georgemiller

Publish Date: Tue, 18 Nov 2025, 08:06 AM

Key takeaways

- Chinese exports are proving competitive beyond just pricing with robust performance this year amid all the tariffs.

- Still, China wants to better balance imports and exports, in part by moving production overseas, closer to consumers.

- FDI is rebounding as some multinationals reassess their strategies from ‘China for China’ to ‘China for global’.

China data review (October 2025)

- Retail sales eased slightly to 2.9% y-o-y in October as durable goods that benefited from trade-in subsidies weakened in October, despite the recent allocation of the last batch of trade-in subsidies. This was primarily owing to a much higher base from last year. In particular, auto sales were down 6.6% y-o-y and largely weighed on overall retail sales growth.

- Industrial Production (IP) slowed to 4.9% y-o-y in October, partly owning to a fall in exports. However, the NBS previously noted that some production was front-loaded before the eight-day long Golden Week holiday and therefore weighed on activity in October. By sector, weaker exports likely explained pullbacks in IP growth in electrical machinery and computer and communication.

- Fixed Asset Investment (FAI) fell 1.7% y-o-y in October, as investment in manufacturing (-6.7%), property (-23%) and infrastructure (-8.2%) faced more pressure. The domestic anti-involution campaign will likely remain a key nearterm drag weighing on investment appetite, which may come back only when investors see industry consolidation play out or profit margins notably improve.

- Exports contracted 1.1% y-o-y in October for the first time since February. While most of this slowdown is attributable to a high base, there may be some impact from the expansion of the US Bureau of Industry and Security 50% ownership entity rule and China’s export controls, including on rare earths shipments. Meanwhile, imports slowed to 1.0% y-o-y as high-tech products slowed, likely affected by trade tensions.

- CPI was up 0.2% y-o-y in October, after two consecutive months of contraction, helped by a continued improvement in core CPI (+1.2%). PPI also eased its decline, falling 2.1% but turned positive in m-o-m terms (+0.1%) for the first time since last November, partly helped by higher non-ferrous metals prices. Meanwhile, efforts to rectify irrational competition may have provided support.

China’s trade playbook

Strong exports, investing overseas, and FDI

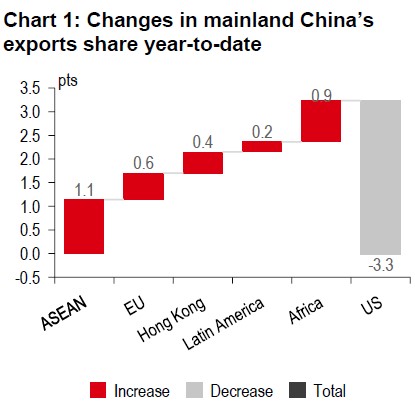

China’s exports grew by 5.3% y-o-y (in USD terms) in the first ten months. This resilience is supported by trade diversification and the pull effects from other economies’ front-loading purchases, generating demand for Chinese intermediate and capital goods. China’s tariff disadvantage is now less significant than anticipated, too. Meanwhile, its average export prices are declining, driven by domestic depreciation pressure and a relatively weaker RMB against non-USD currencies, such as the euro.

“Made in China” goods are competitive beyond just pricing

US demand for Chinese capital goods and intermediate goods has been increasingly less price sensitive over time, per US Census data. That said, we acknowledge that c67% of the lowestpriced consumer goods imported by the US originated from China in 2024, significantly surpassing China’s 32% share of US consumer goods imports. The recent 10% tariff reduction now aligns US tariffs on consumer goods from China with those from some emerging economies, which could potentially boost China’s exports to the US.

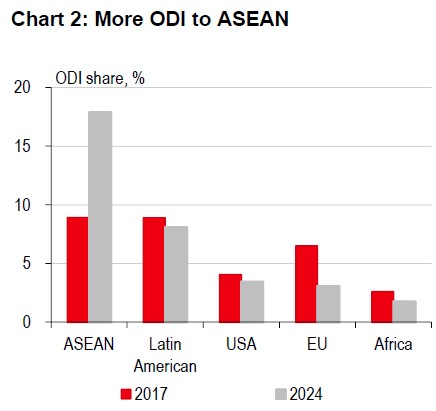

Will outbound direct investment (ODI) be a viable playbook?

Concern about China’s exports competitiveness is rising among trading partners. However, in the new Five-Year Plan, China pledges to balance imports and exports with more trade and investment cooperation. Will Japan’s playbook, aka stepping up ODI and localising production, work for China? A significant challenge is the stricter national security concerns over Chinese investments abroad. Nonetheless, China’s ODI has substantial growth potential. For certain trading partners, allowing direct investments by China to build factories with the aim of replacing exports could help ease tensions.

An emerging trend in FDI: from "China for China" to "China for global"?

Multinational corporations (MNCs) are re-evaluating their strategy in China amid trade uncertainties. Some are now pausing plans to diversify supply chains away from China while others are exploring China’s innovation capabilities to enhance their global competitiveness. Meanwhile, FDI into China has shifted to moderate inflows, with an increase in foreign funded R&D centres in China. If this trend continues, it could signify a new phase of re-globalisation.

Source: China Customs, HSBC; Note: Data as of September 2025.

Source: CEIC, HSBC

Source: LSEG Eikon

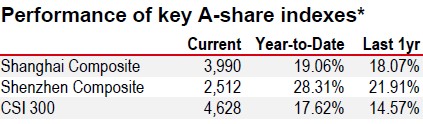

* Past performance is not an indication of future returns

Source: LSEG Eikon. As of 14 Nov 2025 market close

https://www.hsbc.com.my/wealth/insights/market-outlook/china-in-focus/chinas-trade-playbook/