georgemiller

Publish Date: Mon, 22 Dec 2025, 08:05 AM

Key takeaways

- A weak USD is likely to persist into 2026, providing temporary support for the EUR and GBP.

- With the ECB expected to maintain its policy rate in 2026, the EUR will be largely shaped by external and fiscal factors.

- The BoE’s ongoing easing cycle may still weigh on the GBP, particularly against currencies likely to see rate increases.

Assuming global economic growth remains steady, the Federal Reserve (Fed) is in no rush to hike rates, and US financial conditions remain accommodative, the USD will likely stick to a softer trajectory in 2026. In this environment, the EUR and GBP may benefit from broad-based USD weakness over the coming months, but this relative strength is unlikely to persist for the entire year.

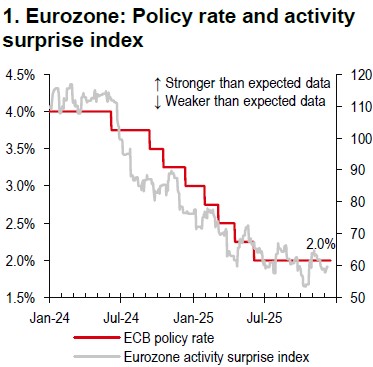

The European Central Bank (ECB) held its key deposit rate at 2% on 18 December, in line with market expectations (Chart 1). The ECB’s updated forecasts were hawkish, with growth projections raised to 1.2% for 2026 and 1.4% for 2027 (from its September forecasts of 1.0% and 1.3%, respectively) and only limited inflation undershooting for the next two years expected. This makes further rate cuts unlikely. However, ECB President Christine Lagarde did not support expectations of a rate hike as early as next year, emphasising that all options remain open. Our economists expect the ECB to maintain its current policy stance through 2026, with a possible rate increase in 2027. Given this policy stability, developments in other major economies are likely to have a greater influence on the EUR’s direction. The EUR may also face headwinds if regional fiscal measures fall short of expectations or if external conditions become less supportive.

This chart shows the ECB’s deposit facility rate.

Source: Bloomberg, HSBC

Market data as of 18 December 2025.

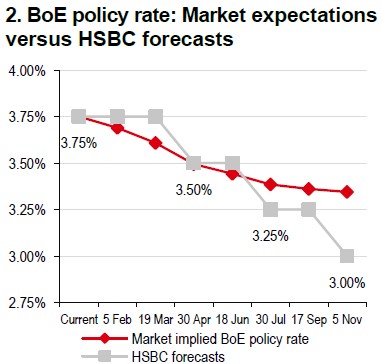

Source: Bloomberg, HSBC forecasts

Regarding the GBP, the Bank of England (BoE) cut its policy rate by 25bp to 3.75% on 18 December, marking the sixth cut in the current easing cycle. This widely expected decision was closely contested, with a 5-4 vote split. Megan Greene, Clare Lombardelli, Catherine Mann, and Huw Pill dissented in favour of hold. The meeting’s tone was rather hawkish, as the guidance indicated that “judgements around further policy easing will become a closer call.” As the BoE is likely to continue to lower rates in 2026 (Chart 2), the GBP will probably underperform against other G10 currencies whose policy rates are already at neutral levels or are set to rise, such as the AUD and NZD.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/eur-and-gbp-ecb-on-hold-and-boe-cut-rates/