georgemiller

Publish Date: Thu, 09 Oct 2025, 07:04 AM

Key takeaways

- New tariffs on pharma, lumber, furniture, and kitchen cabinets are set to weigh on eurozone exports.

- US labour market has weakened, and inflationary pressures are building; economic data elsewhere remains resilient.

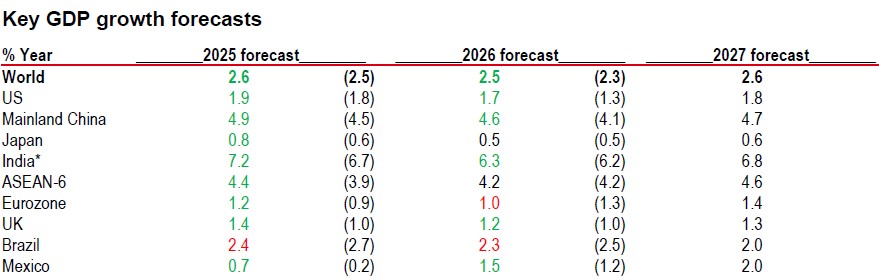

- We recently raised our global GDP growth forecasts to 2.6% in 2025 and 2.5% in 2026 given strong Q2 economic data.

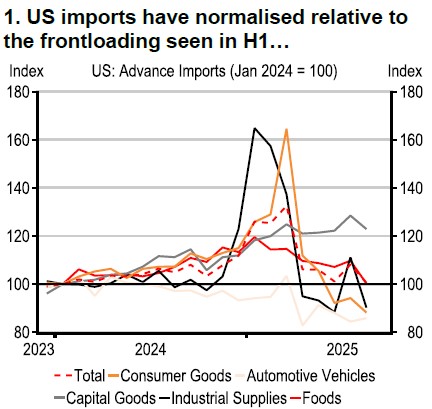

The global economic outlook continues to be dominated by trade-related uncertainties. After the much-discussed reciprocal tariffs took effect in early August, clearly impacting global trade flows, sector-specific tariffs are now grabbing the headlines.

New tariff hit

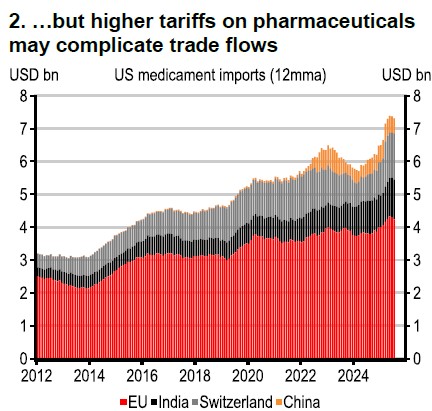

Over the past two weeks, the Trump administration has announced a 100% tariff on branded and patented pharmaceutical products, unless drug manufacturers relocate production to the US. In addition, a 10% tariff will be applied to softwood timber and lumber imports, and a 25% on kitchen cabinets, and upholstered wood furniture starting 14 October. These duties will, however, be capped at 15% for imports from the EU and Japan. Tariffs on films produced overseas have also been mooted.

The EU is likely to be strongly affected by the pharma tariffs, even if they end up being capped at 15% as anticipated by the European Commission - imports from Ireland have already been frontloaded earlier this year. Switzerland and Singapore will also be substantially impacted. Meanwhile, Vietnam is the top import source for furniture and household fittings, and so could see some impact if trade flows dip.

Source: Macrobond

Source: BLS

Higher US inflation

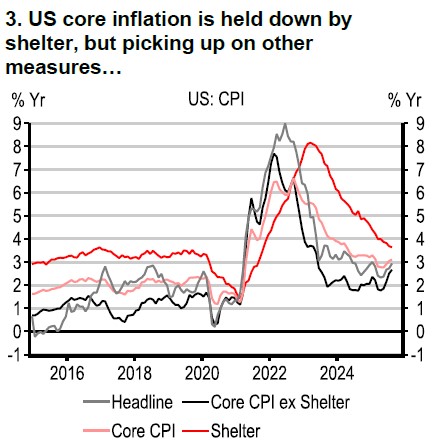

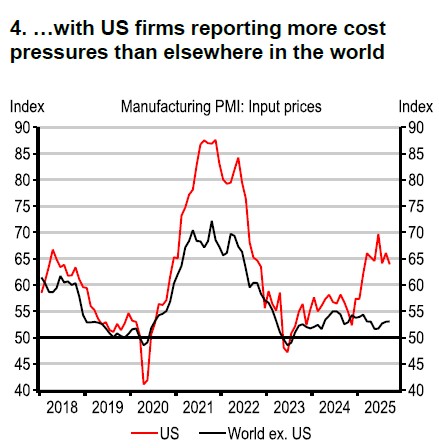

While these tariffs are causing turbulence in global trade flows, the US is already experiencing an uptick in inflation, particularly in core goods. Products like headphones, motor vehicles and parts, and strikingly, bananas, are already seeing a surge in prices. However, headline CPI and PPI figures are masking these underlying pressures, as lower rental and energy prices continue to offset much of the tariff-driven impact.

Source: Macrobond

Source: Macrobond

Weaker US jobs market

Due to the government shutdown in the US, we’re entering a bit of a data vacuum at a crucial time. The US labour market is showing clear signs of cooling, and private sector data and surveys will be given even more importance until we get the next sets of official payrolls and inflation data. The Federal Reserve has already delivered a 25bp rate cut at its September meeting and we expect an additional two 25bp rate cuts this year.

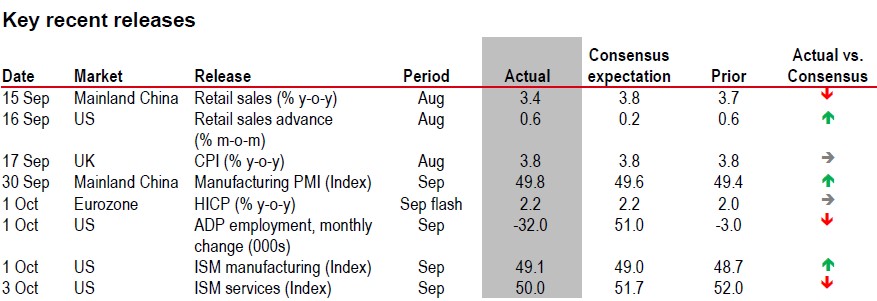

Resilient global data

Outside the US, economic data continues to prove resilient, even if we find little reason to get too excited about a rapid pick up in domestic demand. Despite falling inflation and interest rates in most economies, we expect consumption to mostly remain subdued, with a few key exceptions. We forecast global consumption growth to moderate from 2.6% in 2025 to 2.4% in 2026.

Uncertainty is clearly playing a role here and is also impacting investment across the world. So, while resilience has been a key topic in 2025, it’s hard to get too carried away.

Our GDP growth forecasts

We recently revised up our global GDP growth forecasts a touch, reflecting stronger than expected growth in many countries in Q2 rather than an improving outlook. The biggest upgrades are to India, parts of ASEAN and Mexico. Still, we see global GDP growth slowing from 2.8% in 2024 to 2.6% in 2025 and 2.5% in 2026.

We have also introduced our 2027 forecasts which show an ongoing expansion at a trend rate of growth that is a little lower than the pre-pandemic rate for most countries, reflecting more trade friction, slower labour force growth and high government debt stocks weighing on growth.

Note: *India data is calendar year forecast here for comparability. Previous forecasts are shown in parenthesis and are from the Macro Monthly dated 8 July 2025.

Green indicates an upward revision, red indicates a downward revision.

Source: Bloomberg, HSBC Economics

Source: Bloomberg, HSBC

⬆ Positive surprise – actual is higher than consensus, ⬇ Negative surprise – actual is lower than consensus, ➡ Actual is in line with consensus

Source: LSEG Eikon, HSBC

https://www.hsbc.com.my/wealth/insights/market-outlook/macro-monthly/new-tariffs-take-effect/