georgemiller

Publish Date: Mon, 13 Oct 2025, 12:02 PM

Key takeaways

- Gold hits new highs despite a stronger USD.

- The rally could continue into 2026…

- …but may ebb later when the Fed’s easing cycle ends alongside lower physical demand and greater supply.

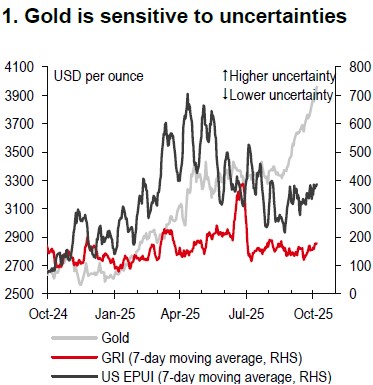

On 8 October, gold smashed above USD4,000 an ounce for the first time, bolstered by uncertainties (Chart 1), like the ongoing US government shutdown, renewed tariff concerns, and growing political uncertainty in France. Markets are also becoming more concerned over fiscal challenges not just in the US but also in other economies, such as France, the UK, and Japan, all of which likely contributed to the price of gold moving higher. Perhaps, the “fear of missing out” (FOMO) can explain a good portion of the recent gold rally, in our precious metal analyst’s view.

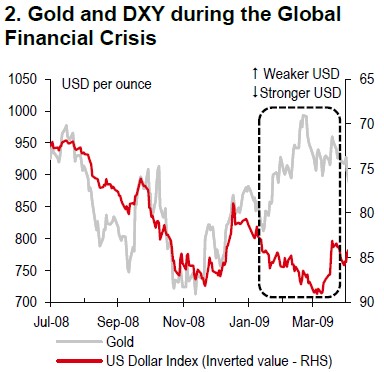

It is worth noting that gold has been rallying alongside a stronger (not weaker) USD, with the US Dollar Index (DXY) rising to a two-month high (Bloomberg, 9 October). The two generally move inversely. The fact that gold can rally in the face of a stronger USD could be a sign of risk aversion, driving demand for “safe haven” assets, whether for hedging or diversification. This is unusual, but it did happen during the Global Financial Crisis (Chart 2), for example.

Note: Geopolitical Risk Index (GRI) is compiled by Fed economists Dario Caldara and Matteo Iacoviello, while US Economic Policy Uncertainty Index (EPUI) based on newspaper archives from Access World New's NewsBank service, is developed by Baker, Bloom and Davis.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

Our precious metal analyst thinks that gold could trend higher over the near term and such a rally can continue into 2026, supported by hedging and diversification demand against a backdrop of elevated geopolitics, trade, and fiscal risks.

Nevertheless, global central banks, in light of an increase in the percentage of gold in their foreign reserves as a result of the gold rally, may feel less compelled to add to gold reserves. High gold prices are also encouraging gold supply (via mining and recycling) but curbing physical demand (in particular jewellery demand). Other potential factors that could curb the gold rally include a soaring USD that drives portfolio flows away from gold, an equity market correction that invokes gold selling to cover margin and raise cash, a rise in longer-end US yields, which increases the opportunity cost of holding gold, the Federal Reserve’s (Fed) rate cutting cycle that pauses or even ends, and a drop in uncertainties.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/gold-smashed-through-usd4000-oz/