and pharmaceuticals. Meanwhile, recent high frequency non-oil domestic exports (NODX) data also point in the same direction. The electronics NODX growth remained at double-digits until decelerating notably in July. This suggests to us that frontloading trade has already peaked, ready for some payback in 2H25.

Outside of frontloading, Singapore also saw strong expansion in construction and services activities. The former has benefitted from infrastructure projects, and we think the trend is set to continue, given the construction on Terminal 5 at the Changi Airport.

Meanwhile, Singapore’s services also saw broad-based growth. Retail sales have seen some improvements while the wholesale trade sector has been riding on the back of frontloading trade activities. The continued boom in tourism-related sectors has also been encouraging. Singapore’s visitors have recovered to 90% of the 2019 level, not far off a full recovery.

All in all, we maintain our GDP growth forecast at 2.8% for 2025, beating the government’s growth forecast range of 1.5-2.5%. We expect growth to be around 1.7% in 2026.

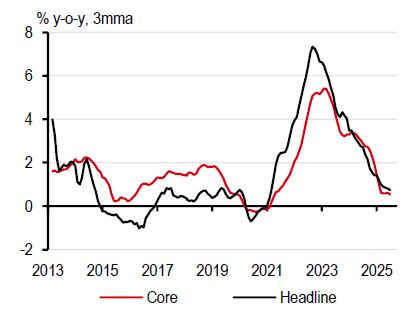

Also, inflation has taken a backseat. Core inflation has remained subdued, averaging 0.6% y-o-y y-t-d as of July, thanks to a broad-based cooling of price pressures. Given falling food prices, benign energy costs, and growth uncertainties, we expect the subdued inflation trend to continue. We lowered our core inflation forecast to 0.6% (from 0.7%) for 2025 but have kept it at 0.9% for 2026. While a low inflation environment opens the door for the Monetary Authority of Singapore (MAS) to ease again, we expect the MAS to remain on hold through our forecast horizon. The MAS’s primary focus is undoubtedly on growth, but fiscal policy should take the lead if headwinds are to materialise.

Despite benefitting from front-loading, NODX momentum seems to have peaked

Source: CEIC, HSBC

Singapore’s inflation continues to be subdued below 1% y-o-y

Source: CEIC, HSBC

Thailand

Taking the edge off

Thailand has been swimming against the tide for quite some time now. But we believe the current should soon ease off a bit or, at least, be weaker than one might have initially expected. Despite 2Q25 growth being in line with our expectations, we recently upgraded our growth forecast for Thailand to 2.2% in 2025 and 2.0% in 2026 (from 1.7% and 1.9%, respectively). We then expect growth to improve to 2.6% y-o-y in 2027 as global trade normalises.

However, we still believe Thailand will grow below its potential. The 2Q25 GDP print supports the view that Thailand’s structural impediments are likely to remain for quite some time. For instance, private consumption has moderated for the seventh consecutive quarter as households, most especially low- to middle-income households, grapple with high levels of debt. Services exports are also likely to remain weak with tourist arrivals still falling year-on-year. Local manufacturers will also continue to face tough competition from Chinese exporters looking for new markets to sell to. This tough import competition is the reason why the goods CPI has remained muted in Thailand.

This is where a line can be drawn. Thailand’s goods exports have been outperforming, growing by double-digits, as importers frontloaded their demand in anticipation of tariffs. But when the imminent payback arrives, we don’t think the payback will be as bad as many expect it to be.

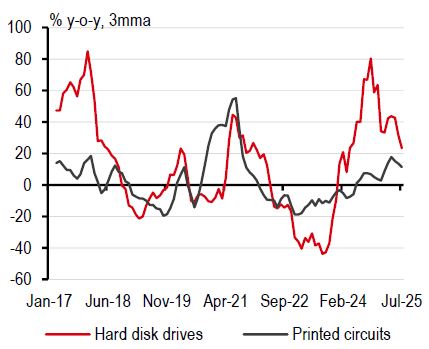

Key here to understand is that not all the surge in exports is due to frontloading demand. Thailand’s supply chains for printed circuit boards and Hard Disk Drives (HDDs) run deep, with Thailand being the second largest exporter of HDDs globally. And the boom in AI-related investments has brought renewed demand for both. HDD exports, in particular, have grown c50% y-o-y on average over the past 12 months, representing a rejuvenation of a technology that was once thought to be outdated.

Thailand will also benefit from its new tariff advantage with China. In the US market, Thailand competes with China on HDDs, computer parts, telephone parts, and pet food. From a tariff advantage of nil to 25 ppt prior to Liberation Day, Thailand’s tariff advantage for these items now ranges from 19-35%. As a result, Thailand is likely to take some market share away from China, taking the edge off the eventual payback in frontloading demand.

Inflation is likely to remain low. Upside risks to growth also remain limited. But the downside risks have, thankfully, minimised enough to keep the economy afloat.

AI-driven investments have led to renewed demand for Thailand’s electronics goods

Source: CEIC, HSBC

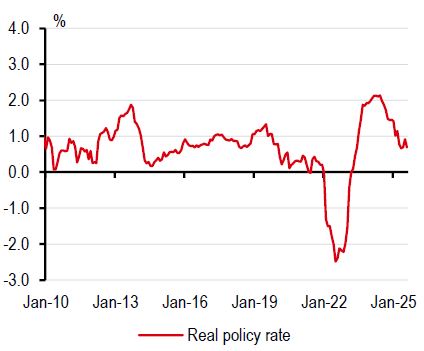

Cutting the policy rate to below 1.00% would bring real rates to negative territory

Source: CEIC, HSBC

Vietnam

It’s all relative

It’s not surprising to see strong growth in 2Q25 across export-oriented economies, thanks to frontloading. However, the magnitude of Vietnam’s 2Q growth surprise stands out. After strong growth of 7% y-o-y in 1Q, Vietnam’s 2Q growth rallied at an impressive pace of 8% y-o-y, outpacing regional peers.

No doubt, the frontloading effect is obvious. The manufacturing pillar saw strong growth of more than 10% y-o-y, reflecting the urgency of producers and exporters to rush to ship exports to the US in 2Q25. This is also reflected in record-high quarterly exports, growing over 18% y-o-y in 2Q25.

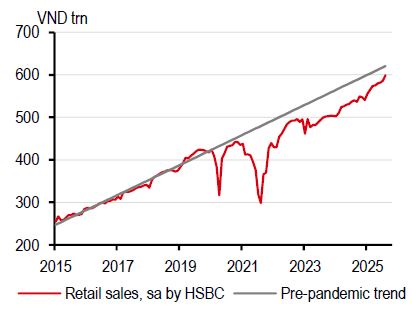

But it’s not just frontloading, 2Q growth is broad-based. The services sector saw strong performance, given decent growth in externally-oriented trade services as well as tourism-related sectors. The trend is also corroborated in retail sales, with the gap between the actual outturn and the pre-pandemic trend narrowing to 6%. Vietnam also saw the fastest tourism recovery in ASEAN.

Despite 2Q being off season, Vietnam welcomed 10.7m tourists in 1H25, 20% above the 2019 level. A fast recovery in Chinese visitors, many of whom we surmise are business travellers, helped. It is even more impressive given that Vietnam does not have a visa waiver program with China.

The dust has settled in relation to tariffs, with Vietnam receiving a 20% tariff. However, there are key questions yet to be answered. One area of ambiguity is the US announcement of a 40% tariff on “transshipments”, which lacks details on how such a practice is defined, and how the additional tariff would be enforced. Meanwhile, the potential semiconductor tariffs also matter significantly to Vietnam, as its electronics exports to the US alone account for 10% of GDP.

All things considered, we forecast GDP growth of 6.6% for 2025 and 5.8% for 2026. This does not only account for the significant 2Q upside surprise, but also reflects a notably lower tariff rate than announced in April. However, uncertainties surrounding trade are far from over.

Outside of growth, inflation decelerated to 3.2% y-o-y y-t-d through August. Despite some upside risk to food prices, given the recent worsening of the African swine flu, we expect the underlying trend to remain well below the State Bank of Vietnam’s (SBV) inflation target ceiling of 5.0%. We expect inflation to hit around 3.2% for both 2025 and 2026.

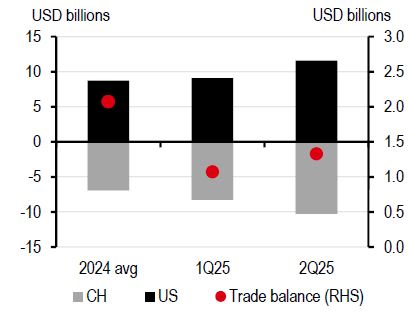

Vietnam’s monthly trade surplus has shrunk

Source: CEIC, HSBC

But retail sales have been improving

Source: CEIC, HSBC

https://www.hsbc.com.my/wealth/insights/market-outlook/asean-in-focus/policy-easing-supporting-growth/