georgemiller

Publish Date: Tue, 16 Dec 2025, 12:01 PM

Key takeaways

- China’s Central Economic Work Conference identified boosting domestic demand as a priority for next year.

- Policymakers signalled stronger property support, focusing on supply adjustments and affordable housing.

- Anti-involution efforts may pick up in 2026, while the 15th Five-Year Plan will be boosted by tech and infrastructure.

China data review (November 2025)

- Retail sales recorded their slowest growth of the year in November, rising by 1.3% y-o-y. Consumer confidence remained muted, particularly regarding employment prospects, while the deeper drag in the property sector may have also contributed. Further, base effects from last year’s consumer goods trade-in programmes have affected some categories, e.g., home appliances and autos.

- Fixed Asset Investment weakness continued, falling 12% y-o-y in November, on par with last month’s reading. The key deterioration was in the property sector, which saw a record fall in property investment (-30% y-o-y), though some moderation in the decline for the manufacturing sector helped a touch. Infrastructure investment fell slightly faster than last month at about 10%.

- Industrial Production proved resilient in November, up 4.8% y-o-y, thanks to robust growth in exports, and high-tech (+8.4%) and equipment (+7.7%) manufacturing. Still, there are reasons for caution, as manufacturing investment fell 4.5% y-o-y, likely influenced by the anti-involution campaign; e.g., electrical machinery and ferrous metals grew at their slowest pace since September 2024.

- CPI picked up 0.7% y-o-y in November, its highest level since March 2024, mainly supported by higher food prices. Core CPI also rose, 1.2% y-o-y, boosted by rising prices of gold-related products, which were up 58.4% y-o-y. Meanwhile, PPI fell 2.2% y-o-y as sectors relating to property and infrastructure saw their prices underperform, likely owing to recent slowdowns in investment.

- Exports rebounded to 5.9% y-o-y in November following a contraction in October. This turnaround was mainly due to a low base and easing of trade tensions, which gave high-tech exports and those to the EU a lift. Imports also grew by 1.9% y-o-y, supported by strong demand for high-tech goods and copper, reflecting ongoing investment in technology and innovation.

China’s Central Economic Work Conference 2025: Key Takeaways

China’s Central Economic Work Conference (CEWC), held on 10–11 December, reviewed the year’s economic performance and set priorities for 2026. The conference emphasized progrowth strategies, focusing on high-quality development through consumption, technology, and green initiatives, aiming to ensure a strong start to the 15th Five-Year Plan.

Strategic Priorities

The CEWC provided clarity on several points not addressed in the December Politburo meeting. Notably, the main priority for 2026 will be on strengthening domestic demand through increased consumption and investment, supported by new policy financing tools and urbanisation projects. The urgency around stabilising the property sector was more pronounced, reflecting recent market declines. Additionally, the anti-involution campaign was referenced, signalling the potential introduction of targeted policies to address supply demand imbalances.

Fiscal and Monetary Policy

The conference reaffirmed a proactive fiscal approach, maintaining a fiscal deficit target of 4% of GDP and supplementing this with special government bonds. Fiscal reforms will focus on improving local tax systems and restructuring local government debt, including accelerated settlement of overdue payments to enterprises. On the monetary front, the People’s Bank of China will likely keep using interest rate and reserve requirement ratio cuts, as well as structural policy instruments and government bond purchases to support growth and price recovery.

Consumption and Social Measures

The primary focus identified by the CEWC is to stimulate domestic demand via consumption and investment. The rollout of the “special action plan to boost consumption” suggests further policy initiatives are forthcoming. Strengthening household incomes is expected to play a key role in restoring consumer confidence. Other structural measures – such as expanding social safety nets by extending employment insurance to gig workers and improving access to healthcare – can also help to unlock consumption. With over 240 million gig workers in China (NBS, 2024), expanding coverage for this group should reduce precautionary savings.

The CEWC has also highlighted the need to “unleash the potential of services consumption”, recognising that China’s services consumption as a share of GDP remains below that of many developed economies. Next year’s policies may include expanded support for the services sector, such as targeted consumption subsidies.

Investment in infrastructure and urbanisation are needed to complement rising consumption. As the 15th Five-Year Plan commences, a wave of new projects is anticipated, supported by the recent introduction of innovative financial policy tools. In October, RMB500bn in new financing instruments was issued, fully allocated across thousands of projects, potentially underpinning total investment of approximately RMB7trn.

Property Sector Stabilisation

On the property front, the CEWC emphasised the importance of stabilising the property market through city-specific policies by controlling new supply, reducing inventory and optimise housing mix, as well as converting existing commercial housing into affordable housing. This suggests a stronger stance than we expected. If the government were to make larger interventions – such as using central government funds to segregate housing assets from banks’ balance sheets and digest housing stock – this can more effectively stabilize the sector.

Market Reforms and Green Transition

While anti-involution measures have received less attention recently, the CEWC reaffirmed their importance. Plans include establishing a unified national market to facilitate the free movement of production factors and reduce local protectionism, thereby promoting fair competition. The green transition remains a priority, with accelerated energy efficiency and carbon reduction initiatives, and the expansion of the national carbon emissions trading market to cover major industries by 2027, in line with 2030/2060 carbon neutrality targets.

Technology and Opening Up

The CEWC also highlighted continued focus on technology development, with investment in education, research, and innovation centres, alongside the rapid adoption of advanced technologies, such as AI. Despite prioritising domestic demand, China will maintain its commitment to opening up and reform, supporting economic rebalancing through increased imports and expanded overseas investment, e.g., the Belt and Road Initiative and bilateral trade and investment agreements.

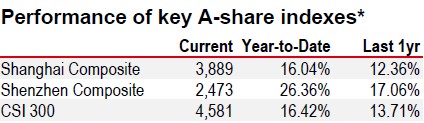

Source: LSEG Eikon

*Past performance is not an indication of future returns.

Source: LSEG Eikon. As of 12 Dec 2025, market close

https://www.hsbc.com.my/wealth/insights/market-outlook/china-in-focus/chinas-central-economic-work-conference-2025/