georgemiller

Publish Date: Mon, 17 Nov 2025, 12:02 PM

Key takeaways

- The CHF gains amid US-Switzerland trade deal optimism.

- Post-government shutdown, the USD is facing economic, monetary policy, trade, and Fed leadership uncertainties.

- The JPY’s weakness has triggered MoF’s verbal intervention and the likelihood of an increased BoJ hike.

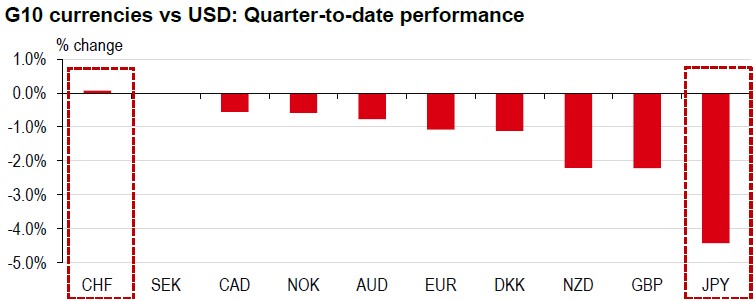

In this fourth quarter, the CHF leads as the top-performing G10 currency, with the USD close behind. In contrast, the JPY, another “safe haven” currency, is the weakest. This disparity prompts questions about the reasons for their varied performances and the potential persistence of this trend.

Note: Data as of 13 November 2025 (20:00 HKT)

Source: Bloomberg, HSBC

The CHF has recently strengthened due to optimism about a potential USSwitzerland trade agreement. Reports indicate that Switzerland may be close to reaching a deal that would lower its reciprocal tariff rate on exports to the US from 39% to 15% (Bloomberg, 11 November). This development is favourable for the CHF, especially given previous domestic growth concerns due to the anticipated tariff impact, which led to growth downgrades by the Swiss National Bank (SNB) and the government. While investment pledges, particularly in US gold refining, might impact the CHF, the trade deal is expected to be beneficial overall.

The USD’s strong quarter-to-date performance may not persist. With the US government shutdown now resolved, upcoming data might highlight its negative impact on economic growth, potentially affecting the USD. Interestingly, US rate expectations have not declined alongside the USD; rather, the likelihood of a December rate cut by the Federal Reserve (Fed) has dropped to just below 50% (Bloomberg, 13 November). The reopening could boost equity markets, possibly weakening the USD due to increased risk appetite, although evidence remains mixed. In the end, the USD is navigating uncertainties related to economic performance, monetary policy direction, and potential risks from US trade policy and Fed leadership changes.

USD-JPY has continued to rise, despite the verbal intervention from Japan’s Ministry of Finance (MoF). Japanese Finance Minister, Satsuki Katayama, highlighted recent “one-sided, rapid currency moves” and stressed the government’s vigilance against excessive and disorderly fluctuations (Bloomberg, 12 November). The MoF last intervened in July 2024 when USD-JPY exceeded 160, so if that remains the threshold for the new leadership, USD-JPY may continue to rise. A consequence of the JPY’s ongoing weakness could be an increased likelihood of a rate hike by the Bank of Japan (BoJ), with markets currently pricing a 33% chance of this occurring in December (Bloomberg, 13 November). Thus, the JPY’s weakness may be moderated by rhetoric from both the MoF and the BoJ.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/safe-haven-currencies-diverging-performance/