georgemiller

Publish Date: Fri, 10 Oct 2025, 07:04 AM

Key takeaways

- Weakness across a broad range of indicators in September…

- …as existing challenges combine with near-term uncertainty.

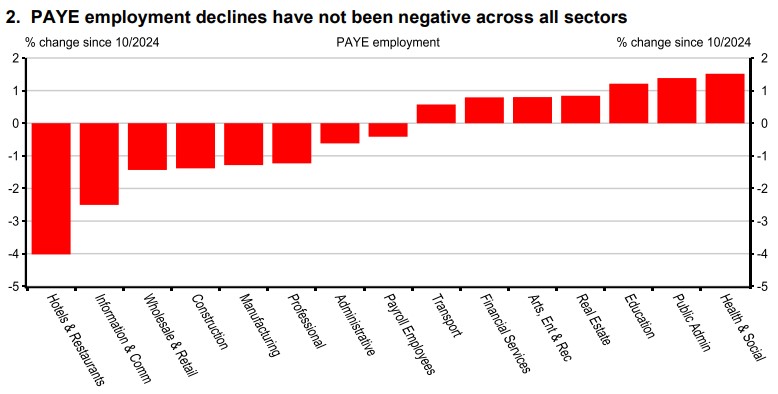

- Lack of disinflation to put the BoE’s interest rate cuts on hold until Spring 2026.

Source: HSBC

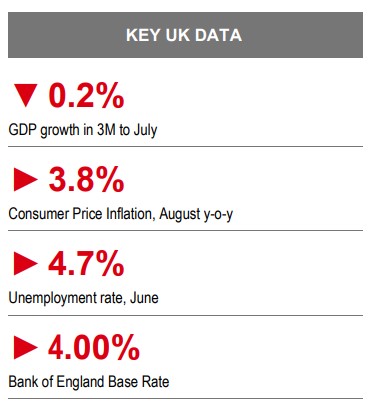

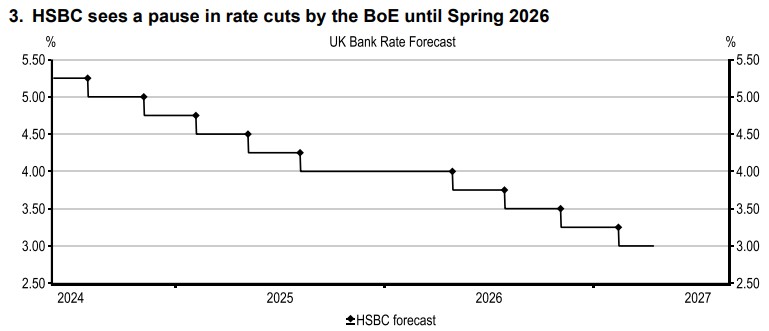

September was a challenging month for the UK economy. Economic activity took a disappointing turn with the composite output PMI falling into contractionary territory, for its second time this year. Moreover, despite an overall pick-up in the PMIs in the third quarter relative to Q2, official data for July showed zero growth on the month.

Businesses are operating in a challenging environment with tailwinds now meeting headwinds. It’s perhaps no surprise, then, that business confidence has fallen back, and spend and investment decisions appear to be in ‘wait-and-see’ mode, possibly until after the Autumn Budget when the Chancellor is expected to tighten policy by cGBP30bn by 2029/30 (FT, 2 October 2025). Similarly, consumer confidence was weak with households nervous about the past and future ‘economic situation’.

Disinflationary forces have taken a break

Meanwhile, price growth likely peaked in September – we forecast a 4.2% y-o-y CPI rate – up from 3.8% reported in August. In particular, food price growth was at its highest since January 2024 while the moderation in services price growth has stalled in recent months. Both are of concern due to their knock-on impact into inflation expectations and broader wage and price setting behaviour. Indeed with medium-term inflation expectations at 4% and real incomes, at best, on par with three years ago, there is a risk that a degree of ‘real wage resistance’ becomes evident in 2026, whereby households aim to offset the recent rise in the cost of living.

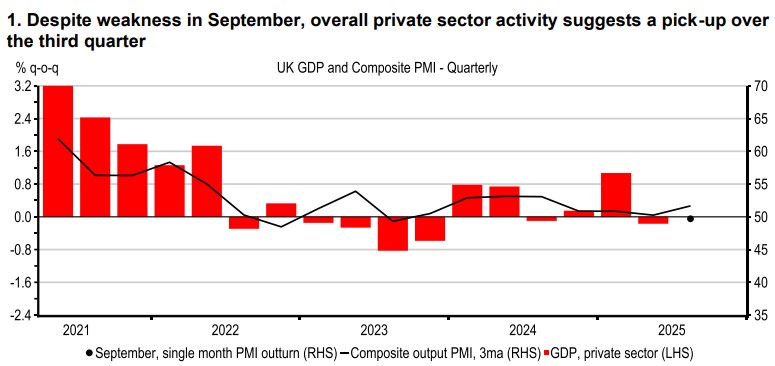

That upside risk to inflation is possible against a backdrop of a stabilisation in labour demand. Notwithstanding elevated unit labour cost growth, outright falls in headcount appear to have been concentrated in sectors most exposed to higher labour costs while overall employment is just 0.4% lower than October 2024.

Positively, the absence of outright labour market weakness puts the UK in a good position for a potential pick-up in activity, if near-term risks subside. However, we expect employment growth to remain soft while improved labour supply pushes the unemployment rate higher; helping to moderate wage growth and return inflation to target in 2027.

In policy terms, we expect Bank Rate to be held at 4.00% until the Spring, when the BoE should have greater certainty that these risks have subsided and further disinflation is evident. From April 2026, we expect rate cuts to resume their “gradual and careful” path of one-cut-per-quarter.

Source: Macrobond, ONS, HSBC calculations

Source: Macrobond, HMRC

Source: Macrobond, Bloomberg, HSBC calculations

https://www.hsbc.com.my/wealth/insights/market-outlook/uk-in-focus/are-we-at-peak-UK-pessimism-yet/