georgemiller

Publish Date: Thu, 11 Dec 2025, 12:01 PM

Key takeaways

- The Fed delivered a 25bp cut, with neutral guidance; our economists expect the Fed to be on hold in 2026 and 2027.

- The Fed will start buying USD40bn of Treasury bills per month from 12 December.

- The USD may weaken further before stabilising in early 2026, in our view.

As anticipated, the Federal Open Market Committee (FOMC) implemented a third consecutive 25bp rate cut at its 9-10 December meeting, lowering the federal funds target range to 3.50-3.75%. The decision passed by a 9-3 vote, with dissent from two regional Fed presidents − Austan Goolsbee (Chicago) and Jeff Schmid (Kansas City) − who preferred to maintain current rates, and Governor Stephen Miran, who advocated for a larger 50bp cut.

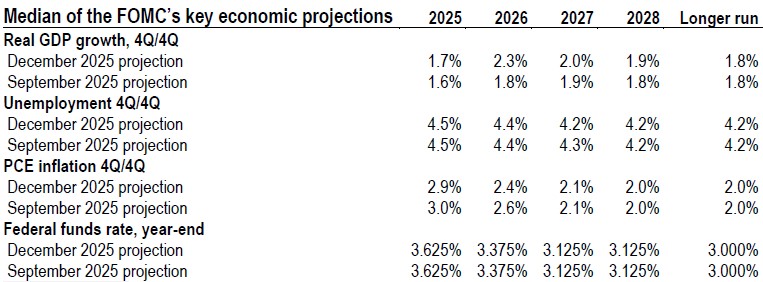

Initial USD weakness reflected the absence of hawkish signals. The updated “dot plot” revealed a wide range of views among all 19 FOMC members, with the median interest rate projection for 2026 indicating only one further 25bp cut, compared to market expectations of two. It is worth noting that the significant dispersion of rate forecasts for 2026 (2.125% to 3.875%) highlights a lack of consensus on the pace of easing.

Source: Federal Reserve

Forward guidance remained unchanged, suggesting policymakers are not yet prepared to signal an end to the easing cycle. Additionally, the Fed announced USD40bn in monthly Treasury bill purchases from 12 December, to “maintain an ample supply of reserves on an ongoing basis”. While not a policy shift, this move contributes to a more dovish overall tone.

Fed Chair Jerome Powell reiterated a neutral stance, noting that the current rate is within the estimated neutral range and that the Fed is positioned to observe economic developments. This approach contrasts with market pricing for two rate cuts in 2026, which the USD saw a brief rebound, but the USD Dollar Index (DXY) declined further to c98.5 (Bloomberg, 12 December). The Fed is in “wait and see” mode, so policy and the USD is data dependent. Our economists expect rates to remain unchanged through 2026 and 2027, though risks persist.

We still believe the DXY may see more downside before a more lasting base is formed during 1Q26. Historically, the USD tends to weaken when the Fed cuts rates outside of recessionary periods. Besides, market expectations for further rate cuts in 2026 may increase with a new Fed Chair. Concerns over Fed independence could further contribute to USD weakness.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/usd-feds-third-25bp-cut-with-neutral-guidance/