georgemiller

Publish Date: Mon, 08 Dec 2025, 12:01 PM

Key takeaways

- Labour market softness in the US and a disinflationary budget in the UK should ensure near-term rate cuts…

- …but with inflation and domestic demand surprising on the upside in parts of G10, not every central bank is cutting…

- …and a few are turning a little more hawkish.

Fears of an AI bubble spooked the market in November, but with earnings and global growth holding up (including some notable upside Q3 surprises in Asia) and some easing of trade uncertainty, global equites are just below their late-Oct record highs.

US government re-opened

The US government’s record-long 43-day shutdown finally ended on 13 November, after President Trump signed a bill which extends government funding through to the end of January. It also guaranteed back-pay to all federal workers, which could lift Q1 GDP. Data releases are still delayed though, with the next set of key BLS and BEA releases – like payrolls and CPI – not scheduled until after the Federal Reserve (Fed)’s 10 December meeting.

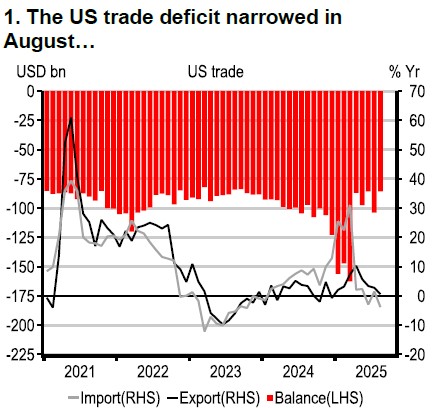

Some lagging US data have already been released, including August trade data, which showed a smaller US trade deficit. This was likely reflecting some payback following earlier frontloading trends. Tariff uncertainty prevails though, as sector tariffs could change, and we await a Supreme Court ruling on the International Emergency Economics Powers Act (IEEPA) tariffs. Yet some tariffs are falling too, given the recent détente between the US and China, and, following signs that tariffs are raising consumer prices, several agricultural products have been excluded from scope.

Source: Macrobond

Source: Macrobond

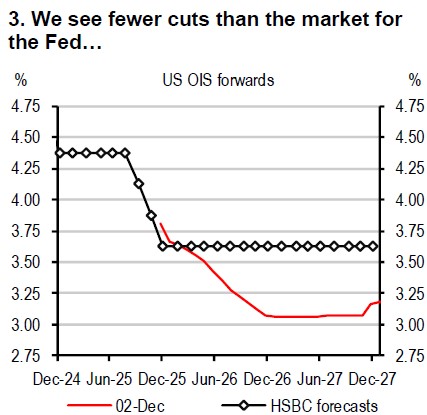

September labour market data were mixed, with an upside surprise from payrolls (119,000), but the unemployment rate ticking up to 4.4%. Other data, for October, showed falling job openings, higher layoffs, and lower confidence, seemingly locking in the prospect of a December rate cut, even amid dissent on the FOMC.

Source: Bloomberg, HSBC forecasts

Note: OIS = Overnight Index Swap

Source: Bloomberg, HSBC forecasts

Note: OIS = Overnight Index Swap

Disinflationary UK budget

The UK’s much-anticipated Budget leaves many structural issues unresolved, but it stuck to the fiscal rules and more than doubled the fiscal headroom. Railway fare and energy price freezes should keep CPI trending lower, supporting further Bank of England (BoE) rate cuts. Meanwhile, Japan’s cabinet approved a 3.2% of GDP economic stimulus, supporting our case for a Bank of Japan 25bp rate hike in December.

Easing cycles nearing an end

Elsewhere, it has become clearer that other central banks are at the end of their easing cycle. The European Central Bank (ECB) and ASEAN countries look set to be on hold in the coming year, so first out of the blocks on rate rises is likely to be the Reserve Bank of New Zealand. With an upswing now evolving, we now expect a rate rise in Q3 2026. With firming demand and core inflation above the Reserve Bank of Australia (RBA)'s 2-3% target band, the RBA will also likely raise its policy rate by Q3 2026.

Strong India growth

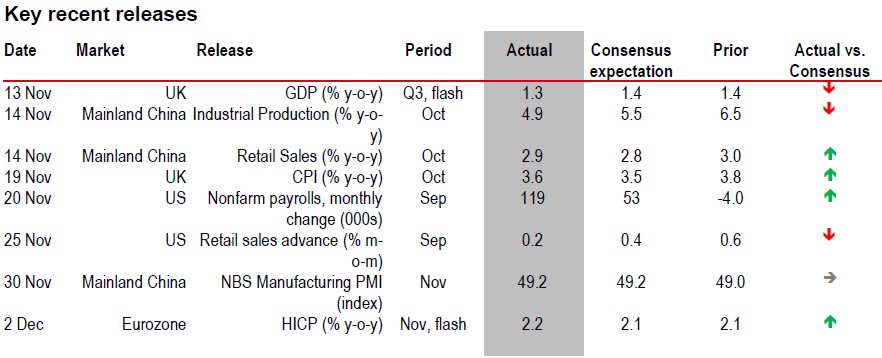

Despite very strong Q3 growth of 8.2% y-o-y in India, lower inflation provides scope for further easing. Fiscal and monetary stimulus also loom for China where the October data disappointed. Investment, consumption, and industrial production slowed, as external and domestic demand remained subdued. The property sector is also showing renewed weakness, with a steeper fall in primary home sales and real estate investments.

Source: Bloomberg, HSBC

⬆ Positive surprise – actual is higher than consensus, ⬇ Negative surprise – actual is lower than consensus, ➡ Actual is in line with consensus

Source: LSEG Eikon, HSBC *October data in this release will not include unemployment rate

https://www.hsbc.com.my/wealth/insights/market-outlook/macro-monthly/a-hawkish-tilt/