georgemiller

Publish Date: Tue, 21 Oct 2025, 12:02 PM

Key takeaways

- China’s Golden Week showed muted spending: per-capita trip spend down 0.6% y-o-y and down 2.6% relative to 2019.

- Underlying pressures remain in the labour market and property sector.

- We expect policy support for consumption-driven growth to feature prominently in China’s 15th Five-Year Plan.

China data review (September 2025 & Q3)

- GDP growth eased to 4.8% y-o-y in Q3 amidst trade headwinds and ongoing domestic challenges. September activity data showed a mixed performance in key categories, including Industrial Production, Fixed Asset Investment and retail sales. The strong H1 growth helped round out the first three quarters at 5.2%, suggesting that this year’s growth target of “around 5%” is in reach.

- Retail sales continued to grow at a more modest pace, up 3.0% y-o-y in September, dragged by tepid consumer confidence. The recent campaign to curb excessive spending by government officials on banquets likely continued to impact catering sales, which declined 1.6% y-o-y. Meanwhile, goods consumption may have been weighed down by a high base following the allocation of RMB150bn in subsidies for the trade-in programme initiated in August 2024.

- Fixed Asset Investment contracted by 7.1% y-o-y for the second consecutive month. Manufacturing investment was down 1.9% y-o-y as trade uncertainty weighed on investments in electrical machinery and computing. Property investment remained the primary drag, falling 21.3% y-o-y, while infrastructure investment dropped 4% on a lack of funding at the local government level.

- Industrial Production growth improved to 6.5% y-o-y in September, given better-than-expected exports growth, though we remain cautious that this outperformance can be sustained, given lingering US tariff impacts and potential trade payback. On a brighter note, key drivers will likely continue to stem from equipment and high-tech related manufacturing.

- CPI fell 0.3% y-o-y in September, dragged down by weaker pork and vegetable prices, while oil prices moved sideways, staying at a relatively low level. Core CPI rose 1.0% y-o-y, supported by ongoing consumption policies and tourism prices. PPI dropped by 2.3% y-o-y, narrowing its year-on-year losses, largely helped by base effects. Meanwhile, its m-o-m reading was flat at 0%.

- Exports accelerated to 8.3% y-o-y in September, continuing to benefit from trade restructuring. Even as exports to the US remain under pressure (-27% y-o-y in September), those to other markets have seen double-digit growth, e.g., EU +14.2%, ASEAN +15.6% and Africa +56.4%. Meanwhile, imports rose by 7.4%, helped largely by an increase in high-tech goods, which lifted 14.1% y-o-y.

China consumption – Pulse check

Muted Golden Week

With the Golden Week (1-8 October) behind us, it is a fitting time to take stock of the latest trends in Chinese consumer behaviour. The data shows a mixed bag: domestic trips hit a record 888 million and tourism spending reached RMB809bn (Ministry of Culture and Tourism, 9 October), but we estimate the average daily growth was up only 1.6% y-o-y and 1% y-o-y, respectively. On a per-capita trip basis, spending slightly decreased by 0.6% y-o-y, or 2.6% relative to 2019.

Tax revenue data showed that the services sector outperformed, helped in part by government support, although movie sales disappointed. Meanwhile, overseas travel picked up, with inbound foreign travel up 20% y-o-y, boosted by China’s visa-free entry programmes, while mainland Chinese residents saw increased international travel of 10% y-o-y.

Consumption pressures have increased…

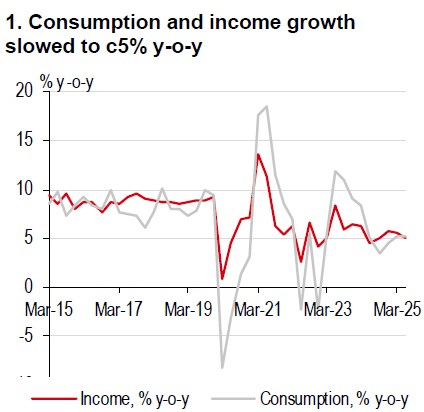

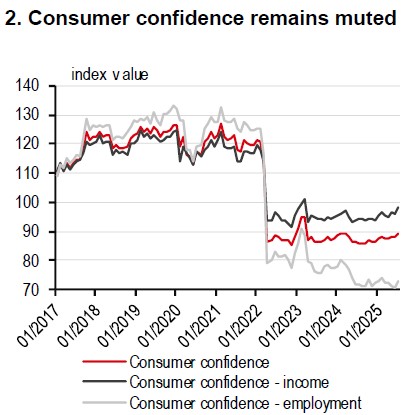

The muted Golden Week performance carries on some of the recent trends as seen in softer consumption data. Retail sales, growing under 4% y-o-y in recent months, have faced some headwinds due to lingering labour market and property sector pressures. Wage growth is running below the pre-pandemic level at c5% y-o-y versus c9% in 2019. Consumer confidence has yet to pick up, while the youth unemployment rate reached 18.9% in August.

On a brighter note, the government recently announced that the last batch of subsidies for goods trade-ins had been issued as of 29 September (NDRC, 29 September), involving RMB69bn of central government funds and c7bn of local government funds. This likely contributed to the outperformance in the Golden Week data in certain goods, such as consumer electronics, and means we should see some continued support in the rest of the year.

Source: Wind, HSBC

Source: Wind, HSBC

…leading to more policy support for services

The push for more services consumption has been clear in recent government policies, most recently with plans for services and sports consumption issued in September. Based on the retail sales breakdown, the increased focus on services consumption seems to be helping sectors, such as cultural goods, and sports and entertainment goods.

The next steps are set to bring structural reforms aimed at enhancing social safety nets and urbanisation efforts. Recent policies to boost basic care subsidies, like childcare and elderly care, show a shift towards supporting a broader range of services. Additionally, there is a focus on providing social benefits tied to permanent residence and advancing new urbanisation plans.

China’s 15th Five-Year Plan

At the time of writing, China’s policymakers are convening for the Forth Plenum (20-23 October) where they will review the 15th Five-Year Plan, setting priorities from 2026 to 2030. We expect a strong emphasis on consumption-driven growth, supported by services consumption and structural reforms to expand social safety net coverage. Other key areas of focus may include fostering innovation, green development and opening-up reforms.

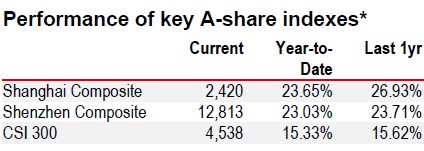

Source: LSEG Eikon

*Past performance is not an indication of future returns

Source: LSEG Eikon. As of 20 October 2025, market close

https://www.hsbc.com.my/wealth/insights/market-outlook/china-in-focus/china-consumption-pulse-check/