georgemiller

Publish Date: Mon, 15 Dec 2025, 08:05 AM

Key takeaways

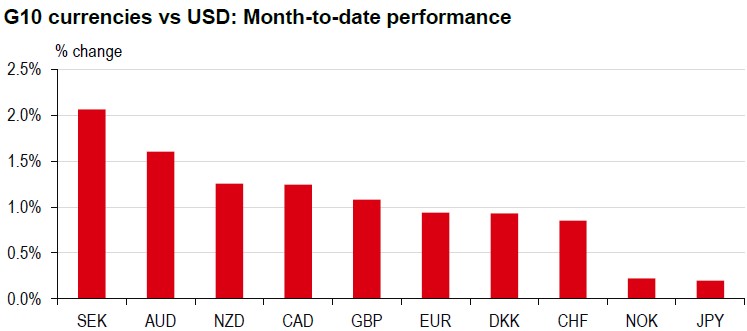

- USD weakness has been evident across the G10 space so far in December, with the SEK leading the gains.

- The SEK is supported by positive European sentiment and an expansionary Swedish budget.

- The AUD, NZD, and CAD benefit from a halt in central bank easing, with their outlook likely shaped by external factors.

So far in December, the SEK has led G10 currency gains this month, followed by the AUD, NZD, and CAD (see the chart below). This trend reflects broad USD weakness across the G10 space (see FX Viewpoint Flash: USD: Fed’s third 25bp cut, with neutral guidance for details).

Note: Data as of 11 December 2025 (19:00 HKT).

Source: Bloomberg, HSBC

The SEK’s gains are supported by positive European risk sentiment and expectations of improved Swedish growth, underpinned by an expansionary SEK80bn budget.

For the AUD, NZD, and CAD, the likely conclusion of their respective central banks’ easing cycles has been a key factor in their relative strength. The Reserve Bank of Australia (RBA) maintained its policy rate at 3.6% on 9 December, with the governor noting that the board discussed “what might have to happen for rates to rise”. Our economists anticipate rate hikes beginning by 3Q26, although markets are already pricing in c40bp of increases by end-2026 (Bloomberg, 11 December). Near-term AUD performance is likely to be driven by external sentiment.

Similarly, the Bank of Canada (BoC) held rates steady at 2.25% on 10 December. While markets expect a 25bp rate hike in October (Bloomberg, 11 December), our economists’ central case is for the BoC to remain on hold through 2026 and 2027, citing downside growth risks. The CAD’s short-term trajectory remains closely tied to US economic developments and ongoing uncertainty around US tariff policy, which could present upside risks for USD-CAD in 2026, in our view.

For the NZD, the anticipated end of the Reserve Bank of New Zealand’s (RBNZ) easing cycle is expected to provide support into 2026. Domestic fundamentals are improving, with the current account deficit narrowing, the budget deficit contained, and economic activity stabilising. Considering also a potential RBNZ ratehike cycle starting in 2H26, we see scope for the NZD to outperform the EUR, GBP, and CAD next year.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/g10-fx-when-the-usd-weakens/