georgemiller

Publish Date: Mon, 19 Jan 2026, 12:01 PM

Key takeaways

- Gold broke above USD4,600 per ounce, driven by geopolitical risks and Fed independence concerns.

- FOMO inflows may reverse, increasing volatility, but central bank buying and “safe haven” demand could sustain gold rally…

- …at least until geopolitical risks ease or Fed easing expectations fade.

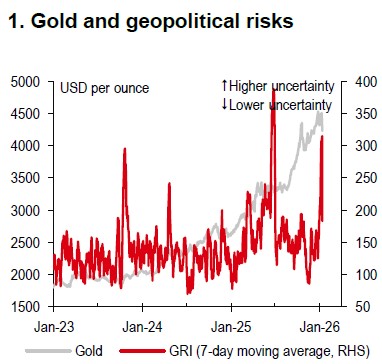

Gold rallied to new highs recently on elevated geopolitical risks (Chart 1), notably developments in Iran and Venezuela. Any escalation could further support gold prices, while a reduction in geopolitical tensions may exert downward pressure.

Concerns regarding the Federal Reserve’s (Fed) independence have also lent further support to gold and weighed on the USD. While a softer USD provides a foundation for gold prices, it is unlikely to drive significant further gains.

In addition, rising fiscal deficits in the US and other countries are also boosting gold demand and may become increasingly influential. According to the International Monetary Fund’s (IMF) biannual Fiscal Monitor report (15 October), global government debt is projected to reach 100% of GDP by 2029 − the highest level since the post-World War II period.

Global trade frictions continue to provide some support for gold, although this theme is less pronounced than in 2025. On balance, robust central bank purchases and sustained “safe haven” demand − set against a backdrop of ongoing geopolitical and economic risks and a softer USD − are likely to keep gold trading at historically elevated levels.

Note: Geopolitical Risk Index (GRI) is compiled by Fed economists Dario Caldara and Matteo Iacoviello.

Source: Bloomberg, HSBC

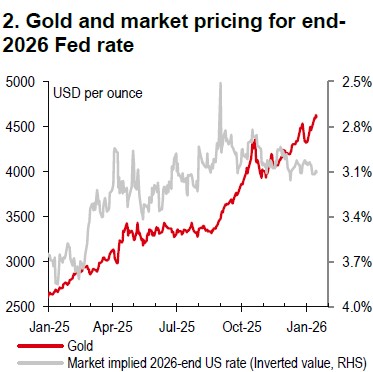

Source: Bloomberg, HSBC

Our precious metals analyst cautions that inflows driven by “fear of missing out”’ (FOMO) may push gold prices higher over the near term, but these could reverse rapidly at new highs, resulting in greater volatility and a broad trading range. Should geopolitical risks diminish or expectations for Fed easing not materialise (Chart 2), a correction could be intensified by increased supply from mining and recycling, alongside weaker physical demand.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/gold-hit-usd-4600-oz/