georgemiller

Publish Date: Mon, 24 Nov 2025, 12:01 PM

Key takeaways

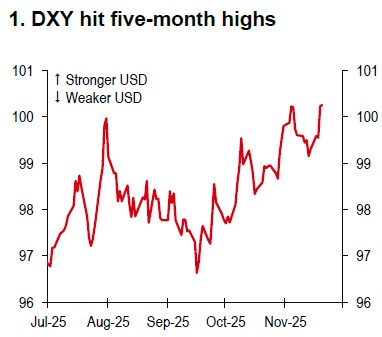

- The DXY has exceeded 100, but the USD is likely to face downward risks, in our view.

- These risks could arise from a potential insurance cut by the Fed in December.

- Fed succession discussions might influence future rate paths and even trigger independence concerns.

The US Dollar Index (DXY) has recently climbed above the 100 mark (Chart 1), prompting debate on whether the USD’s decline has ended and if an upward trend is imminent. In our view, further USD softness is likely, contingent on the Federal Reserve’s (Fed) upcoming decisions and the appointment of its new Chair.

For the Federal Open Market Committee’s (FOMC) rate announcement on 11 December at 03:00 HKT, markets currently price in a c40% chance of a 25bp cut (Bloomberg, 20 November), after the FOMC minutes for October suggest that “many” FOMC members are inclined to leave policy unchanged at the December meeting. Our economists slightly favour a rate cut in December, provided some labour market data shows softness. The US Bureau of Labor Statistics is scheduled to release October/November employment figures on 16 December.

Should the Fed implement an insurance cut, the USD is likely to soften albeit with modest flow through. Conversely, if rates remain unchanged, the USD might spike, although the Fed is likely to indicate openness to future cuts. With a c95% chance of a January cut currently priced in (Bloomberg, 20 November), the scope for USD strength appears limited.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

Looking ahead to 2026, the extent of the Fed’s rate cuts may be influenced by the selection of the next Chair. Recently, US President Trump has indicated he has identified a candidate for the Fed Chair position, and Treasury Secretary Scott Bessent, overseeing the selection process, aims to finalise it next month (Bloomberg, Fox News, 19 November). The eventual appointee is unlikely to trigger a significant hawkish market repricing (Chart 2),which may keep the USD defensive. Concerns about Fed independence may also heighten, potentially extending and exacerbating the USD’s decline into next year.

That being said, once the Fed’s easing cycle ends and its incoming Chair is revealed, there is a stronger case for the USD to then bottom.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/usd-fed-unknowns/