georgemiller

Publish Date: Wed, 15 Oct 2025, 08:05 AM

Key takeaways

- US-China trade relations suddenly deteriorated over the weekend…

- …weighing on Asian currencies, in particular the KRW.

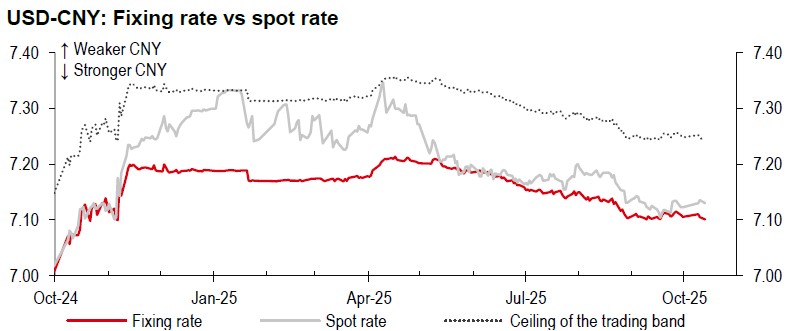

- China’s FX policy remains steady, with the USD-CNY fixing rate hovering at c7.10, despite the tariffs threat.

US-China trade tensions are taking a turn for the worse and are a reminder of the post ‘Liberation Day’ (2 April) blues. This is the latest in a series of US trade-related headwinds for Asian currencies in recent months – a rough doubling of ‘reciprocal’ tariffs compared to earlier for most economies, secondary tariffs for India, and disagreements over the USD350bn investment plan with Korea. But US-China trade tensions have the most potential for broader spillovers, seeing risk aversion in global markets.

Apart from trade issues, Asian currencies have also been weighed down by a combination of low domestic yields, unexpected monetary easing, and idiosyncratic political unrest in some places. The immediate underperformers are those currencies which have a stronger link with foreign equity flows, like the KRW due to the sell-off in equities. In contrast, low-yield currencies, like the SGD and RMB, are holding up better for now.

Source: Bloomberg, HSBC

The USD-CNY fixing rate was at 7.1007 today (13 October), the lowest level since US elections last November. This indicates a steady FX policy, despite the tariffs threat. Ahead of the fourth plenum (20-23 October), the Chinese authorities are probably prioritising domestic market stability. That being said, the low-probability but high-impact risk is that we could see another round of tit-for-tat tariffs (not merely threats), like what happened in early April. Back then, the USD-CNY fixing rate increased from 7.17 to nearly 7.21, with the spot rate moving near the ceiling of the USD-CNY trading band. But on a positive note, US President Trump softened his tone this morning, with Vice President JD Vance casting it all as an ongoing negotiation (Bloomberg, 13 October 2025).

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/rmb-tariffs-again/