georgemiller

Publish Date: Wed, 10 Dec 2025, 12:01 PM

Key takeaways

- Clean energy sectors, particularly solar, wind, and nuclear, have underpinned strong performance in climate-related equities in 2025.

- While US outflows dominate, there is evidence of rotation into Europe and Asia, with Switzerland and mainland China reporting net inflows.

- Solar and energy storage emerge as most attractive themes within the climate change space.

After a slow start to the year, global climate stocks – particularly in the solar, wind and nuclear sectors – have made a strong comeback, outperforming global equities year-to-date. Looking forward, HSBC Global Investment Research identifies solar and energy storage as the most compelling opportunities within the climate change space. Solar energy continues to lead the global clean energy transition, supported by falling costs, favourable policy frameworks, and rapid technological progress. Meanwhile, energy storage is becoming increasingly critical for reducing emissions across both the transport and power industries.

Did you know?

- Global climate stocks have outpaced global equities (FTSE All World) by over 11 percentage points year-to-date (as of 16 October 2025)

- Solar capacity additions reached c550GW in 2024, marking a 30% growth from 2023 levels

- China accounted for 97% of global solar wafer production, 87% of solar cells, and 78% of solar modules, as of 2024

- The International Solar Alliance is working to mobilise USD1trn in solar energy investments by 2030

- Global energy storage battery demand needs to jump 6x by 2030 to meet the IEA’s net-zero scenario

- Over the past five years, nearly 20% of energy related funding went towards energy storage and batteries related start-ups

Sources: IEA – Global Energy Review 2025 – License: CC by 4.0; HSBC Global Investment Research

Climate stocks outperformance

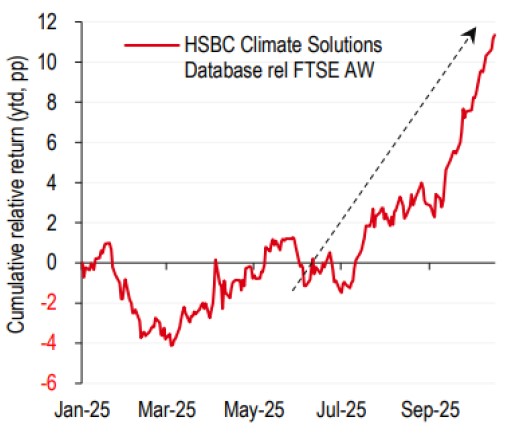

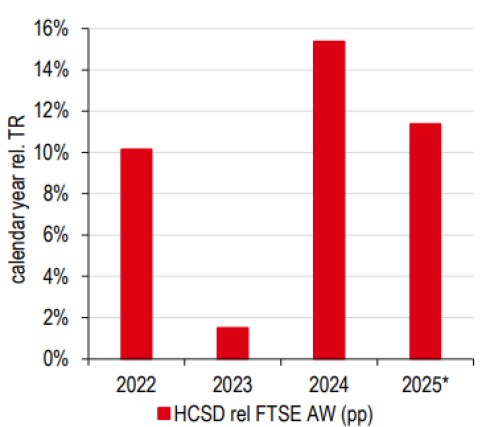

Global climate stocks in the HSBC Global Investment Research (HSBC Research) proprietary HSBC Climate Solutions Database (HCSD) saw a strong price performance in the third quarter of this year and have outperformed the global equity benchmark (FTSE All World Index) by 11.4 percentage points in 2025, as of 16 October. This follows the steady outperformance of climate stocks over the past few years, including a 15.4 percentage point gain in 2024.

Climate stocks have outperformed global equities year-to-date

Source: FTSE Russell, LSEG Datastream, HSBC as at 16 October 2025

Recent surge is driven by pure-play climate stocks

Source: FTSE Russell, LSEG Datastream, HSBC as at 16 October 2025

Broad-based outperformance

HSBC Research’s analysis of climate stocks by region and sector suggests that the recent price outperformance is broad-based, marking a notable turnaround from the challenging outlook earlier in the year. Political backlash, deteriorating sentiment attached to sustainable investing, and concerns associated with greenwashing and regulatory changes had an adverse impact on the performance of climate stocks in the HCSD in the first few months of 2025.

While many of these issues persist, the strong relative performance of climate stocks since early July aligns with a slight reduction in uncertainty, particularly related to the US climate policy, partly alleviated by the One Big Beautiful Bill.

Pure-plays lead

Drilling down further, pure-play climate stocks – those generating more than half of their revenues from climate-related activities, have delivered the strongest returns this year, approximately around 35%. This likely reflects investors’ preference for pure-play stocks, while expanding their exposure to the universe of clean-tech companies.

Importantly, companies with less than 50% climate revenue exposure have also outperformed the global equity benchmark in 2025. This ongoing trend reinforces the consistent outperformance of climate stocks over the past decade, despite facing various market

Asia-Pacific ahead

Analysis of regional price performance of stocks in the HCSD shows Asia-Pacific leading with a 34% year-to-date return. While climate stocks in North America and Europe have lagged HCSD stocks in aggregate, they have still outperformed the global equity benchmark.

Historically, Asia-Pacific climate stocks have delivered stronger returns than other regions, driven by a robust economic growth and increased investment in clean technologies. Notably, the region represents over half of all climate stocks in the HCSD and remains a significant contributor to global climate company revenues.

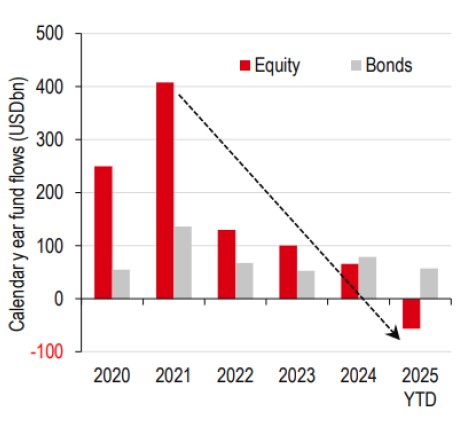

Sustainable funds: US drives equity outflows

Sustainable equity funds have experienced net outflows of USD 57 billion year-to-date—the first recorded outflows since 2020. The US market is the primary contributor, accounting for USD 43.5 billion of these outflows as of 10 October this year. This trend is largely attributed to political backlash, waning investor sentiment towards sustainable investing, and concerns over greenwashing and regulatory changes.

First instance of outflows from sustainable equity funds since 2020

Source: Morningstar, HSBC as at 10 October 2025 (using weekly data)

Nonetheless, sustainable funds’ asset under management continues to rise

Source: Morningstar, HSBC as at 10 October 2025

In contrast, sustainable bond funds have maintained strong momentum in 2025, attracting USD 57 billion in inflows, representing over 6% of all global bond fund inflows.

Despite the outflows from equity sustainable funds, assets under management (AUM) for both equity and bond sustainable funds have increased, reflecting robust price performance and supporting observations of strong returns in global climate stocks. Notably, since 2021, the long-term growth in AUM for sustainable equity and bond funds has been higher than all-equity and all-bond funds, respectively.

Across major markets, the US remains a significant drag, with year-to-date outflows intensifying in recent months—rising from approximately USD 16 billion at the end of the last quarter to around USD 43 billion currently across both equity and bond sustainable funds. These outflows, exceeding 10% of AUM in both categories, highlight a deteriorating outlook for sustainable investments in the US. The early termination and phase-down of Inflation Reduction Act tax credits for renewables and transport, as legislated in the One Big Beautiful Bill, have further dampened sentiment.

While US outflows dominate, there is evidence of rotation into Europe and Asia, with Switzerland and mainland China reporting net inflows.

Climate themes to watch

HSBC Research applied their quantitative framework to the HCSD, identifying solar and energy storage as the most attractive themes within their climate change space. We examine the underlying fundamentals supporting these sectors.

Solar

Solar energy continues to lead global clean-energy growth, supported by falling costs, strong policies and rapid technology gains. Investments in solar photovoltaic technology (cells that convert sunlight into electricity) are expected to surpass USD450bn in 2025, outpacing all other renewable energy sources, according to IEA World Energy Investment 2025 estimates.

Global renewable energy pledges and policies are driving the growth of renewables and solar power. These include plans to triple renewable energy generation capacity to at least 11TW by 2030 (COP28); end a reliance on fossil fuels (REPowerEU); mobilize USD1trn in solar energy investments by 2030 (International Solar Alliance), and numerous supportive national policies and targets set by countries such as China, India, UAE, South Africa and Brazil. Furthermore, to align with the IEA net-zero scenario, solar generation needs to reach approximately 9,200TWh by 2030, requiring an annual average growth rate of around 28% from 2024 levels.

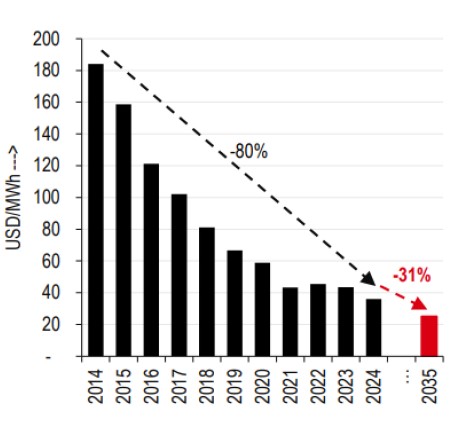

Advanced manufacturing capabilities, a reduction in polysilicon prices, and growing economies of scale have resulted in the significant fall in solar cell prices over the last decade, making them more competitive relative to fossil-fuels powered energy generation. The cost of solar energy has become substantially lower than both gas, coal, and other renewable energy sources except wind. Moreover, the BNEF expects the cost to fall further by 31% over the next decade, potentially making it an attractive long-term energy investment.

Emerging economies are forecasted to add c78% of the global net solar capacity additions by 2030, which is principally driven by China. Indeed, China has emerged as a global centre for the solar energy investment and supply chain, with the country adding almost two-thirds of all new renewable capacity globally in 2024.

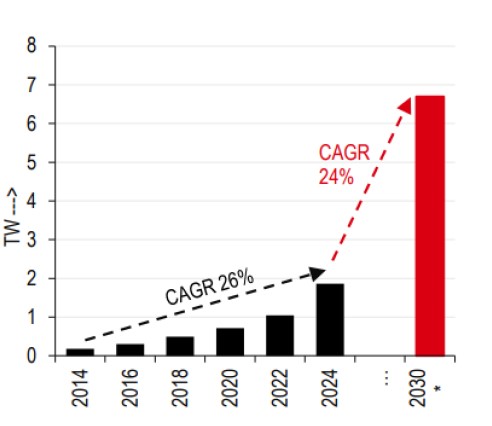

Solar power plant capacity trend and forecast

Source: IRENA, BNEF*, HSBC

*BNEF forecast based on COP28’s tripling renewable energy capacity by 2030

Global Levelized cost of solar energy is expected to fall 31% by 2035

Source: BNEF, HSBC

Energy storage

Reducing emissions from the transport and power sectors, which together represent approximately two-thirds of global emissions, is key to hitting net-zero goals. Energy storage systems play a pivotal role in improving the efficiency and reliability of clean transport and renewable power sources. According to the IEA’s net-zero emissions scenario for 2050, increased adoption of electric vehicles could reduce oil demand by 8 million barrels per day by 2030, with battery solutions being central to this transition.

In the electricity sector, battery storage solutions enhance the efficiency of power systems by storing excess energy during periods of low demand and releasing it when demand is high. This minimises losses and supports the integration of renewables into the grid.

To align with the IEA’s net-zero scenario, global annual demand for energy storage batteries must increase sixfold to reach 6TWh by 2030. Of this demand, 90% is projected to come from batteries for electric and hybrid vehicles, with the remaining 10% from other energy storage applications. Additionally, the global energy battery systems market is expected to quadruple, reaching USD 500 billion by 2030, up from USD 120 billion in 2023.

Battery Price Decline Accelerates EV and Energy Transition

The clean transport and energy sectors now account for over 90% of global annual demand for lithium-ion batteries—a figure set to rise as falling battery prices drive broader adoption of electric vehicles, as well as utility-scale and residential solar solutions. Battery costs have dropped significantly, from USD 1,400/KWh in 2010 to below USD 115/KWh in 2024. Continued innovation and higher-density battery production are expected to reduce average global prices to under USD 100/KWh within the next few years, further supporting the energy transition.

Conclusion

Clean energy sectors—particularly solar, wind, and nuclear—have underpinned strong performance in climate-related equities in 2025. At the same time, outflows from US sustainable equity funds have increased, with Switzerland and China emerging as leading recipients. Analysis from HSBC Research highlights solar and energy storage as the most promising themes within the climate change investment landscape.

https://www.hsbc.com.my/wealth/insights/esg/why-esg-matters/investing-in-climate-change/