georgemiller

Publish Date: Mon, 01 Dec 2025, 12:02 PM

Key takeaways

- The NZD has strengthened after the RBNZ’s hawkish cut, potentially marking the end of the easing cycle.

- Market sentiment is positive regarding the UK Autumn Budget, supporting the GBP.

- In our view, the NZD seems to have found a bottom, while GBP-USD may gain further over the near term.

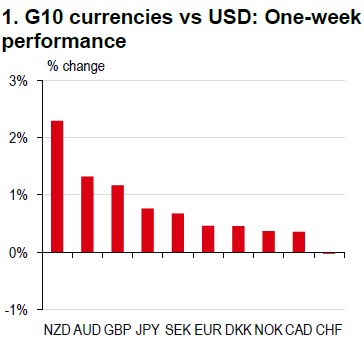

Over the past week, the NZD led the performance among G10 currencies, with the AUD and GBP following closely (Chart 1), driven by specific domestic factors.

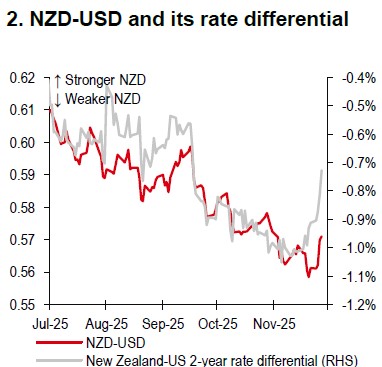

On 26 November, the Reserve Bank of New Zealand (RBNZ) cut its policy rate by 25bp to 2.25%, as widely expected. The central bank’s policy rate projection indicates a minimal additional reduction of 5bp, with the lowest rate expected by June 2026. Governor Hawkesby noted that this aligns with the rate remaining stable in 2026. The RBNZ emphasised that the significant 325bp reduction since August 2024 is bolstering demand, and the unemployment rate has peaked. Following this announcement, NZD-USD jumped, driven by rate dynamics (Chart 2).

With a floor now established under the terminal rate, we believe the NZD has found a bottom. Any improvement in risk appetite could further strengthen the NZD as the year draws to a close.

Note: Data as of 27 November 2025 (19:25 HKT).

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

Like the NZD, the AUD has been benefiting from similar drivers. With both headline and core CPI inflation for October surprising on the upside, markets have dismissed the likelihood of rate cuts by the Reserve Bank of Australia (RBA), anticipating a hold instead (Bloomberg, 27 November 2025). We believe the AUD’s support through the rates channel is becoming limited.

Meanwhile, the GBP has experienced a relief rally following the UK’s Autumn Budget announcement on 26 November. Markets responded positively to a GBP26bn tax increase for 2029/30, which provides GBP22bn of fiscal headroom. Additionally, enhancements to child benefits may have mitigated immediate political risks. In our view, GBP-USD could rise further over the near term, influenced by factors on the US side (please refer to “FX Viewpoint - USD: Fed unknowns” for details).

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/nzd-and-gbp-beyond-relief-rally/