georgemiller

Publish Date: Mon, 20 Oct 2025, 12:02 PM

Key takeaways

- The discussion continues on whether the USD has hit its lowest point and is ready to begin an upward trajectory.

- We think there is still room for the USD to weaken further before bottoming out early next year.

- EUR-USD may have bottomed for now and could grind higher into 2026, but a longer-term rally seems unlikely.

The US Dollar Index (DXY) has remained stable since July but recently surpassed the 99-mark due to heightened policy risks in France and Japan, coupled with escalating US-China trade tensions. However, as the US federal shutdown continues and with French politics stabilising, the DXY is now back to hovering around 98.5 (Bloomberg, 16 October).

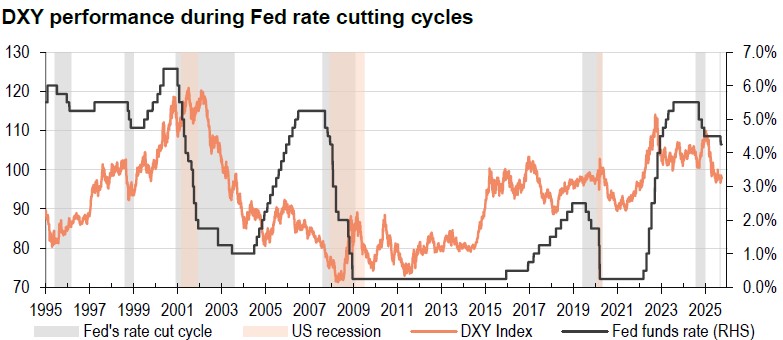

Markets are debating whether the USD has bottomed and is ready to begin an upward trajectory. We believe there is still room for the USD to fall gradually before bottoming out early next year, particularly given potential rate cuts by the Federal Reserve (Fed). Historical instances of Fed rate cuts without accompanying U.S. recessions (namely, 2002-03, 2H07, and 2H19) have typically resulted in a weaker USD (see chart below), offering insights into the current situation. In addition, US trade policy uncertainty and Fed independence could also weigh on the USD.

Source: Bloomberg, HSBC

As for EUR-USD, we think that it may have bottomed for now, given that the immediate French political and fiscal risks appear to have receded. On 16 October, French prime minister Sebastien Lecornu survived two no-confidence votes in the National Assembly, indicating that France has avoided the need for new National Assembly elections, at least for now.

As the Fed is likely to ease and the European Central Bank is likely to be on hold, EUR-USD could benefit from narrowing rate differentials over the near term and into 2026. That being said, a longer-term rally seems unlikely, as headwinds, like weak domestic demand, could hold EUR-USD back.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/usd-poised-for-an-upswing/