georgemiller

Publish Date: Mon, 12 Jan 2026, 12:01 PM

Key takeaways

- The USD was the worst performing G10 currency last year and is likely to stay soft in 2026.

- A significantly stronger USD would require unexpected Fed rate hikes, while other central banks hold or cut rates.

- The AUD, NZD, and potentially SEK are well positioned, but changes in risk sentiment remain a concern.

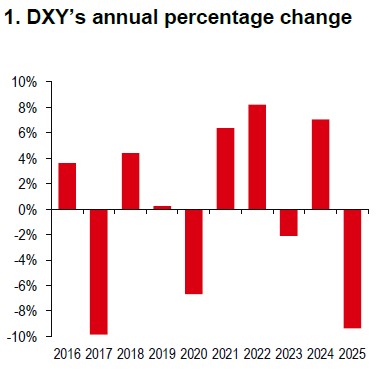

In 2025, the USD was the worst performing G10 currency, with the US Dollar Index (DXY) falling c9.4% − its largest annual decline since 2018 (Chart 1). As we look towards 2026, the outlook for the USD remains subdued, provided that global economic growth holds steady, the Federal Reserve (Fed) does not raise rates, and US financial conditions stay accommodative.

A key variable for the USD’s trajectory is the Fed’s monetary policy. Current market pricing anticipates c56bp of Fed easing by end-2026 (Bloomberg, 8 January). Should expectations for Fed rate cuts be removed, this could offer some support to the USD. However, this alone is unlikely to drive a sustained recovery, especially if other major central banks are expected to raise rates. For the USD to regain significant strength, the Fed would need to begin a rate-hiking cycle much earlier than currently anticipated, at a time when markets are not expecting further tightening from other central banks − a scenario we view as a high hurdle for 2026.

That being said, a further significant weakening of the USD also appears unlikely once the Fed’s rate-cutting cycle concludes.

Source: Bloomberg, HSBC

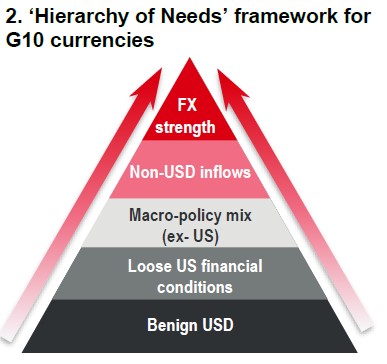

Source: HSBC

Applying our ‘Hierarchy of Needs’ framework to the G10 currency complex (Chart 2), several currencies are notable. The AUD, NZD, and potentially SEK are well positioned, benefiting from improved fiscal outlooks, recovering domestic growth, and the prospect of tighter monetary policy. These factors collectively enhance their relative attractiveness. However, it is important to note that risk sentiment is likely to remain a key driver; in a “risk-off” environment, these currencies could come under pressure. In contrast, the USD, EUR, GBP, and JPY currently lack the same combination of supportive factors.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/the-broad-usd-to-stay-soft/