georgemiller

Publish Date: Mon, 10 Nov 2025, 07:04 AM

Key takeaways

- The BoE narrowly kept the Bank Rate unchanged at 4.00%, but with a 5-4 vote.

- New look guidance suggests that Andrew Bailey’s vote will be key in determining the timing of the next move.

- December is a close call, but our new central case is for a resumption of the easing cycle in February (previously: April).

The Bank of England (BoE)’s Monetary Policy Committee (MPC) has kept the Bank Rate on hold at 4.00%. This is the first time it has not cut rates at a quarterly Monetary Policy Report (MPR) meeting since May 2024, marking a pause in the easing cycle. However, if August was a hawkish cut, today was a dovish hold.

For the GBP, the Bank of England’s dovish 5-4 hold is mildly bearish near term given the consensus was for a 6-3 vote. Over the next few weeks, unemployment and inflation prints on 11 and 19 November will likely have an impact. Ultimately, however, the Autumn Budget is likely to prove the key factor for GBP in the coming weeks.

The dovish hold likely limits the upside for GBP over the near term, as it means the market thinks a December rate cut remains a possibility. GBP-USD has come under pressure in recent weeks given broad USD strength, along with speculation ahead of the UK’s Autumn Budget. A surprise rise in the August unemployment rate to 4.8% and slower-than-expected CPI which fell short of the BoE’s peak forecast of 4.0% in September also added to more dovish bets with the front end of the UK yield curve repricing the terminal rate down to 3.35% ahead of Thursday’s meeting.

Data over the coming weeks will provide more evidence of the UK’s disinflationary path. Markets will also look for clues in speeches by BoE chief economists in November.

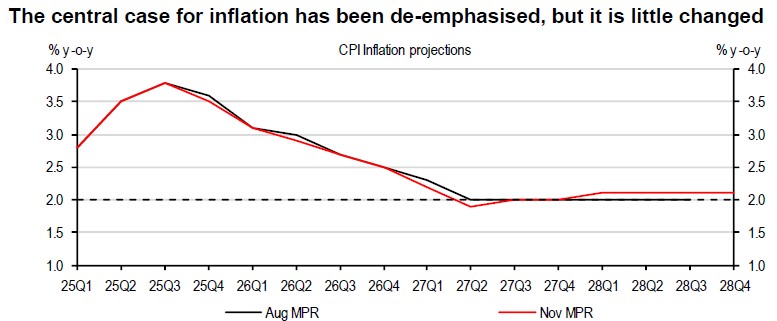

Source: BoE, HSBC forecasts

The Budget, however, will likely prove the determining factor. Last year’s Budget proved inflationary but this year’s statement could hamper already fragile growth. The Budget holds three potential risks for GBP (1) the government must convince markets it can stick to fiscal rules; (2) the impact on growth from likely tax hikes; and (3) the inflationary impact of any potential fiscal measures.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/bank-of-england-on-hold-gbp-implications/