georgemiller

Publish Date: Fri, 14 Nov 2025, 08:05 AM

Key takeaways

- Tariff-related uncertainty continues, despite the US negotiating a few deals with Asia.

- Pockets of inflationary pressure in the US, less so elsewhere.

- We still expect another US Federal Reserve rate cut in December but risks have risen.

The global economic outlook continues to be dominated by uncertainty – ranging from trade-related news and the recent US government shutdown to other global and domestic geopolitical risks. Despite these headwinds, financial markets have remained robust through 2025, with a wide range of asset prices close to, or at, record highs.

Trade developments

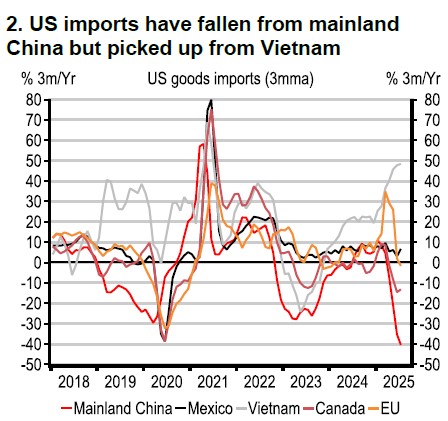

Over the past few weeks, US-China trade tensions intensified and then cooled at the recent APEC summit. The US has agreed to reduce fentanyl related tariffs by 10% and remove the threatened additional 100% tariffs, while China agreed to defer rare earth export curbs introduced in October and could import soybeans once more. President Trump also signed trade deals with Korea, Malaysia and Cambodia during the trip. Meanwhile, the G7 agreed in its latest meeting to accelerate efforts across the critical mineral supply chain to reduce the risk of Chinese dominance in rare earths.

Separately, the US threatened an additional 10% tariffs on Canadian imports after a Canadian advertisement quoted a line from former US President Reagan’s speech stating, “Tariffs hurt every American”. In addition, Washington imposed sanctions on two of Russia’s largest oil companies, potentially curtailing India and China’s import of Russian crude. India’s trade data are seeing some of the impact of the 50% tariffs on exports to the US taking effect, but ongoing negotiations with the US may provide some relief.

Source: Macrobond

Source: Macrobond

Inflation risks

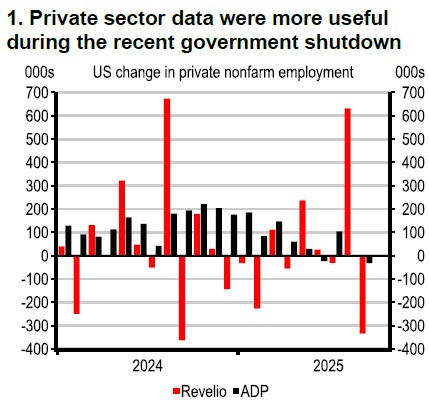

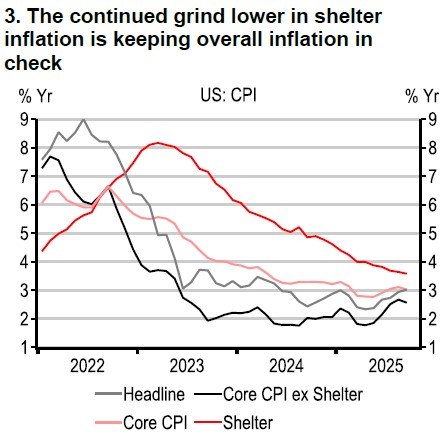

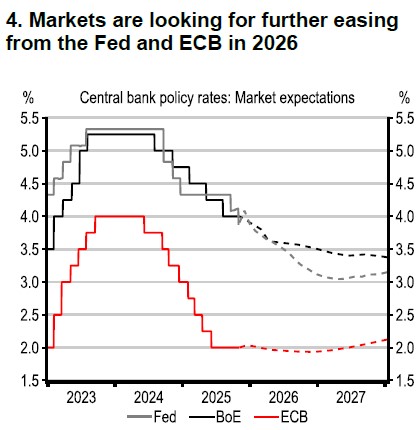

Higher tariffs have already begun to feed into US inflation, with durable goods prices increasing. However, lower rental inflation is going in the other direction, and so the two may cancel each other out to a degree in the coming months, even if survey indicators suggest that firms are feeling the pressure of higher costs. The lack of official US data due to the recently ended shutdown means that policy setting needs to be a little more cautious. The Federal Reserve delivered another rate cut in October, primarily to help the softening labour market, and we still expect another rate cut in December, but risks have risen.

Source: Macrobond

Source: Macrobond

Policy easing

In Europe, most eurozone countries submitted their draft budget plans for 2026 to the European Commission, with the fiscal stance likely to turn expansionary. In the UK, lower-than-expected inflation has increased odds of a rate cut sooner rather than later, but we expect Bank of England to remain on hold until April 2026. Meanwhile, in mainland China, the 15th Five Year Plan unveiled an increased focus on self-reliance, with an emphasis on high quality development fuelled by technology and innovation. The slowdown in recent data, particularly on the investment side, makes the need for government support more pressing.

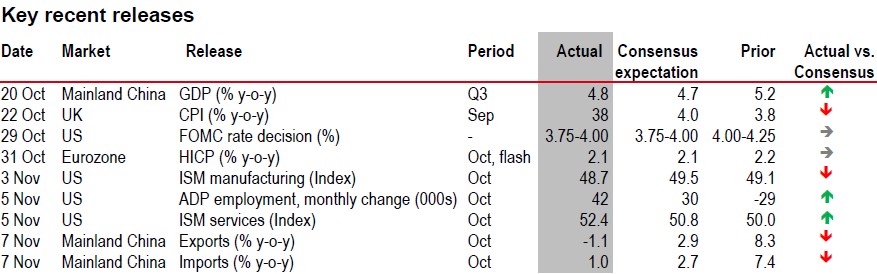

Source: Bloomberg, HSBC

⬆ Positive surprise – actual is higher than consensus, ⬇ Negative surprise – actual is lower than consensus, ➡ Actual is in line with consensus

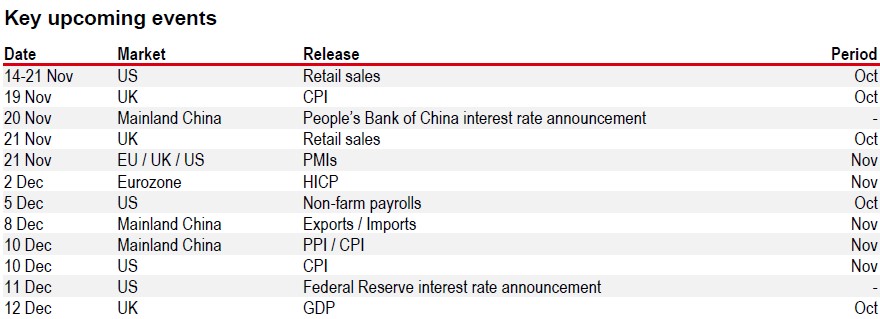

Source: LSEG Eikon, HSBC

https://www.hsbc.com.my/wealth/insights/market-outlook/macro-monthly/cooling-trade-tensions/