georgemiller

Publish Date: Mon, 22 Dec 2025, 12:01 PM

Key takeaways

- With exports galloping ahead, much of ASEAN delivered resilient growth in recent quarters…

- …but as trade begins to weaken, private consumption and investment will need to take up the slack.

- Fortunately, monetary and fiscal easing should help deliver a kick to growth in the Year of the Horse.

Despite external headwinds, from weaker commodity prices to US tariffs, Indonesia’s growth may tick up thanks to greater fiscal spending. In Thailand, a looming election could mean renewed delays in fiscal disbursements, though exports have been a surprising bright spot. Malaysia remains among the star performers, not only continuing to gain global market share in sectors, like electronics, but also being a magnet for tourists that help power services. Singapore, like its manufacturing peers, was riding high in 2025, with extra spending for its 60th anniversary adding a further kick. A global trade downturn poses the biggest risk. For all the noise about tariffs, Vietnam keeps chugging along, not only thanks its vaunted export machine, but also due to vigorous reforms at home.

Economy profiles

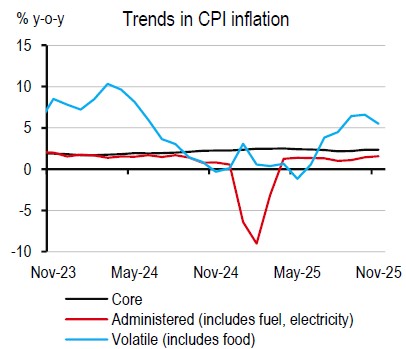

Key upcoming events

Source: LSEG Eikon, HSBC

Indonesia

Growth urgency

Indonesia’s post-pandemic GDP growth has been sluggish, led partly by tight monetary and fiscal policy in the few years following the pandemic. We estimate that at the end of 2025, GDP will be c7% below its pre-pandemic trend.

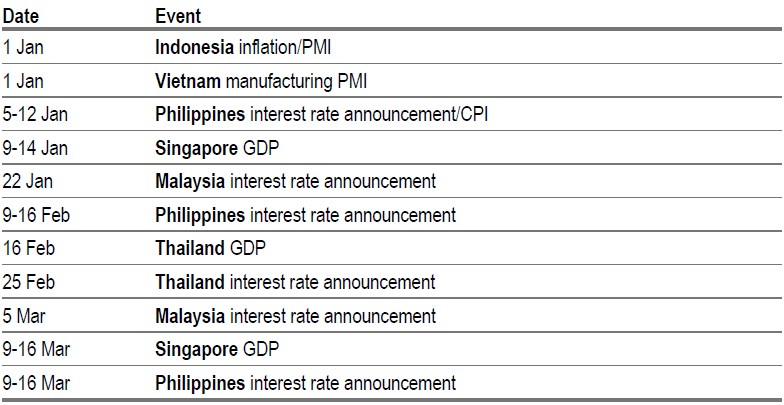

Having said that, the recent policy softening is clear. Bank Indonesia’s (BI) policy rate has been cut by 150bp in this cycle, and a string of fiscal stimuli have been announced through 2025. Indeed, recent data shows that domestic demand has started to improve. The latest PMI details show that new domestic orders are growing faster, even though new export orders are not. Other indicators, like consumer sentiment and truck sales, also point towards an improvement in activity.

In 2026, a payback from front-loading could keep exports soft, but this weakness could be offset by a rise in domestic demand as the reduction in policy rates transmits through the system, and social welfare schemes see improved implementation. We forecast GDP to grow at 5.2% in 2026, a shade higher than the 5% in 2025. Yet, we think the output gap will remain open through the year.

For growth to rise more sustainably, investment must rise, which drives the capacity of an economy to create jobs and incomes. Here, we find that households are dipping into savings to fund consumption. As a result, not much surplus remains for kickstarting investment. Corporates have excess savings, but investment depends on other factors, such as household demand visibility, global growth, and commodity prices, which do not seem too dependable. Government saving is falling as well, led by rising social welfare spending. Who will lead Indonesia’s investment?

In good news, there is Danantara, the new sovereign wealth fund. Its key objective is to manage the country’s State-Owned Enterprises (SOEs) efficiently, and act as a vehicle for investment in strategic sectors. It plans to invest USD10bn in its first few months of operation, starting in October 2025. Alongside, it also aims to boost liquidity on Jakarta’s stock market. In the short-run, the challenge will be to efficiently implement the domestic investment projects announced.

For a sustained rise in Danantara’s investment, revenue sources need to be diversified outside of the fiscal accounts. Here, the fund can look at other places. One, returns from investment projects should rise. Two, FDI inflows should gradually increase. We model the determinants of FDI inflows and find that they boil down to political and macro stability, and economic reforms.

New domestic orders are rising faster

Source: S&P Global PMI, HSBC

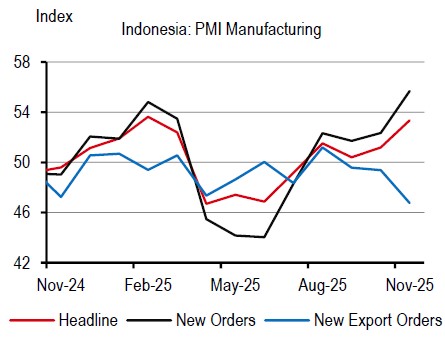

Underlying inflation is near BI’s 2.5% target

Source: CEIC, HSBC

Malaysia

ASEAN’s possible silver medallist

While the tariff saga has been the dominant theme since “Liberation Day”, growth in some tradedependent economies has been, ironically, rather resilient. Malaysia is a notable example, with GDP growth accelerating to 2.4% q-o-q seasonally adjusted in 3Q, translating to 5.2% y-o-y.

While it may be tempting to attribute this to trade front-loading, the economic strength is actually more broad-based. However, no doubt, trade helps, as net exports reversed to a positive growth contribution in 3Q25. Despite trade volatility, there are two notable trends.

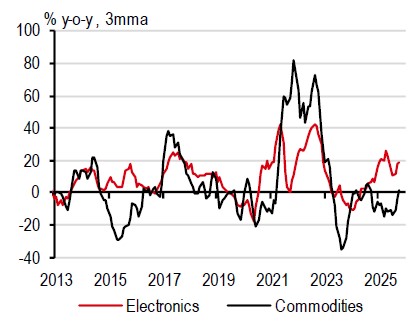

First, Malaysia’s exports to the US have moderated, reflecting the fading impact of front-loaded trade. However, second, Malaysia has benefitted from still-elevated AI-driven demand. While commodity exports remain in the doldrums, electrical machinery & electronics (E&E) exports continue to expand at an impressive double-digit pace. On top of trade, the recently signed Reciprocal Trade Agreement (RTA) between Malaysia and the US also reduces trade uncertainty, with Malaysia being the first economy in ASEAN to sign a deal.

Outside of trade, Malaysia’s domestic strength provides much-needed resilience. While both public and private investments have moderated from their earlier double-digit growth, the moderation has been modest. They continue to benefit from an infrastructure push and data centre construction.

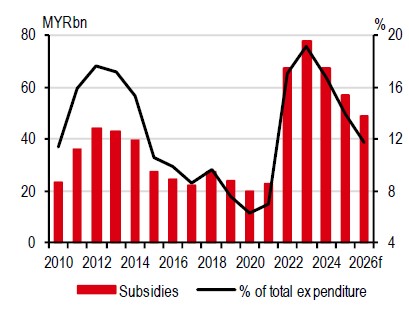

Elsewhere, private consumption remains the backbone of Malaysia’s growth, growing consistently at c5% y-o-y. For one, the labour market continues to recover, with the unemployment rate falling to 3% and wages picking up. In addition, subsidies have also played a role. With even lower petrol RON95 prices, there are good reasons to believe in the sustained momentum in private consumption.

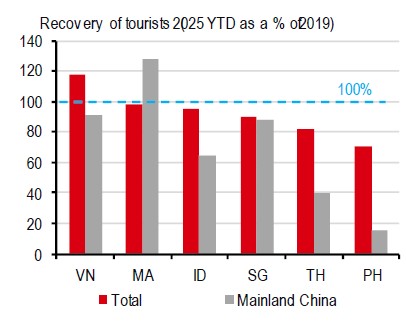

The other tailwind to Malaysia’s retail sales is its booming tourism sector. Malaysia has seen a full recovery in tourism to 2019 levels, just behind Vietnam. In particular, it leads the region in welcoming Chinese tourists, exceeding 20% of their 2019 level. This is aided by a visa-free scheme with China.

All in all, we have recently upgraded our growth forecast to 5% for 2025 (from 4.2%) and 4.5% for 2026 (from 4%). In addition, inflation remains well-behaved, as the headline CPI decelerated to 1.4% y-o-y YTD as of October. Given subdued inflation momentum, we have recently revised down our headline inflation forecast slightly to 1.4% (previously: 1.5%) for 2025 but keep our 2026 forecast at 1.7%.

Malaysia continues to see sustained growth in electronics exports

Source: CEIC, HSBC

Subsidies are budgeted to fall 14% in 2026, though still remain at high levels

Source: CEIC, Ministry of Finance Budget 2026, HSBC

Philippines

Monetary policy taking charge

With domestic engines big enough to brag about, the Philippines is perceived by many to be insulated from the headwinds in trade. But domestic demand stumbled in 3Q25. Growth decelerated to 4.0% y-o-y, which was the slowest pace since 2011, barring the COVID-19 pandemic. The numerous super typhoons during the quarter were one of the main issues: household consumption dipped as weather conditions led to frequent work and school cancellations.

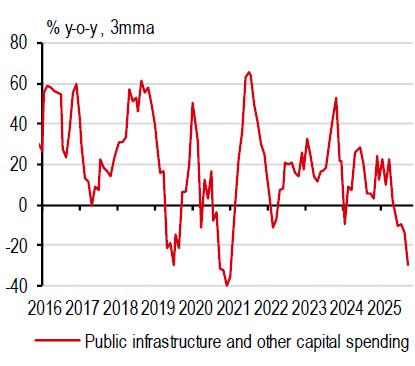

But the main culprit was government spending. When the ambitious Build-Build-Build programme started in 2016, government infrastructure investments became a driving force for growth. However, due to controversies over flood-control projects, public capital disbursements have been falling by more than 20% y-o-y since July – pulling growth down by as much as 1.3ppt.

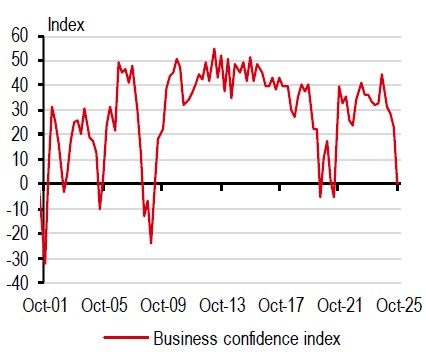

The fiscal drag then had a domino effect on other aspects of the economy. The most important was private investment. For instance, business sentiment has fallen to its lowest level after the COVID-19 pandemic. Consequently, the share of firms which intend to expand their production in the following quarter has fallen to a post-pandemic low. Moving in parallel is a sharp decline in FDI applications. In all, we expect growth in 2026 and 2027 to come in below potential at 5.2% and 5.6%, respectively, with both private and government investment weighing on growth.

We do think private consumption will pick up once weather conditions improve. For one, cheaper imports from China and easing global commodity prices have led to low and stable inflation. We expect inflation to remain below the midpoint of the Bangko Sentral ng Pilipinas’ (BSP) 2-4% target band, even throughout 2026 and 2027. Meanwhile, job creation remains strong with services exports shielded from the onslaught of tariffs. Both have helped bring household saving rates back up, improving the country’s current account dynamics.

Narrowing the country’s current account deficit further is tighter fiscal policy since fewer infrastructure projects entails less demand for capital imports. This should then give leeway for the BSP to keep monetary policy accommodative. Like the spare tyre in the boot – the one that is typically smaller in size but enough to deliver a car to the repair shop – it will be necessary for monetary policy to make up for the fiscal drag, even if only partially. We expect the BSP to ease monetary policy once more to 4.25% with room for more if the Fed were to deepen its easing cycle further.

Government infrastructure spending has fallen by more than 20% since July…

Source: CEIC, HSBC

…bringing business confidence to its lowest point since 2009, barring COVID-19

Source: CEIC, BSP, HSBC

Singapore

Another strong year

The script may look familiar – it was also 3Q when the market saw a big upside surprise in GDP growth in 2024. The same thing has happened in 2025, when Singapore’s growth momentum was revised upwards from 1.3% q-o-q in the advance print to 2.4% in 3Q. This translated into a strong 4.2% y-o-y expansion, even higher than some emerging market (EM) economies in ASEAN.

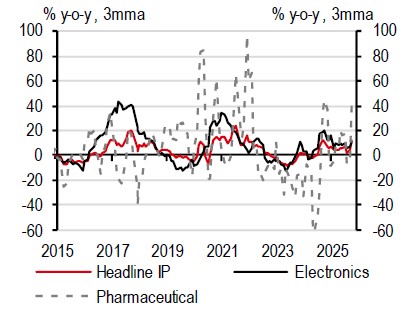

The data breakdown showed most of the upward revision came from manufacturing, which grew over 11% q-o-q seasonally adjusted. Electronics drove industrial production (IP) growth notably. This mirrors the trend in tech-driven economies, where AI-driven demand and trade front-loading have boosted growth.

However, for Singapore, diversification is the key to its manufacturing outperformance. Sectors, like transport engineering, not only contribute to the manufacturing sector but also have boosted related services, such as wholesale. In addition, the pharmaceutical sector, though volatile in nature, lifted IP growth to almost 30% y-o-y in October.

Besides trade, Singapore enjoys some domestic resilience, though it is a mixed picture. Investment growth has accelerated, on the back of an infrastructure push, like Changi Airport’s Terminal 5 construction. However, private consumption has slowed, though the labour market remains resilient.

Given the large 3Q25 upside surprise, we have recently raised our GDP growth to 4.1% for 2025, from 2.8%. This puts our forecast slightly above the government’s forecast of “around 4%”, which has been raised from “ 1.5-2.5%” earlier. We have also recently raised our 2026 growth forecast to 2.0%, up from 1.7%. This would put us in the middle of the government’s forecast range of “ 1-3%”.

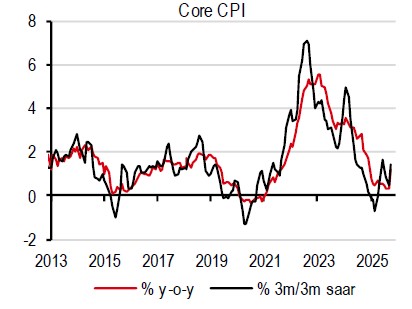

In addition, inflation has finally picked up. After being subdued at 0.5% on average in the first nine months of 2025, core inflation rose 1.2% y-o-y in October, though in part due to base effects. We expect core inflation to grow beyond 1% y-o-y from 4Q25. Overall, we recently revised upward our core inflation forecast slightly to 0.7% (from 0.6%) for 2025 and to 1.3% (from 0.9%) for 2026. While a low-inflation environment opens the door for the Monetary Authority of Singapore (MAS) to ease again, we expect the MAS to stay put through our forecast horizon. The MAS’ primary focus is no doubt growth, but fiscal policy should take the lead in prompting growth if headwinds materialise.

Singapore’s IP has been strong thanks to both pharma and electronics production

Source: CEIC, HSBC

Singapore’s core inflation momentum has been picking up slightly

Source: CEIC, HSBC

Thailand

Changes

Uncertainty lingered over Thailand during the second half of the year, but the private sector – calm and collected – helped sustain the economy. Tensions between Cambodia and Thailand escalated in July, disrupting trade between the two neighbours, while stoking safety concerns for potential tourists. There were even concerns that the US might impose higher tariff rates on both countries if tensions did not de-escalate (SCMP, 13 November 2025). However, as tensions ensued, Thailand found itself in a difficult position. Thailand’s Constitutional Court removed then Prime Minister, Paetongtarn Shinawatra, from office over ethical charges on 29 August 2025 (Nikkei, 29 August 2025). The cabinet was then dissolved and, for the third time in three years, Thailand was in a search for a new Prime Minister. With the help of the opposition, the People’s Party, the Bhumjaithai party formed a minority government with Anutin Charnvirakul at the helm.

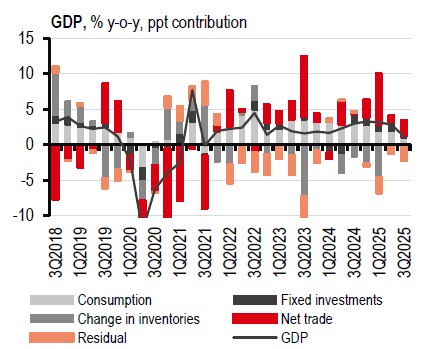

Amid all the uncertainty in politics and policy, growth disappointed in the third quarter of 2025, falling by 0.6% q-o-q seasonally adjusted. Services exports continued to contract with the tourism sector still finding its feet after its stumble earlier in the year. Meanwhile, passing the baton from one Prime Minister to another was a two-month process, which eventually led to fiscal standstill. Government spending fell, dragging growth down by as much 1.1ppt.

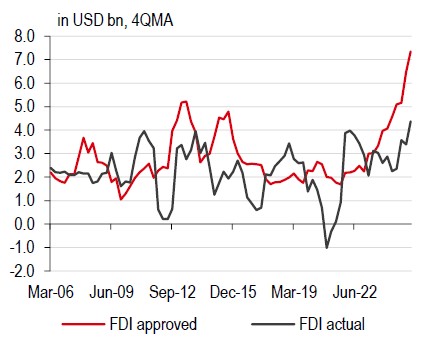

However, despite the uncertainty that lingered, the private sector kept its ground. Private consumption, supported by low inflation, remained steady, while private investment was robust. In fact, foreign investments flowed in – defying uncertainties around tariffs and global trade – and goods exports still grew as electronics manufacturers captured the boom in AI-related investments, all while gaining market share in the US at the expense of China.

However, just like elsewhere, we expect 2026 to be a tough year. Payback from front-loading demand will likely be a headache for the economy, not to mention the potential slowdown in government spending with Thailand expected to undergo another election in February 2026.

Nonetheless, growth opportunities are within reach – the economy just needs to grab them. There are still billions of baht worth of investments committed to the digital sector that have yet to materialise, the size being large enough to boost growth. Thailand is also in the position to be a vital part of the ongoing boom in data centres, with the economy having deep supply chains in producing hardware components, such as hard disk drives and printed circuit boards.

Amid changes in government, the fiscal engines sputtered and growth slowed

Source: CEIC, HSBC

FDI surged, but there are still billions committed that have yet to materialise

Source: CEIC, HSBC

Vietnam

In the 8% league

Despite trade uncertainty, Vietnam’s growth continues to shine. After 2Q, Vietnam delivered another significant upside surprise in 3Q25, with GDP expanding 8.2% y-o-y. The outperformance easily places Vietnam as the fastest-growing economy in ASEAN, again.

What surprised most is the resilience of trade, with both exports and imports growing close to 20% y-o-y in 3Q. As a result, the trade surplus more than doubled in 3Q from 1H25. This indicates that Vietnam has widened its trade surplus with trading partners other than the US, although the latter remains its biggest exporting destination with one-third of the total share.

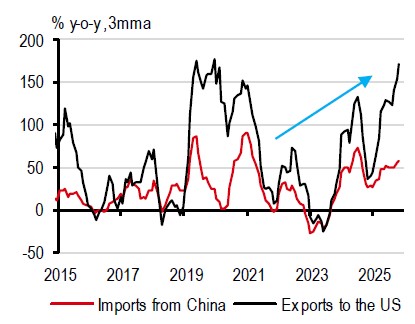

Similar to other tech-exposed economies, Vietnam has also benefitted from surging AI-driven demand. In particular, its electronics exports to the US alone jumped 150% y-o-y on a three-month moving-average (3mma) basis, pushing Vietnam’s total exports to the US up by 30% y-o-y.

In addition, the services sector continues to see strong growth. Consumer-oriented retail sales are enjoying some meaningful improvements. Meanwhile, tourism-related sectors continue to boom, as Vietnam has turned into a popular destination for Chinese tourists, despite not having a visa-free scheme. That said, Vietnam is likely to miss its target of attracting 25 million tourists.

On the demand side of the economy, consumption expanded over 8% y-o-y, while investment grew close to 10% y-o-y in 3Q. In particular, the focus on accelerating mega infrastructure projects has been a priority. That said, there is still room to expand further, as the disbursement rate of public investment is only 50% of the annual target as of 3Q (VNEconomy, 8 October).

All things considered, we have recently upgraded our growth forecast to 7.9% (from 6.6%) for 2025 and 6.7% (from 5.8%) for 2026. The government raised its 2025 growth target to 8.3-8.5% and announced its 2026 growth target at 10%. However, trade uncertainties are not over yet.

Outside of growth, inflation has decelerated to 3.3% y-o-y YTD through November. Despite some recent flood-caused food disruptions, we expect the underlying trend to remain well below the State Bank of Vietnam’s (SBV) inflation target ceiling of 5%. We have recently raised our inflation forecast slightly to 3.3% for 2025 (from 3.2%) and 3.5% for 2026 (from 3.2%).

Vietnam’s monthly trade surplus has shrunk

Source: CEIC, HSBC

Vietnam leads ASEAN in tourism recovery but is still behind its annual target

Source: CEIC, HSBC. NB: MA data as of Aug, VN as of Nov, and the rest as of Oct.

https://www.hsbc.com.my/wealth/insights/market-outlook/asean-in-focus/consumption-and-investment-to-take-the-reigns/