georgemiller

Publish Date: Wed, 14 Jan 2026, 12:02 PM

Key takeaways

- US action in Venezuela is inevitably raising questions about the new world order…

- …but the still buoyant markets will be steered by the macro picture and policy outcomes.

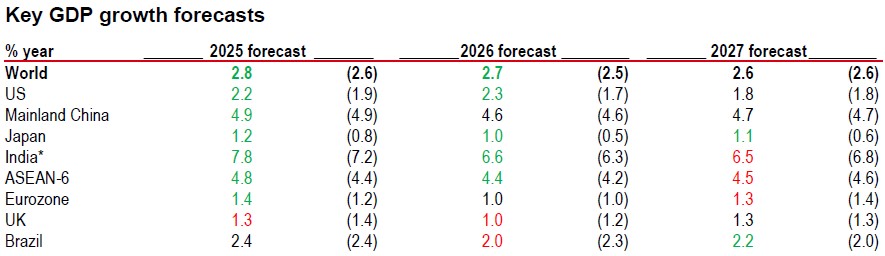

- We recently raised our global GDP forecasts to 2.8% in 2025 and 2.7% in 2026.

While 2025 ended with trade uncertainty abating and some optimism that major conflicts in the world may be moving a little closer to some kind of resolution, US action in Venezuela could once again upend the world order. The implications will only become clear in time, so with global growth still seemingly resilient and global inflation still mostly trending lower, financial market optimism has not faded.

Muddling through

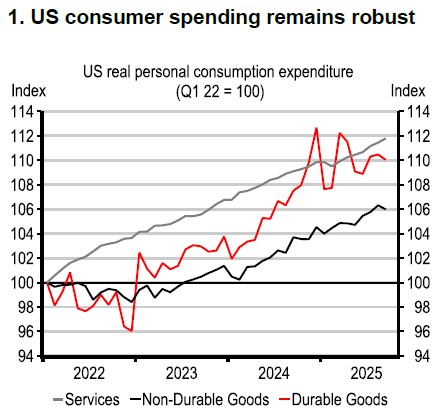

Uncertainty is here to stay though. The global economy in 2025 performed better than most had expected. Despite tariffs, global trade growth was strong, consumer spending held up. The gradual decline in inflation mostly continued. We still expect the global economy to muddle through in 2026, albeit supported globally by fiscal spending and the rollout of AI infrastructure.

AI continues to drive multiple K-shaped expansions. In the US, higher-income households (particularly baby boomers) are driving consumer spending, partly on the back of wealth effects from AI equity holdings. The US is also at the forefront of the surge in AI-related investment. This is benefitting Asian exporters that are most exposed to AI-related electronics production – Taiwan, Korea, and much of ASEAN – and related areas of the AI ecosystem. Such rapid growth in world trade is unlikely to be repeated in 2026, given tariffs and such a high base for Asian exports, but we still expect expansion.

Source: Macrobond

Note: CPI held constant in October due to missing data.

Source: Macrobond

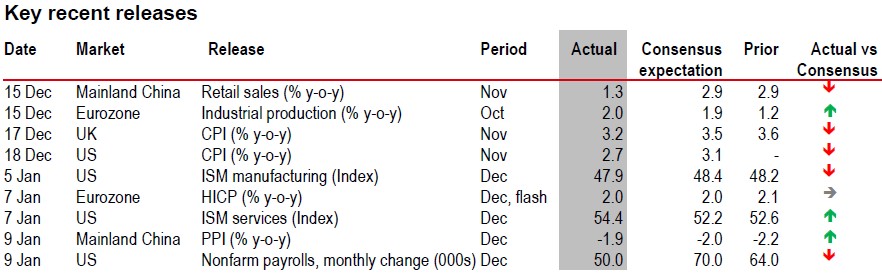

Volatile US data

Although there is now a raft of US data that have become available with the end of the government shutdown, they are still hard to interpret. Payroll softness may have been driven by deferred government job losses, and, while private payrolls are steady, Federal Reserve (Fed) Chair Powell has stated that they could be an overestimate.

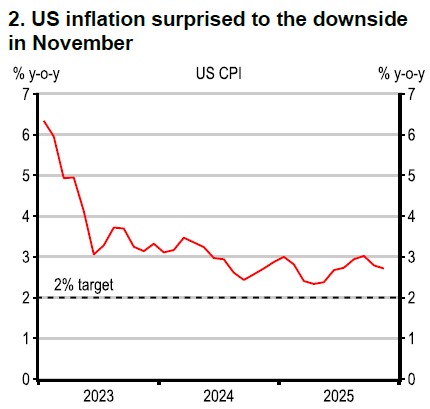

And with immigration slowing and productivity rising, the unemployment rate edged back down to 4.4% in December. Also, US inflation has come down, but technical quirks are playing a role and globally input prices, particularly memory chips, are clearly on the rise. Moreover, government opening effects and tax cuts should support US growth in 1H26.

Fiscal support

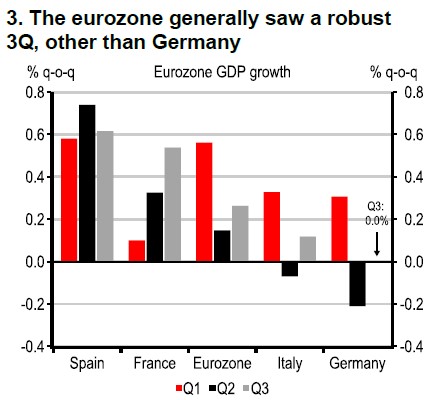

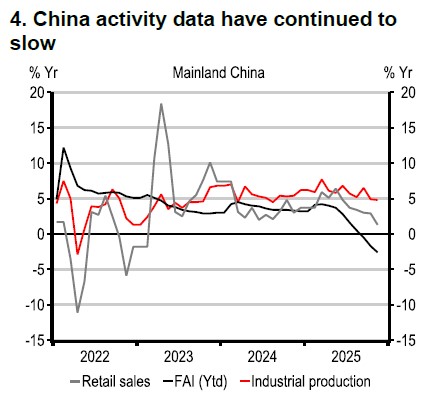

Outside the US, Europe is showing early signs of recovery (Chart 3), though in 2026 much hinges on the execution of the fiscal support. Asia’s macroeconomic fundamentals have improved, but the recovery in mainland China has underwhelmed, and further policy stimulus will likely be needed to provide a boost (Chart 4).

Monetary policy divergence is expected to be a prominent theme this year. We expect Australia, New Zealand, and Sweden to join Japan in raising rates, while the European Central Bank and the Fed stay on hold. In contrast, we see the Bank of England delivering another 75bp of cuts and some emerging market central banks, especially in Asia, continuing to ease.

Source: Macrobond

Source: Macrobond

Our GDP forecasts

Our global GDP estimate for 2025 now stands at 2.8%, higher than the 2.7% at the start of the year. We also recently raised our 2026 forecast from 2.5% to 2.7%, much of this is driven by a US upgrade reflecting payback after the government re-opening. That being said we are mindful that another possible US government shutdown could occur at the end of January, which could be a potential source of volatility. Another notable upgrade is in Japan, reflecting the recently approved fiscal stimulus.

Note: *India data is calendar year forecast here for comparability. Previous forecasts are shown in parenthesis and are from the Macro Monthly dated 6 October 2025. Green indicates an upward revision, red indicates a downward revision.

Source: Bloomberg, HSBC Economics

⬆ Positive surprise – actual is higher than consensus, ⬇ Negative surprise – actual is lower than consensus, ➡ Actual is in line with consensus

Source: Bloomberg, HSBC

Source: LSEG Eikon, HSBC

https://www.hsbc.com.my/wealth/insights/market-outlook/macro-monthly/the-global-economy-in-2026/