georgemiller

Publish Date: Mon, 27 Oct 2025, 08:05 AM

Key takeaways

- The NZD leads as the weakest G10 currency so far in 2H, closely followed by the JPY.

- But downward pressure on the JPY may ease with cautious fiscal expansion and potential shifts in BoJ.

- Rising risk appetite and broader USD weakness could counter domestic challenges, fostering NZD consolidation.

As of the second half of 2025, the NZD is the worst-performing G10 currency, with the JPY following closely behind (Bloomberg, 23 October 2025). This situation prompts the question of whether this trend will persist or if a reversal is imminent.

We believe the downward pressure on the JPY, arising from market concerns about fiscal loosening and the Bank of Japan’s (BoJ) dovish stance, may not be longlasting. The heightened political sensitivity to cost-of-living issues in Japan suggests that the new Finance Minister, Satsuki Katayama, is likely to adopt a cautious approach to fiscal expansion. Some degree of fiscal loosening could support the JPY by fostering a more optimistic growth outlook.

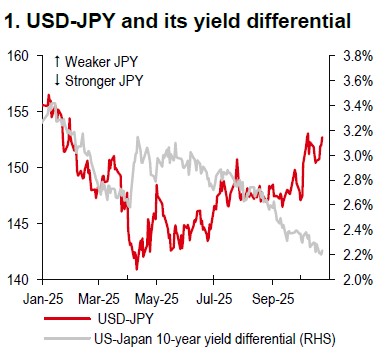

Despite market scepticism about a BoJ rate hike on 30 October, there is a possibility that policymakers might signal a greater willingness to consider tightening on 18 December than currently anticipated by markets. This could present upside risks for the JPY. Additionally, with the Federal Reserve’s easing on the horizon, narrowing interest rate differentials could lead to a decline in USD-JPY over time (Chart 1). Overall, we expect the JPY to strengthen in the months ahead.

Source: Bloomberg, HSBC

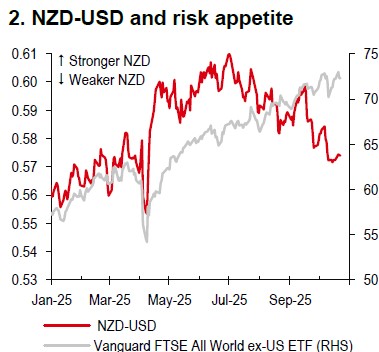

Source: Bloomberg, HSBC

As for the NZD, it has been facing significant domestic challenges. After the 50bp easing by the Reserve Bank of New Zealand (RBNZ) on 8 October, markets are fully priced for a further 25bp cut on 26 November (Bloomberg, 23 October). Our economists also expect this, given the combination of weak economic activity, easing underlying inflation, and a still-weak jobs market, which leaves little to prevent further RBNZ easing. But with a lot of domestic issues already in the price, alongside rising risk appetite (Chart 2), and if our expectation of broader USD weakness holds true, the NZD appears poised for consolidation in the coming weeks.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/jpy-and-nzd-time-for-a-turnaround/